An invoice is very important to maintain whether it is a large scale business or a small business. An invoice is an official document of a business that indicates that a certain person has purchased some products or acquired some services. An invoice can also be thought of as a demand for payment. Every business has its own invoice design and style. Some businesses also use a specific business invoice template for this purpose.

A business invoice template is also used to make contact with your customers. When you send your customers a professional invoice, it indicates that you are doing some proper business. A business invoice template must be a part of record of all other business documents and it must be retained properly by both the sender and receiver of the invoice.

If you are running some small business, you may need business invoices from time to time. For this purpose, check out the given below practical small business invoice templates.

Best Small Business Invoice Templates

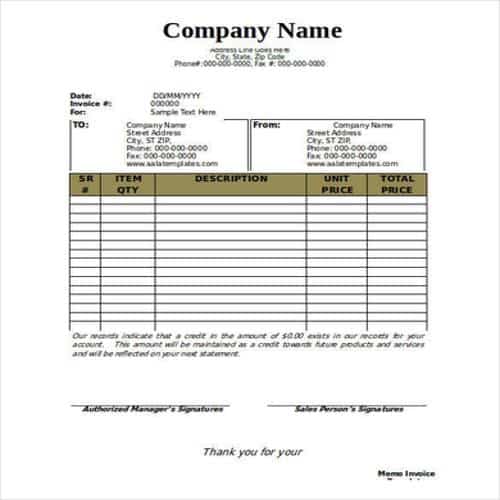

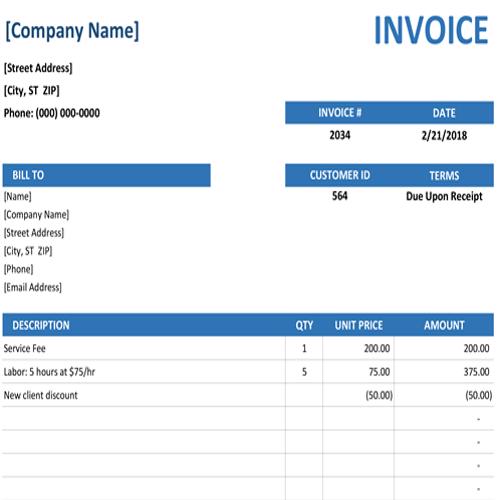

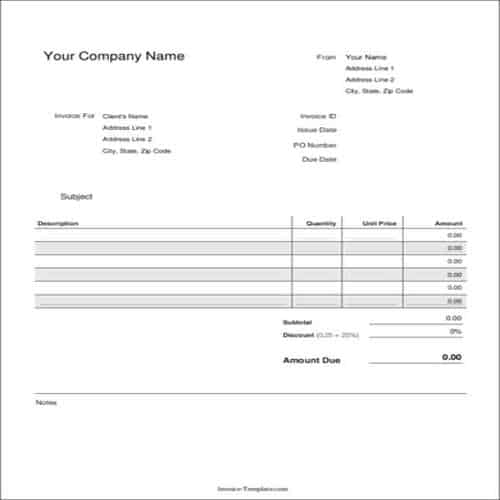

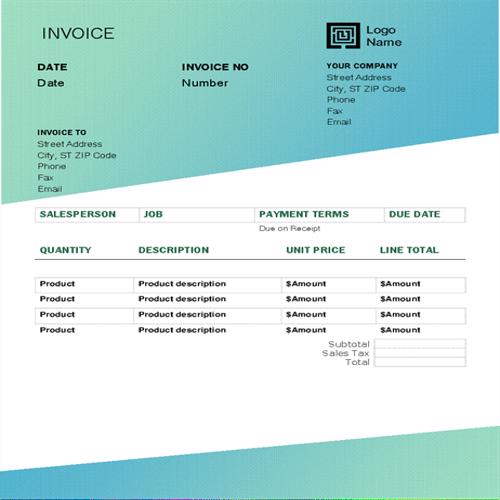

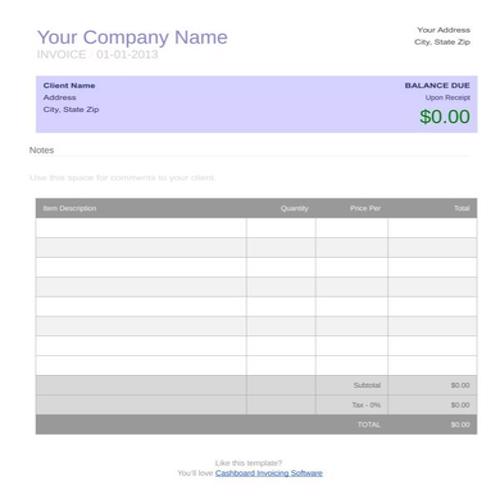

Company’s Business Invoice

