This article is all about loan agreement and loan agreement templates. In the world of business, a loan agreement is one of the most common and important document. A loan agreement is drafted whenever a person lends some money or funds to another person.

Here, the word ‘person’ is used for both ‘natural’ person and an ‘artificial’ person i.e, a company. The person giving the money is called ‘lender’ and the person to whom money is given is called ‘borrower’. In order to save time and effort, most of the businesses or people prefer to use ready made loan agreement templates.

A loan agreement can be very technical in nature. At the time of formation of such an agreement, it must be ensured that all the relevant and important details are included in it. It is also very important that the parties to such a loan agreement must be on the same set of mind, at the time of entering into a loan agreement.

There are many different types of a loan agreement which are explained below. In addition to this, some quality loan agreement templates are also provided for you below. All these templates are free to download and use.

Best Loan Agreement Templates

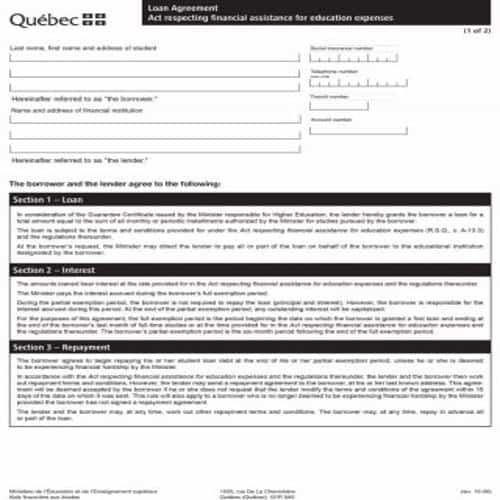

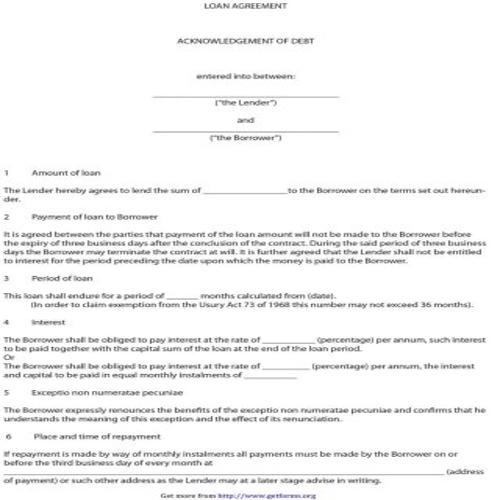

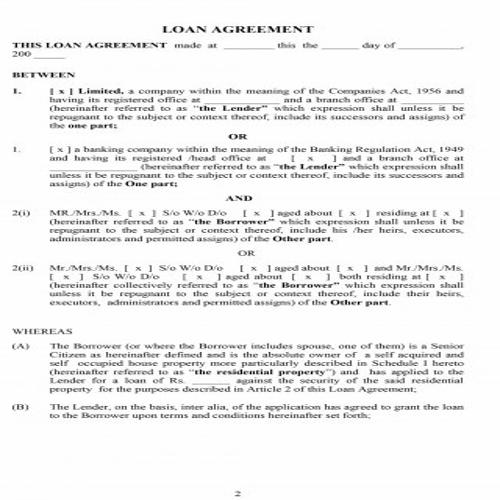

Complete Loan Agreement Template

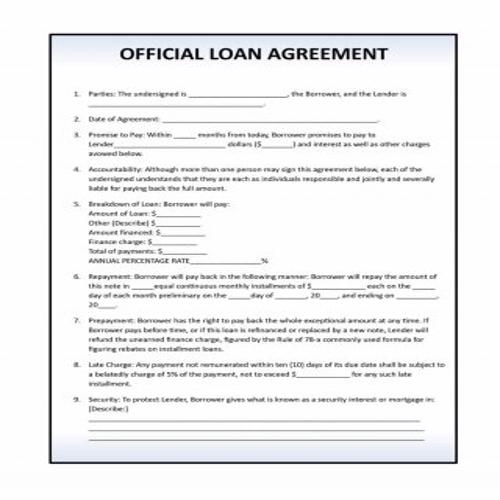

