The people related to businesses, whether the employees or owners, will surely know or at least have some idea about petty cash. A petty cash is not the major cash of a business but a secondary type of cash that is required by businesses to meet their daily basis petty expenses. However, the petty cash is also required to be properly recorded in order to avoid any errors or omissions. For this purpose, a proper petty cash log template is used.

A petty cash log exactly keeps track of all the inflows and outflows of the petty cash. Without a properly maintained petty cash log, there is always a chance of misappropriation in funds fixed for this purpose. A petty cash log template can easily be designed on an excel or word spreadsheet. Also make sure to check out the petty cash log templates given below for you.

Official Petty Cash Log Templates

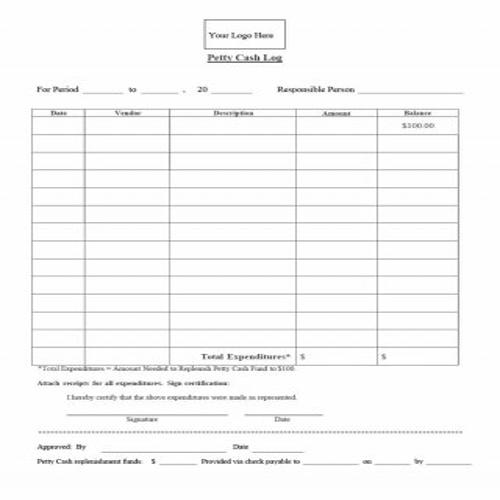

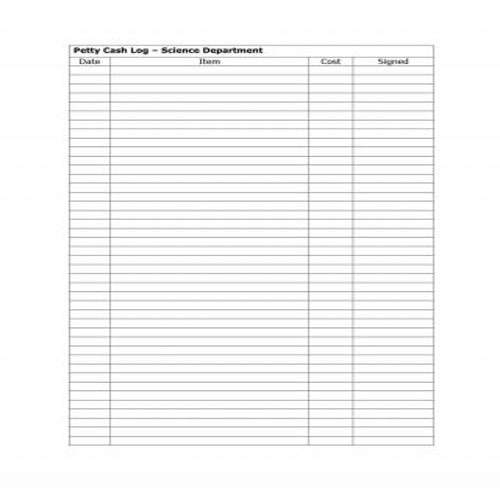

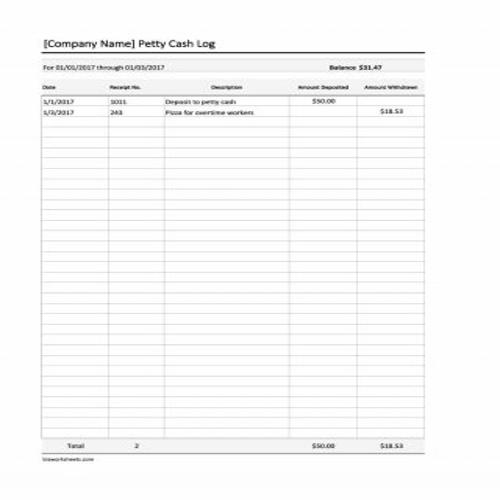

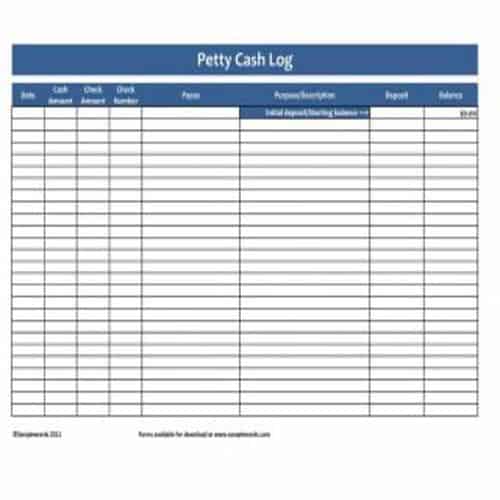

Simple Petty Cash Log Template

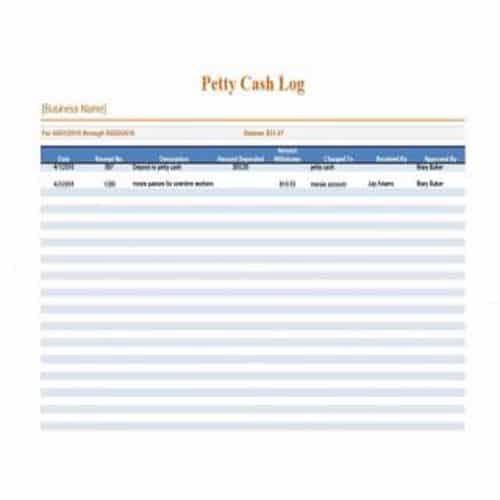

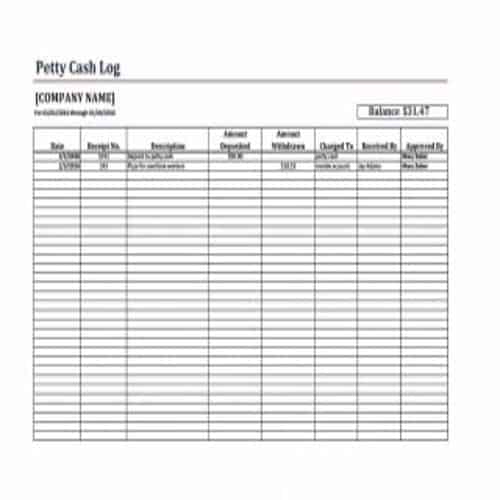

Formal Petty Cash Log Template

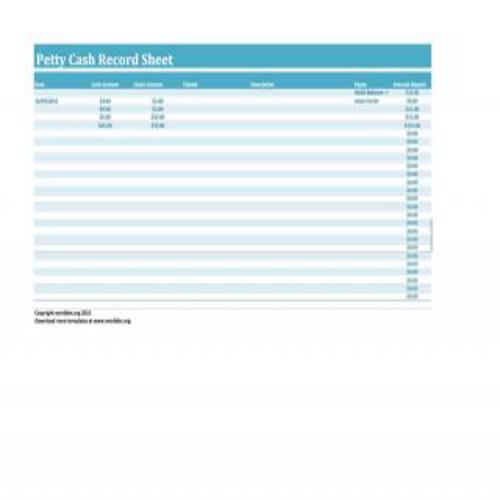

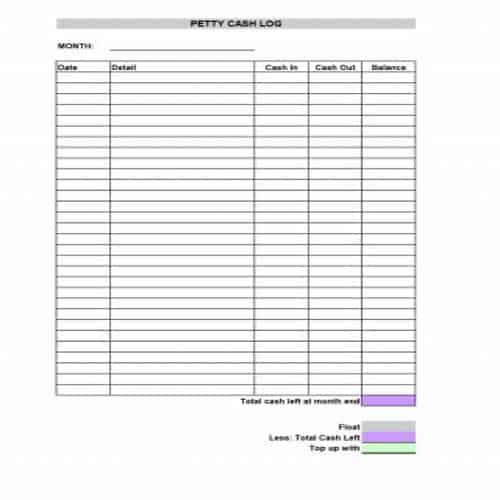

Modern Petty Cash Log Template

