In this article, we provide you some best quality loan amortization schedule templates. But first of all, it is very important to know what a loan amortization schedule is and what is its importance.

Loan amortization schedule is a document that is used to record all the payments relevant to a particular loan. Just like other elements, the component of ‘loan’ is also very important for financial statements.

Therefore, it is very important to keep proper track of all the loans of a business. For this purpose, many businesses use pre-formatted loan amortization schedule templates. Using these templates will save a lot of your time and effort.

So, don’t forget to check out the given below loan amortization schedule templates. All these templates are editable and free to download and use.

Best Loan Amortization Schedule Templates

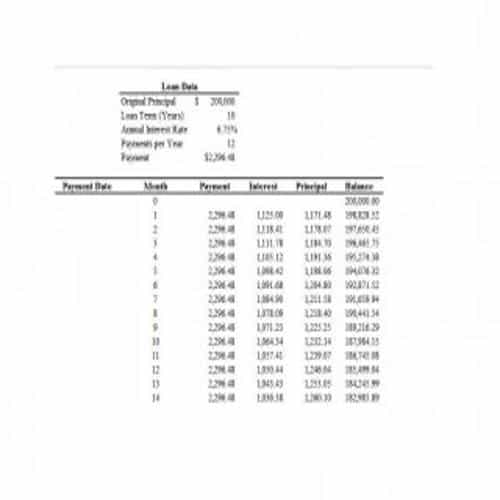

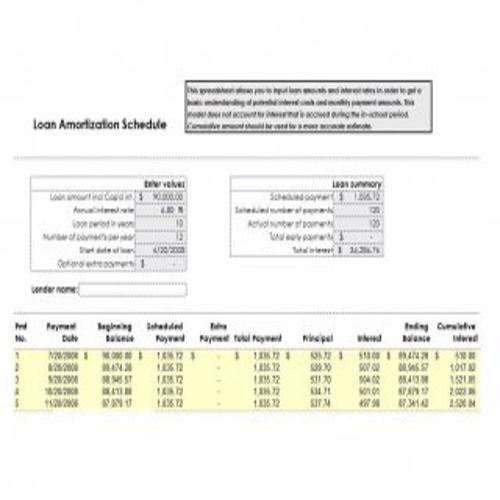

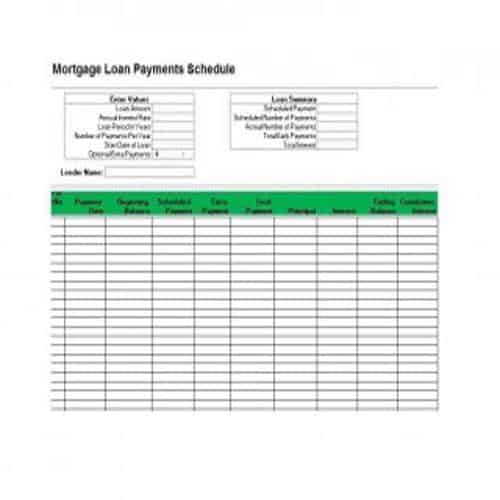

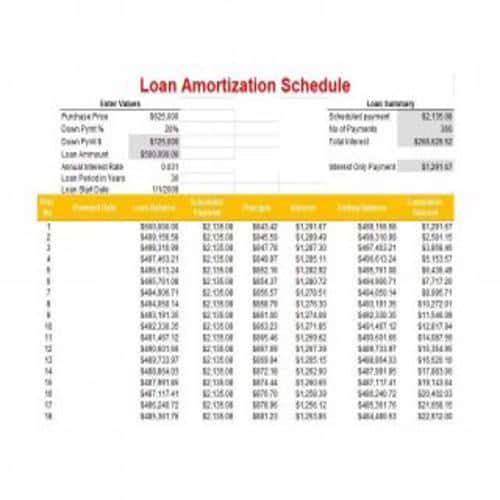

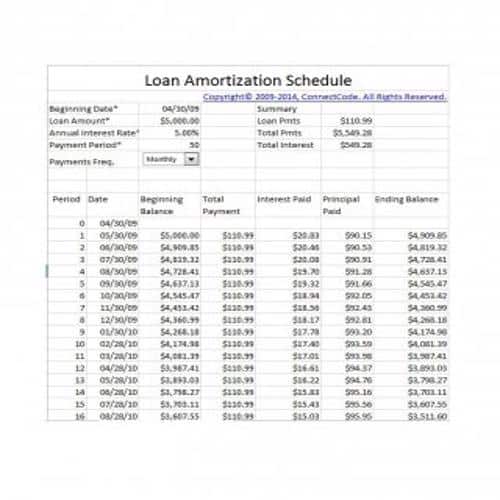

Loan Amortization Schedule SpreadsheetTemplate

Elemental Loan Amortization Schedule Template

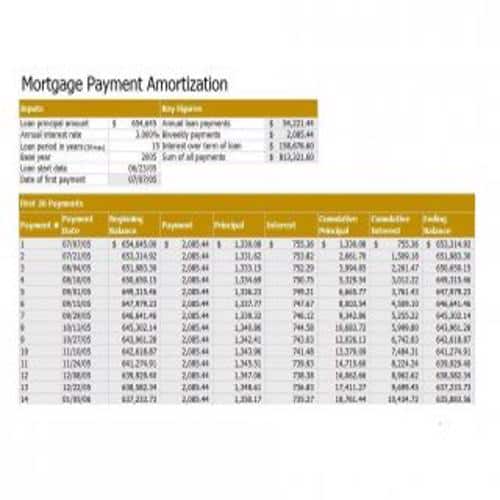

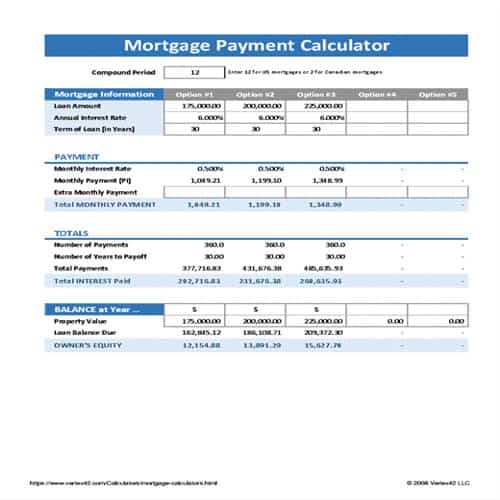

Mortgage Amortization Schedule Template

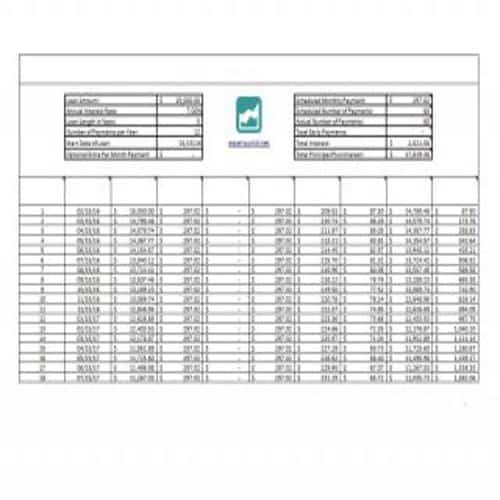

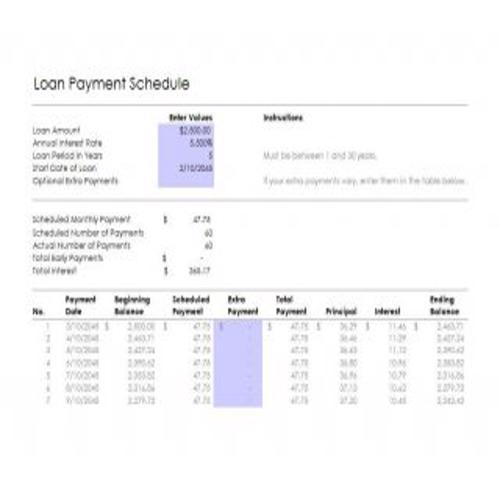

Standard Loan Amortization Schedule Template

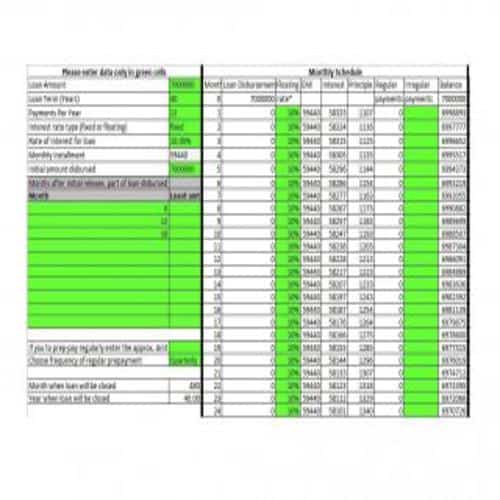