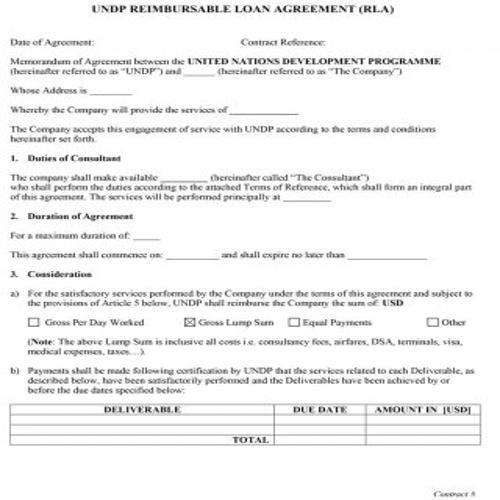

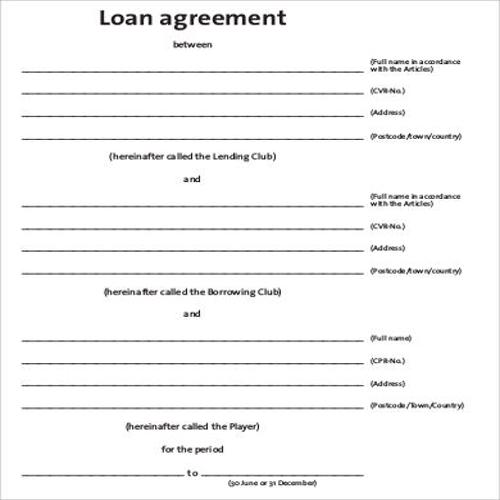

Official Loan Agreement Template

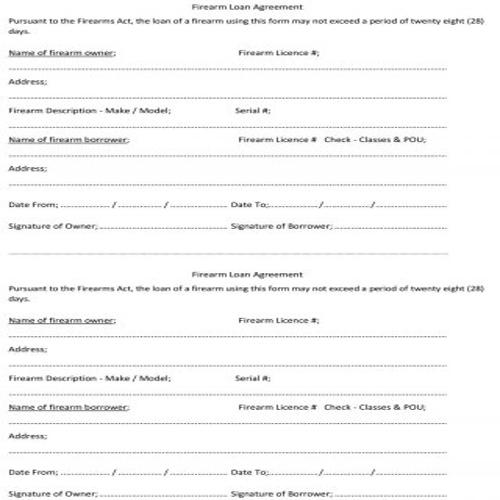

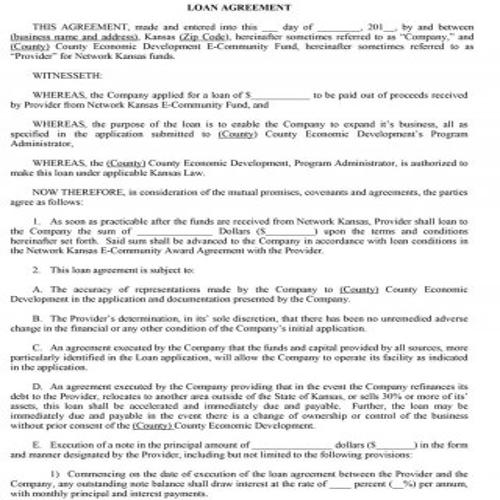

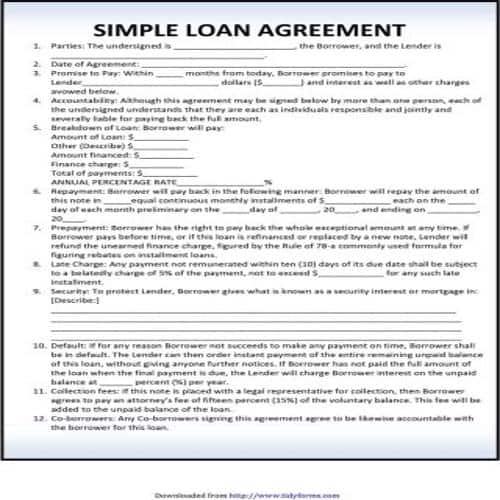

Loan Agreement Form Template

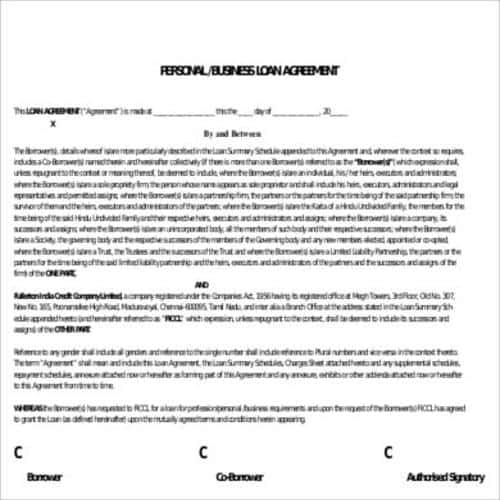

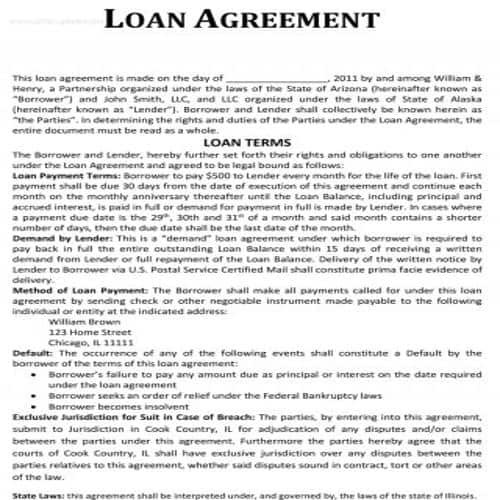

Detailed Loan Agreement Template

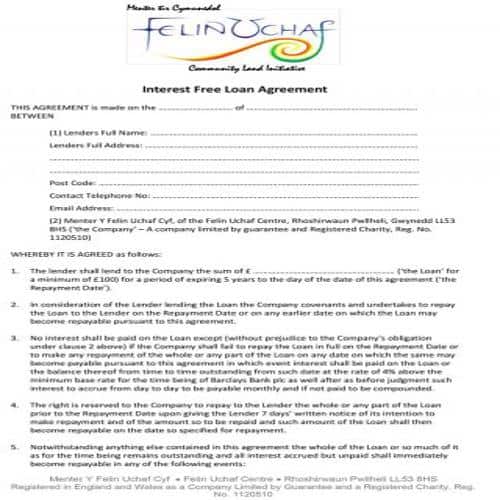

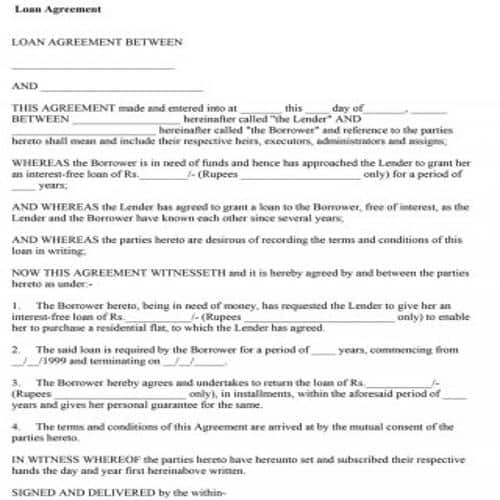

Interest Free Loan Agreement Template

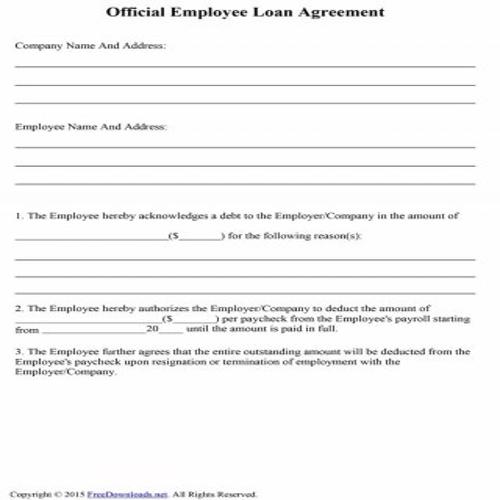

Employee’s Loan Agreement Template

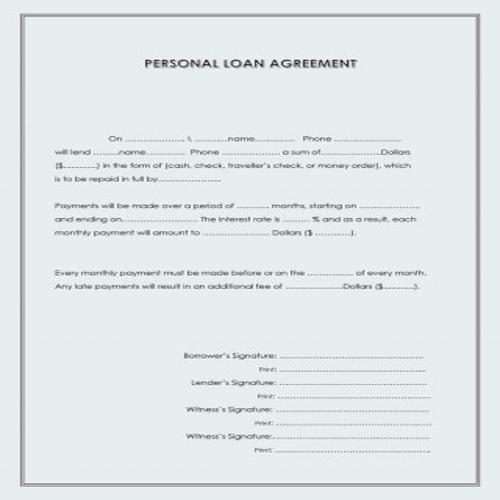

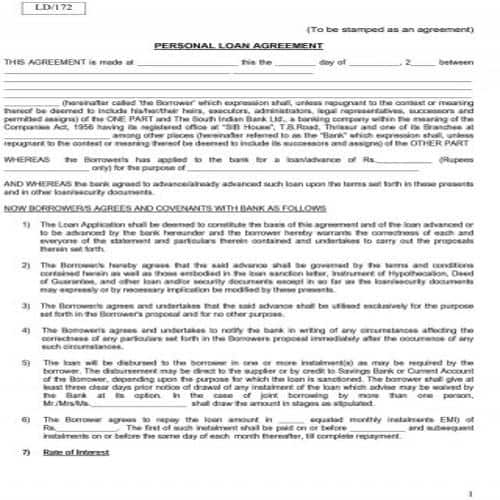

Personal Loan Agreement Template