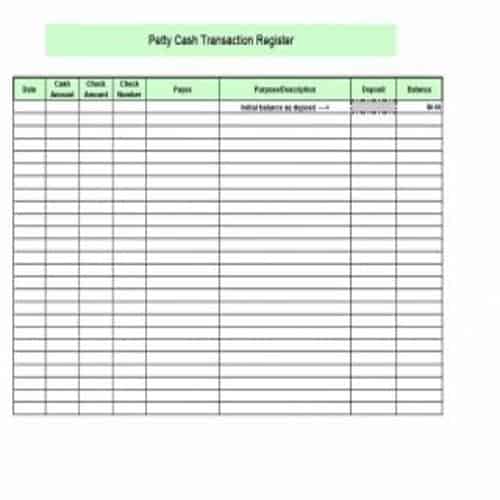

Petty Cash Log Form Template

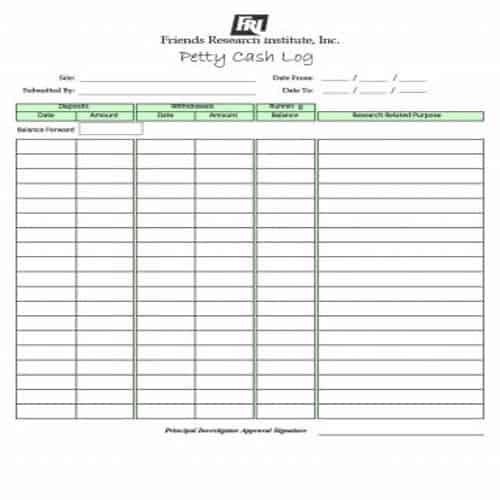

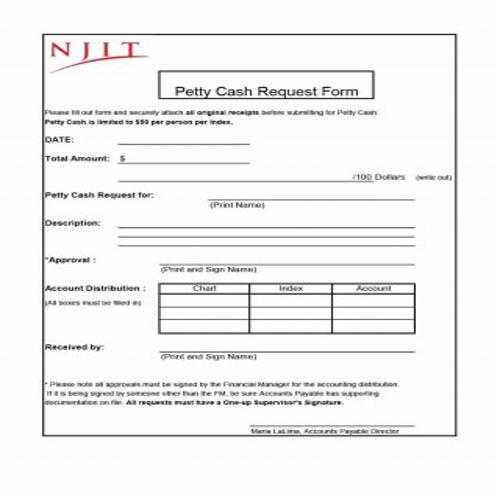

Institute’s Petty Cash Log Template

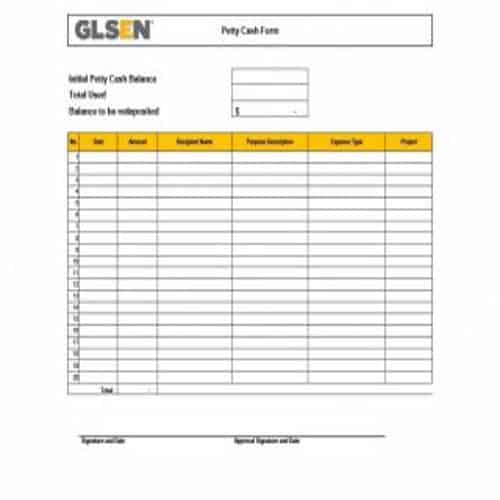

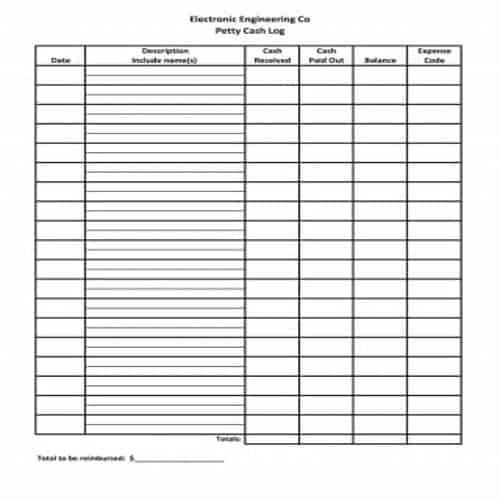

Company’s Petty Cash Log Template

Decent Petty Cash Log Template

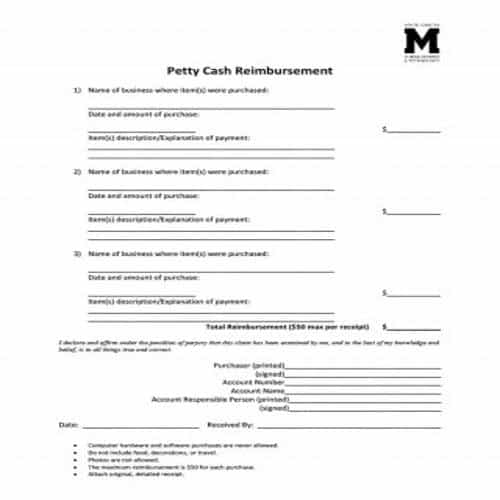

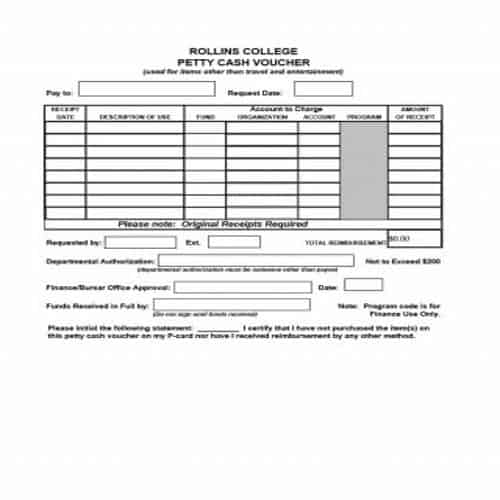

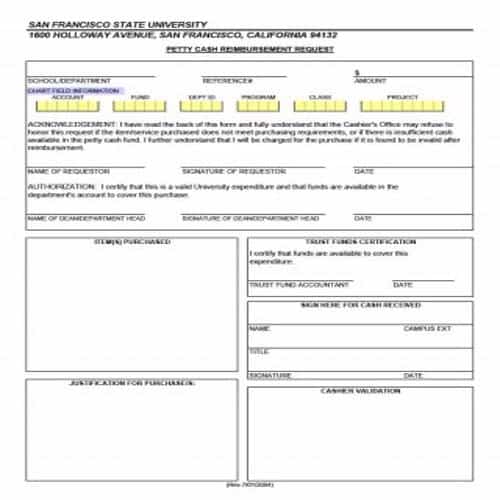

Petty Cash Reimbursement Template

Standard Petty Cash Log Template

Detailed Petty Cash Log Template

Company’s Petty Cash Log Template

Columnar Petty Cash Log Template