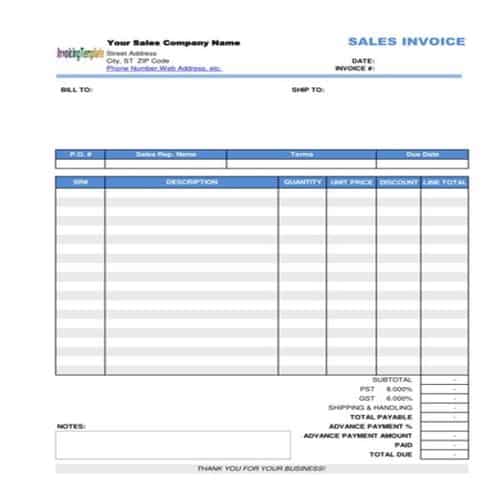

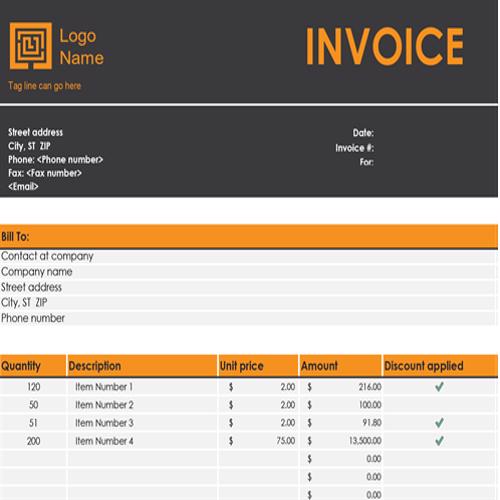

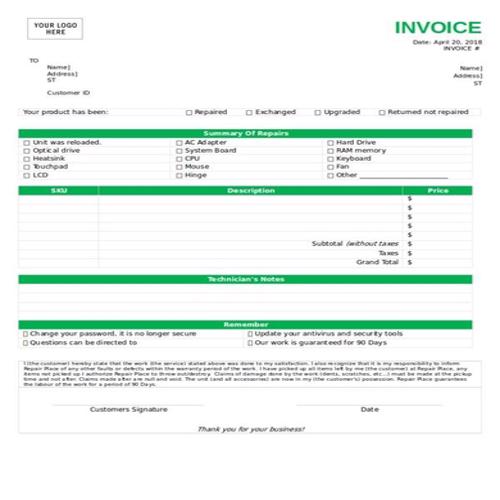

Official Business Invoice Template

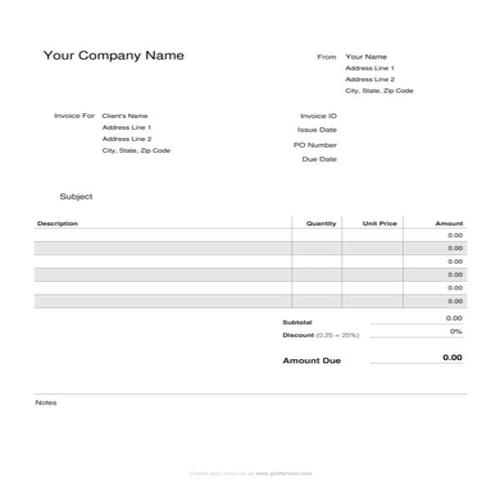

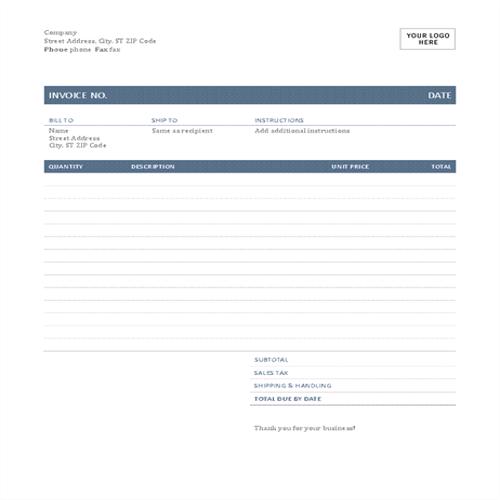

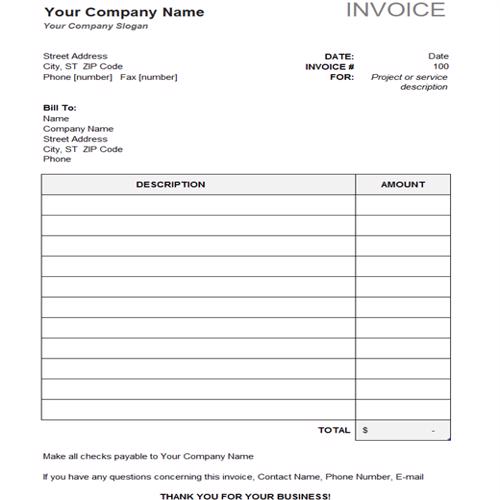

Simple Business Invoice Template

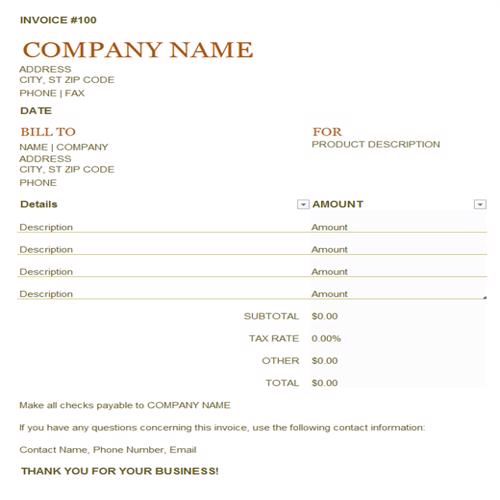

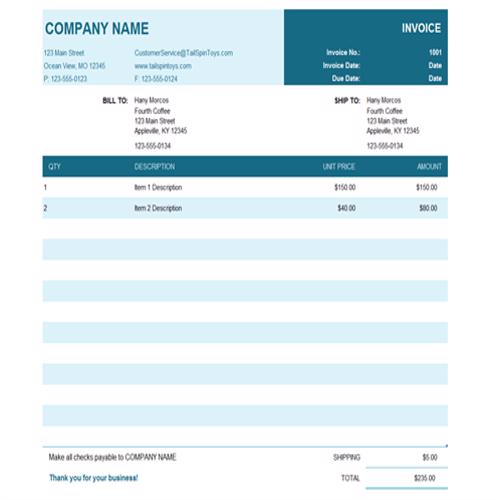

Proper Business Invoice Template

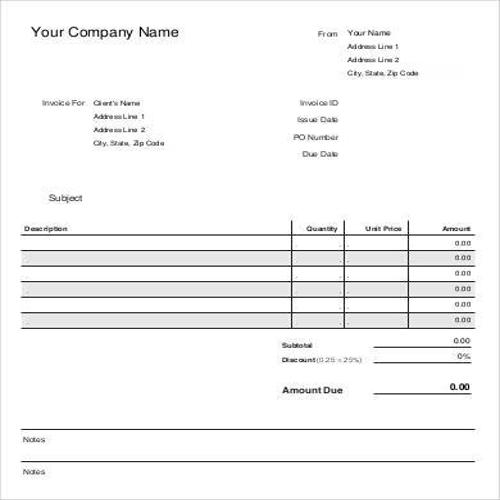

Sample Business Invoice Template

Special Business Invoice Template

Standard Business Invoice Template

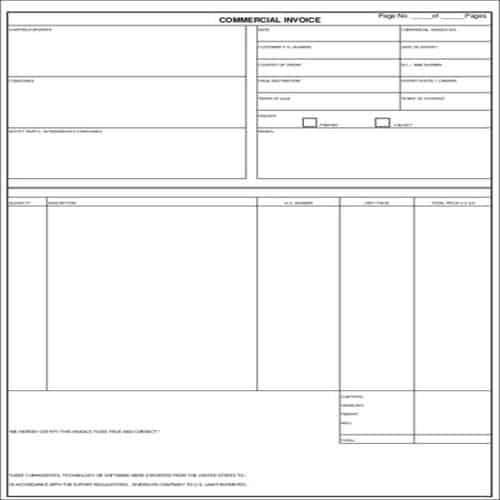