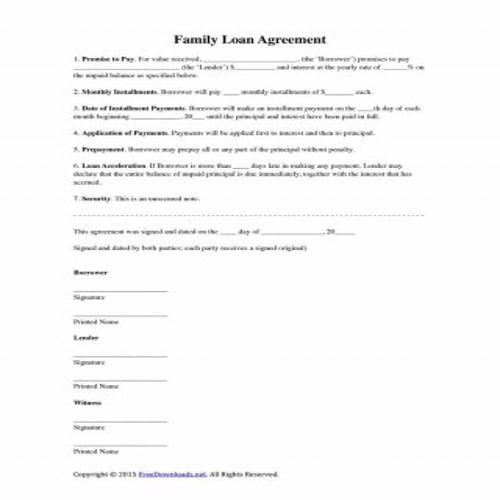

Family Loan Agreement Template

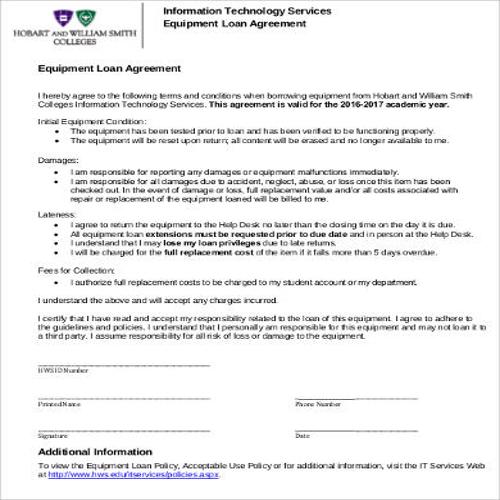

IT Services & Equipment Loan Agreement Template

Exclusive Personal Loan Agreement Template

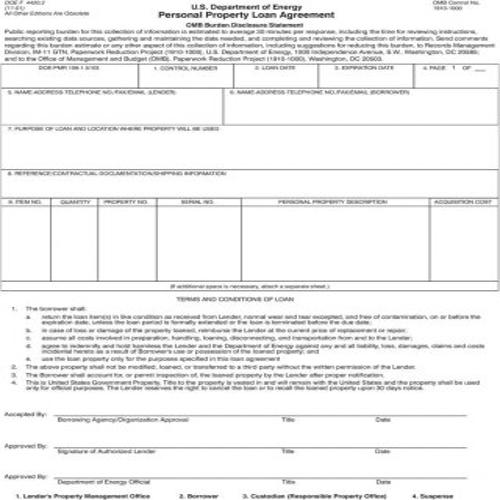

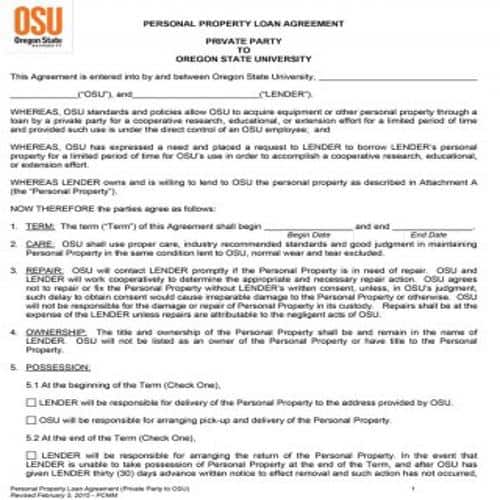

Property Loan Agreement Template

Special Loan Agreement Template

Different Types of Loan Agreements

Following are some common types of loan agreements:

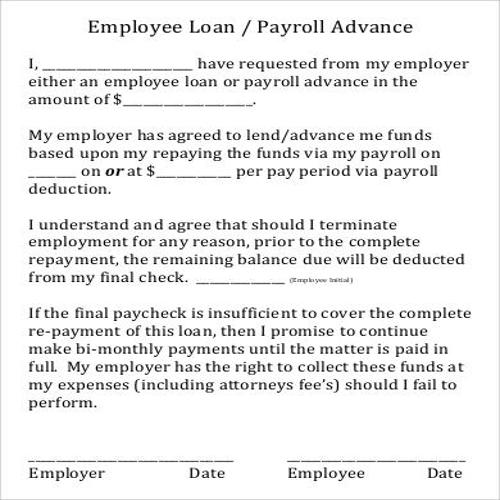

1. Employee’s Loan Agreement:

Such a loan agreement that is signed or formed between an employer and an employee is called employee’s loan agreement. Almost all of the employers provide their employees with the facility of borrowing, especially to executive level employees. Such a loan is provided in accordance with the terms of the employment contract.

2. Student’s Loan Agreement:

This loan agreement is formed between a student and his institute. The most important benefit of this agreement is that the student can continue his study even if he has no money to pay the fee.

3. Loan Agreement for Equipment:

An equipment loan agreement is made when there are no funds to purchase a required equipment. Then such an equipment is borrowed. This type of loan agreement is created between the owner of such equipment and the person or entity who wants to borrow that equipment.