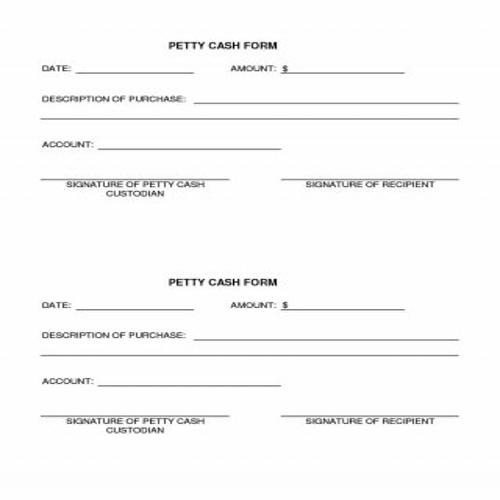

New Petty Cash Form Template

Basic Petty Cash Log Template

Special Petty Cash Log Template

Brief Petty Cash Log Template

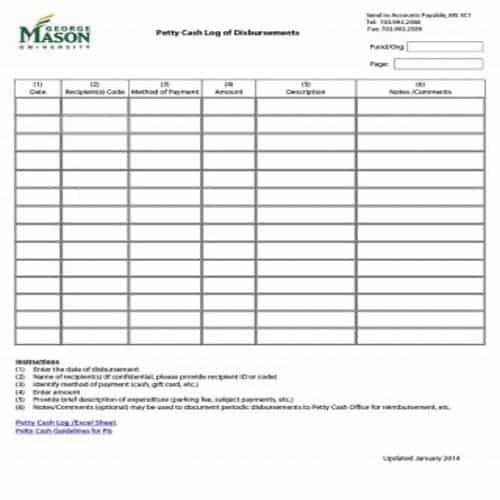

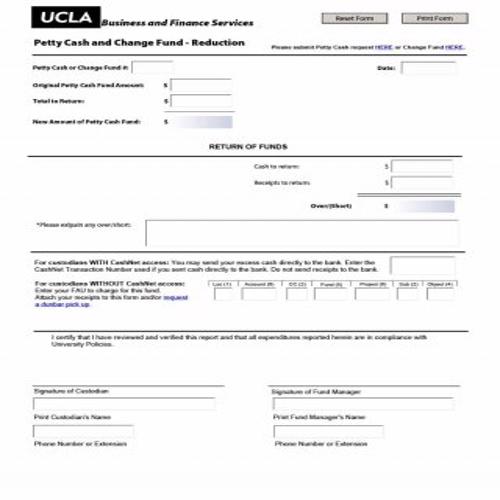

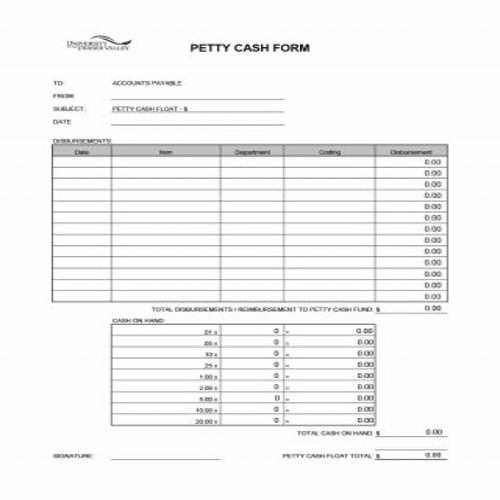

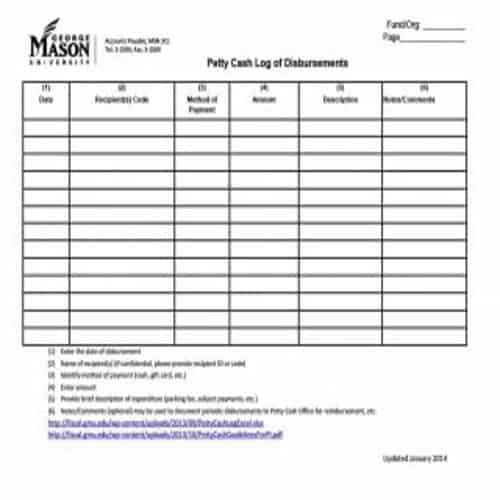

University’s Petty Cash Log Template

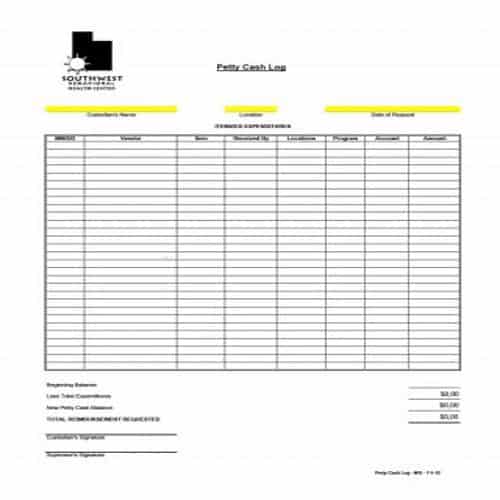

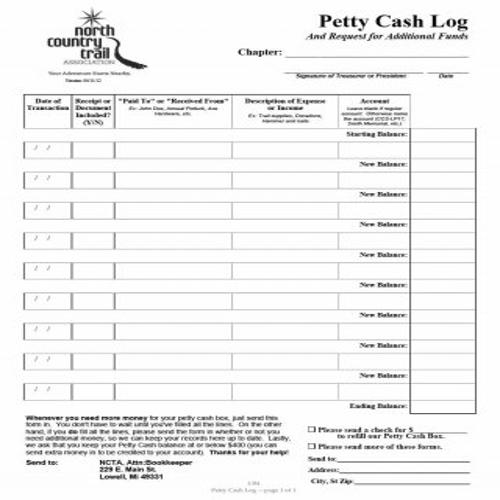

Routine Petty Cash Log Template

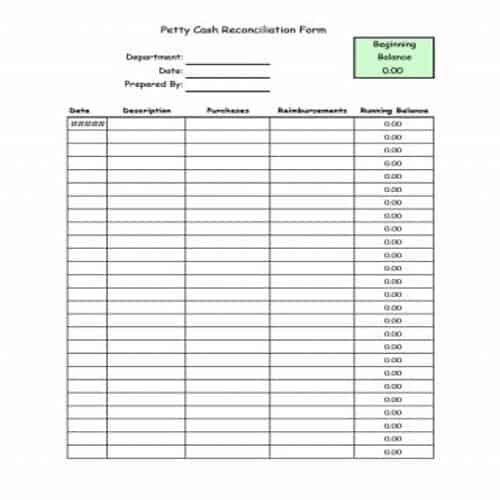

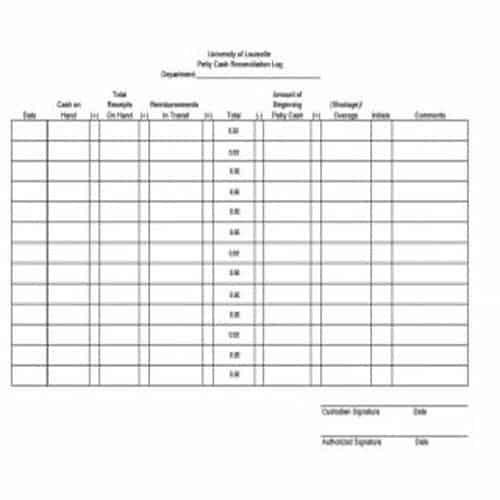

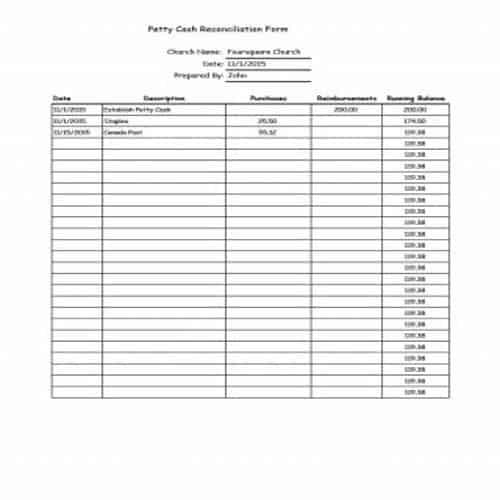

Petty Cash Reconciliation Log Template