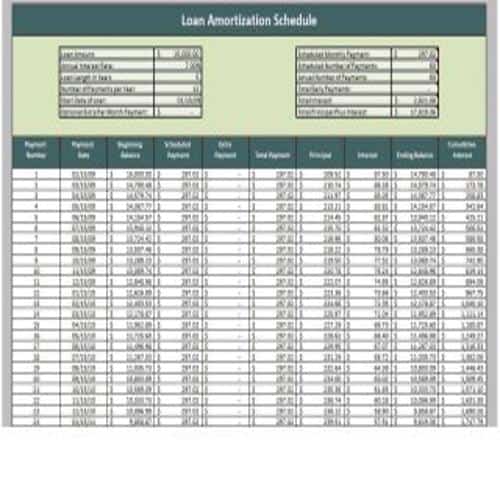

Important Loan Amortization Schedule Template

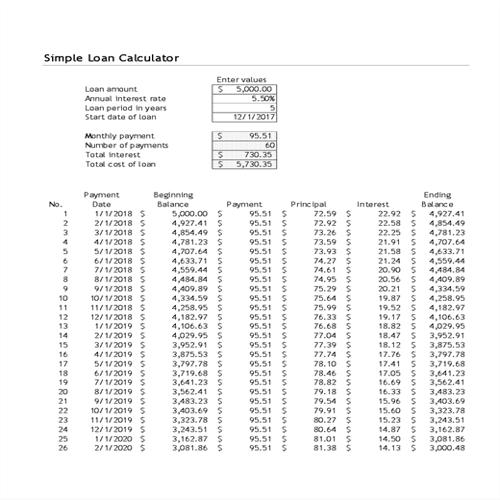

Simple Loan Amortization Schedule Template

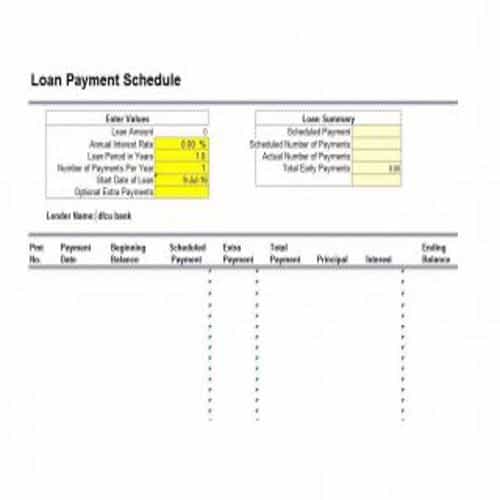

Blank Loan Amortization Schedule Template

Effective Loan Amortization Schedule Template

Specific Loan Amortization Schedule Template

Typical Loan Amortization Schedule Template

Different Types of Amortization Loans

There are three different types of amortization loans, which are explained below:

1. Mortgages:

A mortgage is the most common amortization loan. These loans can be obtained by providing any collateral asset such as a home, a property or a building etc.