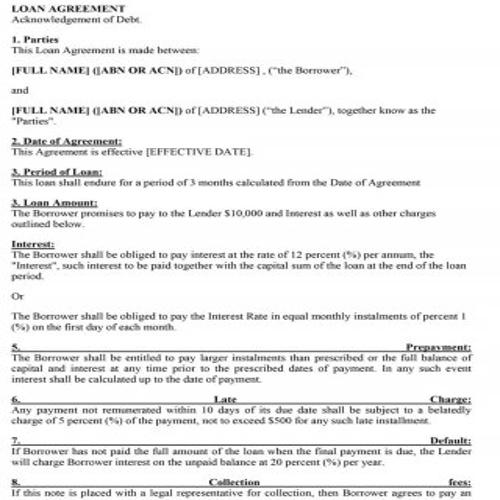

4. Personal Loan Agreement:

A person applies for a personal loan when he requires funds for some personal uses or tasks. The agreement, thus formed between that person and the lender, is known as personal loan agreement.

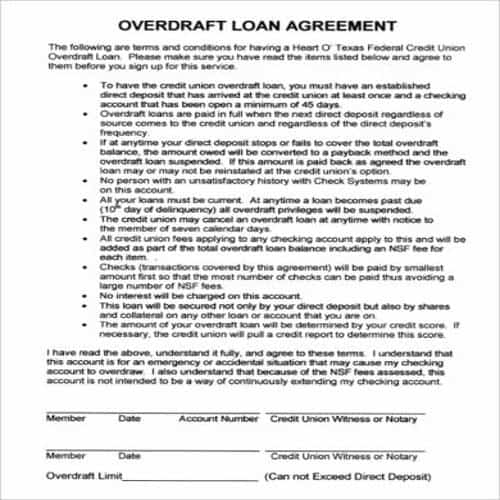

5. Overdraft Loan Agreement:

An overdraft loan agreement is usually formed between a person and a bank where the bank allows the person to withdraw and use money from his account even if there are funds or amounts left in it. Then the bank charge interest on the amount of such an overdraft during a specified period.

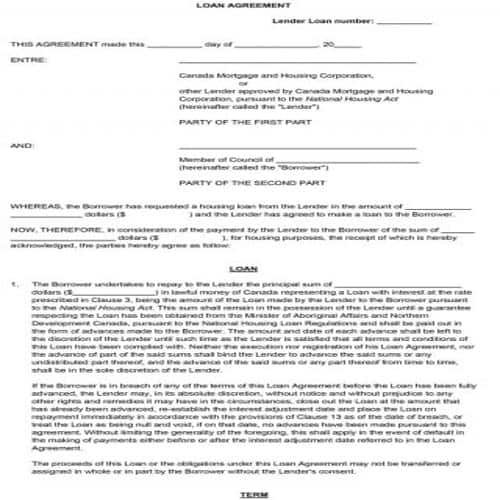

6. Mortgage Loan Agreement:

This type of loan agreement is formed where a person pledges his property with the lender and the lender, in return, provides him the necessary funds. If the borrower fails to repay the loan, the loan agreement allows the lender to take over the property of borrower.