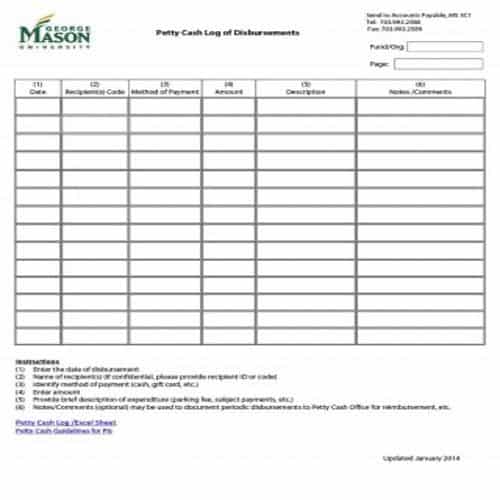

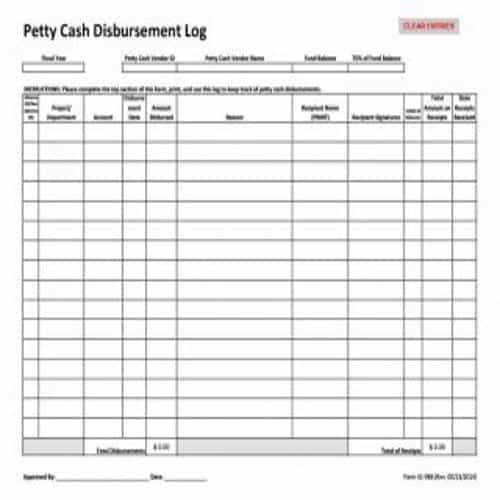

Petty Cash Disbursement Log Template

Importance of Petty Cash Log Template

It is very important to have a properly maintained petty cash log because there is a possibility that small amounts can go unnoticed, which in aggregate, could take the form of big mistakes or errors. Following are some more reasons that why a business would require a petty cash log template:

- The transactions which are smaller in nature and size, are properly recorded in a petty cash log. It includes all the details and information related to such transactions.

- As the petty cash account is separate from the major cash, so a petty cash log makes it easier to manage the petty cash more effectively and efficiently.

- A petty cash log helps in systematic maintaining of all the documentation related to petty expenses and petty payments on daily basis.

- A standard petty cash log clearly shows the amount transferred to the petty cash account and all the payments made for petty expenses incurred. It also helps in any fraudulent or fictitious payments from the petty cash account.

- Writing checks for small amounts is very disturbing. So, a petty cash log eliminates the inconvenience of writing checks for smaller amounts.