The mortgage is usually a long term loan i.e, for 20 or 25 years. It is because the amount of loan is usually much bigger than other types of loans.

2. Loans for Cars:

As evident from the name, this type of amortization loan is used where the borrower intends to buy a car from the amount borrowed. Car loans are typically short term i.e, not more than 5 years.

Such a loan is paid in form of fixed monthly installments. In case of car loans, sometimes you end up paying more interest than the principal amount of loan.

3. Personal Loans:

These amortization loans are acquired by the borrower for some personal or private purposes such as, for medical bills, important home repairs, wedding, vacations, divorce settlement or debt consolidation etc. Both the interest rate and the time period or duration of the loan are fixed.

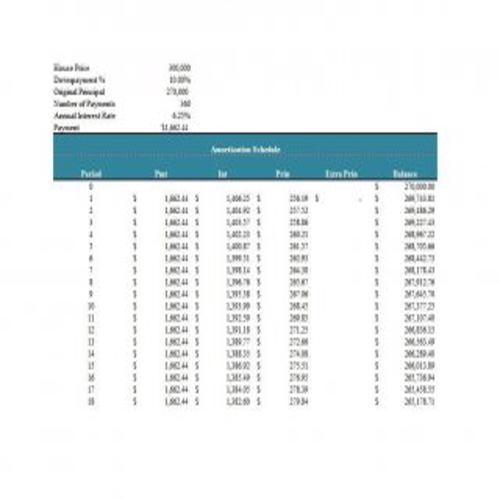

Useful Loan Amortization Schedule Templates

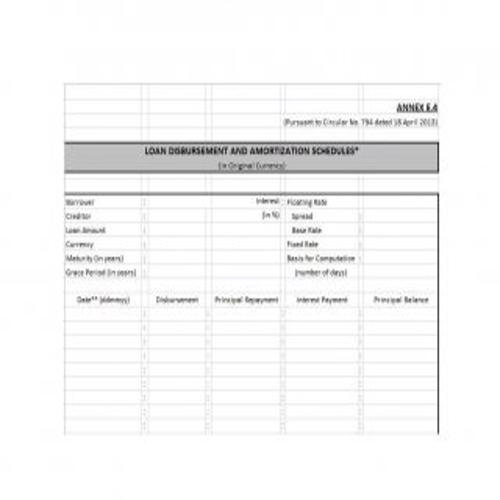

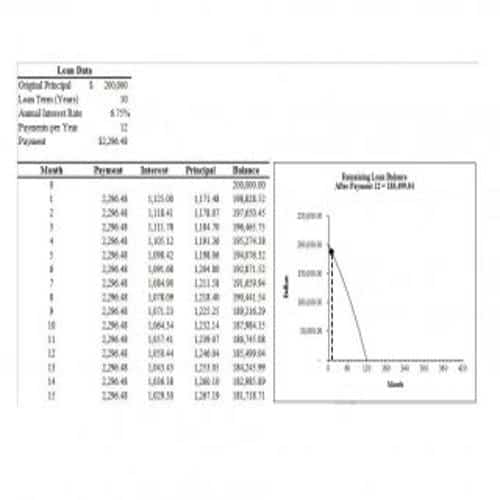

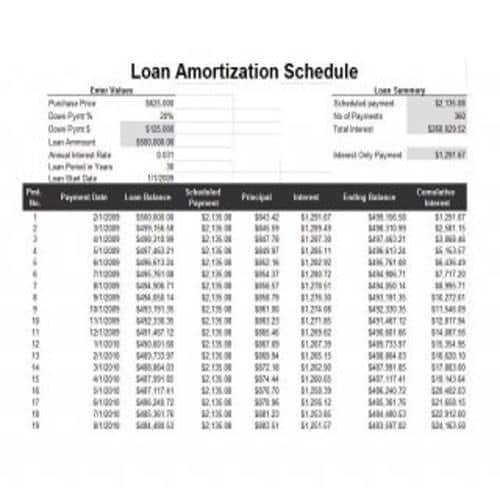

Detailed Loan Amortization Schedule Template

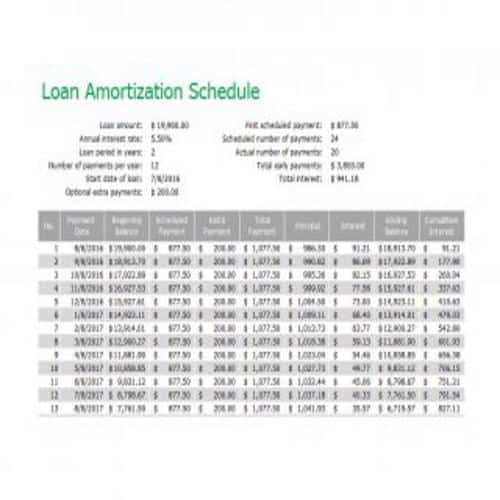

Sample Loan Amortization Schedule Template

Loan Amortization Schedule Format Template

Regular Loan Amortization Schedule Template

Mortgage Amortization Schedule Template

Blank Loan Payment Schedule Template

Effective Loan Amortization Schedule Template

Proper Loan Amortization Schedule Template

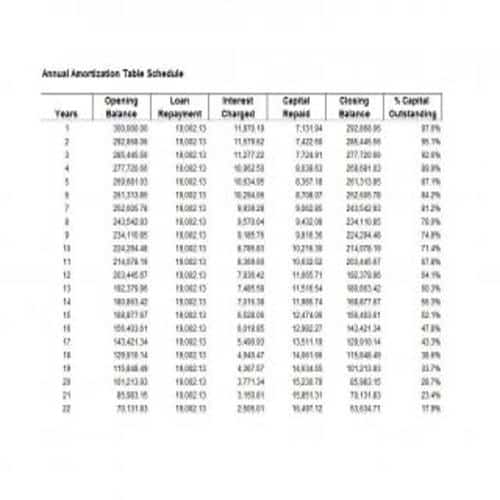

Extensive Loan Amortization Schedule Template

Complete Loan Amortization Schedule Template

Important Terminologies to Know

Whether you want to create your own schedule or use a ready made loan amortization schedule template, it is very important that you must know about certain important terminologies. These terminologies are briefly explained below:

1. Amount of Loan:

The amount of loan, also referred to as ‘Principal’ amount of loan, that is provided by a person or a financial institution and is received by a borrower. The principal amount of loan must be clearly mentioned.

2. Time Duration:

This is the time period or time duration for which the amount is borrowed i.e, 5 years or 10 years etc. The lender and borrower must decide the time duration with mutual understanding.

3. Amount to be repaid:

The total amount to be repaid by the borrower comprises of the principal amount of loan, any fee or other service charges and the amount of interest that is to be paid to the lender.

4. Interest Rate:

It is the borrowing rate or rate of interest that will be charged on the amount of loan. Depending upon the terms and conditions of the loan agreement, the rate of interest can be fixed or it can be variable.

If the rate of interest is variable, it will change according to the market fluctuations. However, the fixed rate of interest will not change and remain same. The market fluctuations will have no impact on it.

5. Cumulative Interest:

As evident from the name, the cumulative interest is the total amount of interest that the borrower has paid or the lender has received, on the amount of loan, during the complete term of a loan agreement. It can be easily calculated by simply adding all the payments of interest.

6. Opening Balance:

In a loan amortization schedule template, the opening balance is the current amount of loan owed before any principal payment for the period has been made. Simply put, the closing balance of the last period can be considered as the opening balance of the current period.

7. Closing Balance:

In a loan amortization schedule template, the closing balance is the amount of loan owed at the end of a period, after all the principal payments for that period have been made.