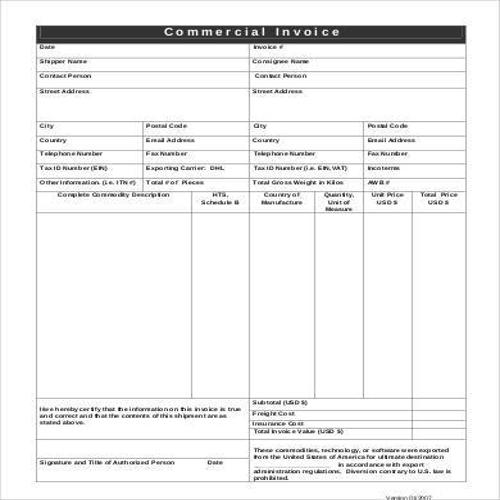

Commercial Business Invoice

Elemental Business Invoice Template

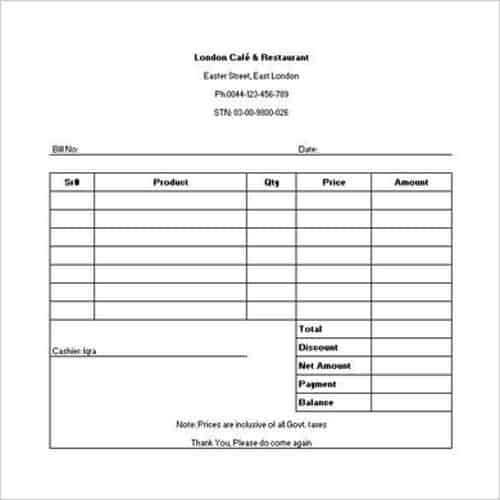

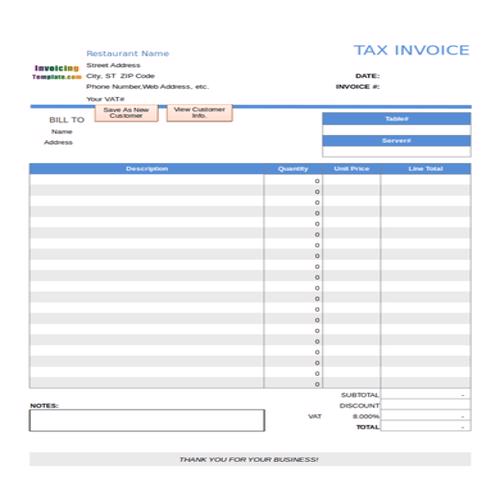

Restaurant’s Business Invoice

Entity’s Business Invoice Template

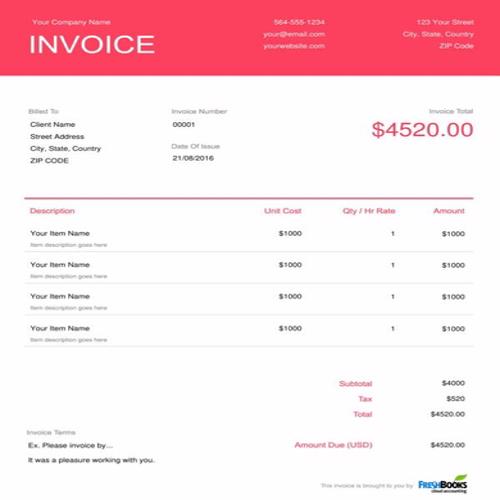

Elements of a Business Invoice Template

The content and details of a business invoice template depends upon the type and nature of business. Every business designs its invoice and include details in it according to its requirement. However following are some of the basic elements of a business invoice template that must be included in it.