More Petty Cash Log Templates

Company’s Petty Cash Log Template

Official Petty Cash Log Template

Standard Petty Cash Log Template

Descriptive Petty Cash Log Template

Departmental Petty Cash Log Template

Simple Blank Petty Cash Log Template

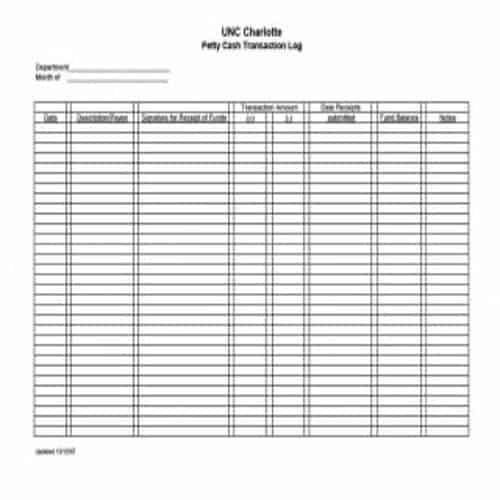

Petty Cash Transaction Log Template

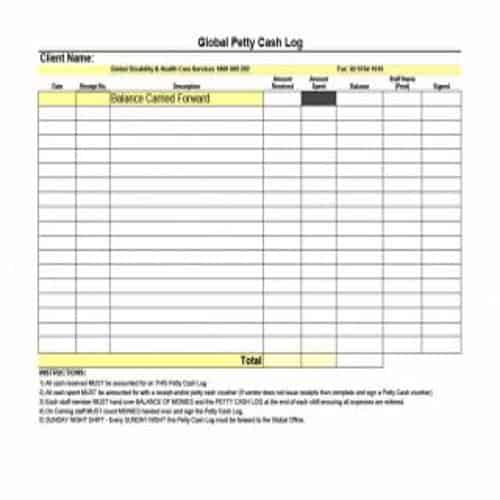

Highlighted Petty Cash Log Template

Petty Cash Fund Log Template

Basic Petty Cash Log Template

Business’s Petty Cash Log Template

Petty Cash Record Sheet Template

Sample Petty Cash Register

Detailed Petty Cash Log Template

Simple Corporate Petty Cash Log Template

Conventional Petty Cash Log Template

Types of Petty Cash Logs

A petty cash log can be prepared according to the nature and size of your business and in accordance with your convenience. Following are some of the most common types of petty cash logs:

1. Simple:

It is the basic type of petty cash log in which a column for the amount and a column for the date is made. The amount received as petty cash is recorded on the debit side and all the payments made for petty expense are written on the credit side of the log. At the end, the balance amount, if any, is written.

2. Analytical:

In this type, each type of expense is recorded in a separate column, in the credit side of the log. Just like the simple petty cash log, the debit side will include only one column i.e, the amount received as petty cash.

3. Columnar:

In this type of log, there are many columns on the credit side, just like the analytical petty cash log. The debit side will have only one column for the amount received as petty cash from the head cashier. In the credit side, the expenses are recorded chronologically and in a classified method. In this type, a separate column for date is also added.

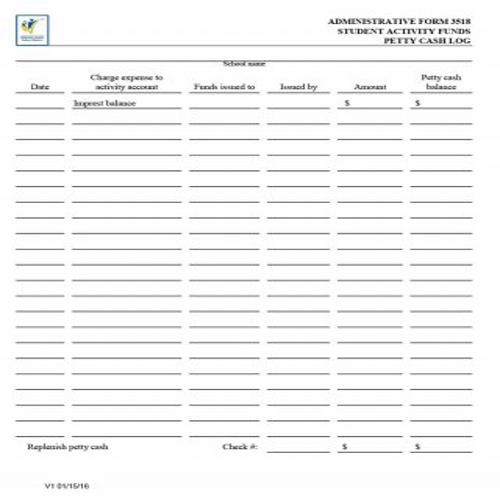

4. Imprest:

Just like the columnar type of petty cash log, the imprest petty cash log will almost have the same layout. The main difference is that in the imprest petty cash log, the head cashier will provide the amount to be used as petty cash, in advance, in order to cover the petty expense for a particular period. After the period is over, the petty cashier will submit a statement of all the petty expense to the head cashier. The head cashier then properly verifies such statement and then again pays the amount to be used as petty cash, to the petty cashier, for the next period.