- Make sure to use the word ‘invoice’ specifically in your document, at the very beginning. It is to make sure that you are sending an invoice and not a quotation or a receipt.

- In your business invoice template, you should properly mention your company’s full name and complete address. Also mention you client’s company name in full and its complete address.

- Make sure your invoice is properly dated and it must include a unique reference number.

- Make sure to address the invoice to a proper and authorized person, who will be responsible for handling and processing the invoice.

- In most cases, you will have to include ‘Value Added Tax’ (VAT) or GST, separately in your business invoice. Ensure that such tax is properly calculated.

- While creating a business invoice template, make sure that it complies with all the necessary and relevant details and information, as required by local laws of the state.

- Discounts are often offered to customers, especially on bulk purchases. Include the exact amount of any such discount in the invoice.

- Add the necessary columns and include costing or charging details like, details of number of items/hours/days, cost per item/hour/day, total amount for each item and a grand total at the end of the invoice.

- At the end of the invoice, mention a grand total of the invoice including tax and discounts.

- Make sure to clearly mention the date by which you demand payment.

- You can also specify the payment method on the business invoice.

Free Small Business Templates

Exceptional Business Invoice

Striking Business Invoice Template

Professional Business Invoice Template

Significant Business Invoice Template

Business Tax Invoice Template

Useful Business Invoice Template

Small Business Invoice Template

Retail Business Invoice Template

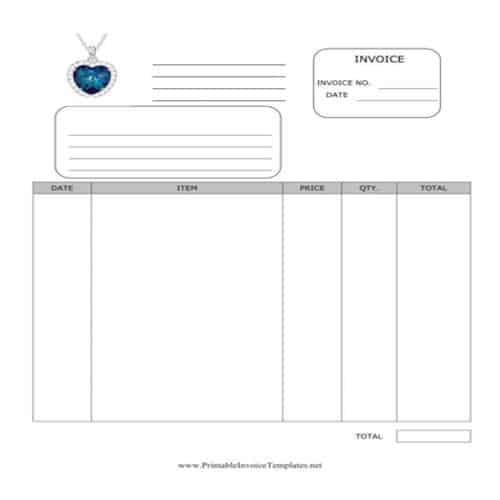

Jewelry Shop Business Invoice

Delightful Business Invoice Template

Particular Business Invoice Template

Advantages and Disadvantages of a Business Invoice Template

A proper business invoice has following benefits:

- A business invoice serves the purpose of a reminder to the customer that a certain sum of money is to be paid.

- With the help of a business invoice, the customer is properly provided with the details of work done or services provided for.

- A business invoice is an evidence of work performed or charged for. If you maintain proper record of business invoices, you will not be disturbed by Tax Authorities.

- When you send a proper invoice to someone with your company name and logo on it, it also increases the visibility of your business brand.

Disadvantages:

Maintaining a proper invoicing system has many benefits, as discussed above. However, if this system is not properly managed, only then it can have some disadvantages, which are as follows:

- If you have not properly included the details of the performed work or services, in your business invoice template, it is more likely that the customer will challenge the invoice.

- If a business invoice is not properly prepared, uncertain or lack necessary information, it can be wrongly interpreted which might cause delay in payments.

- Making an improper or unprofessional invoice can also have a negative impact on your overall business. Customers would believe that you are not carrying out a proper business, and it will damage your goodwill.

- If you are not sending the invoices to your customers on time, it will cause more delay in final settlement of the debt which is not good for your business operations. Make sure to send the invoices immediately after finishing the work.