Practical Loan Agreement Templates

Illustrative Loan Agreement Template

Departmental Loan Agreement Template

Overdraft Loan Agreement Template

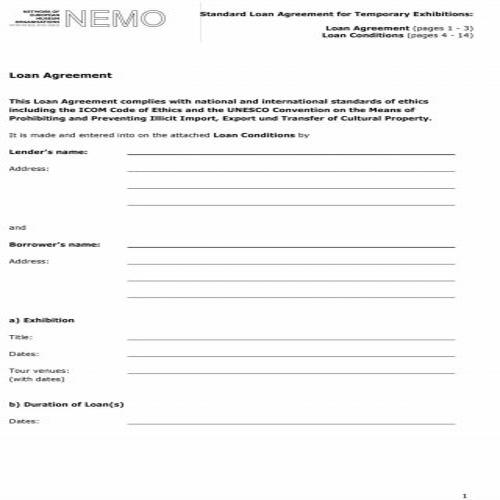

Fine Arts Loan Agreement Template

Effective Loan Agreement Template

Project’s Loan Agreement Template

Simple Detailed Loan Agreement Template

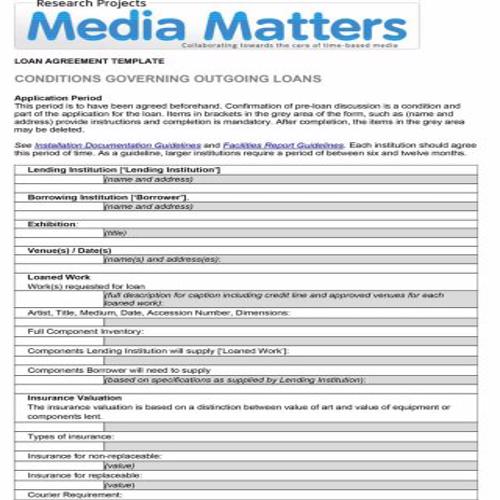

Research Project Loan Agreement Template

Important Loan Agreement Template

Useful Loan Agreement Template

Equipment Loan Agreement Template

Example Loan Agreement Template

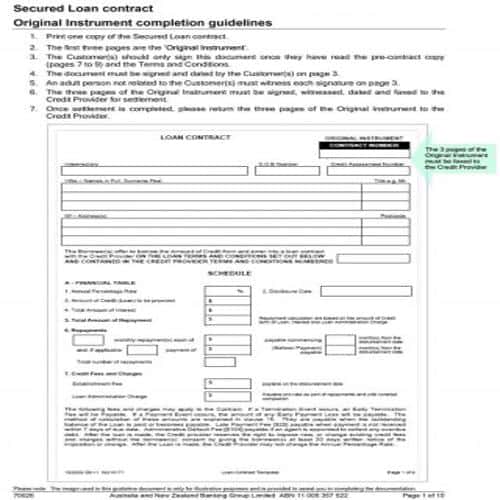

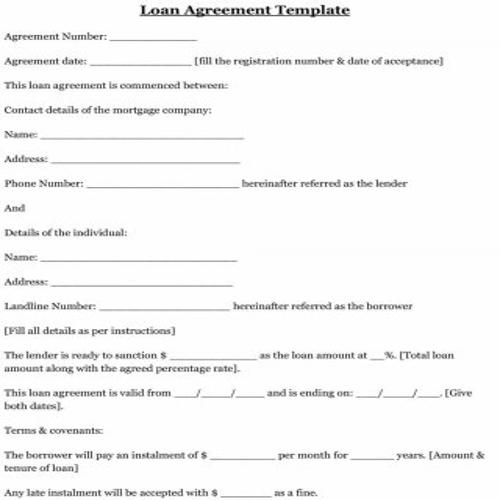

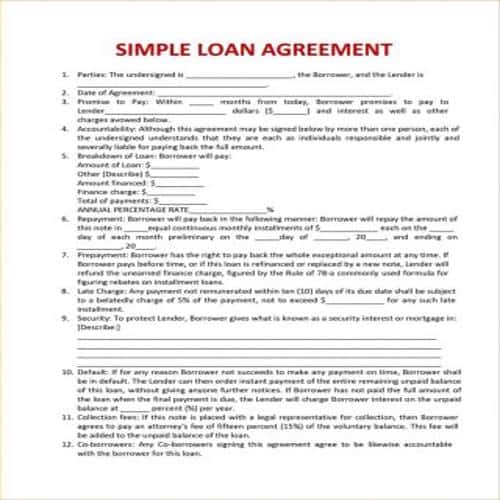

Basic Elements or Details of a Loan Agreement Template

A loan agreement template can be designed and drafted in any way. The details and content of a loan agreement depends upon the type and nature of the loan agreement. However, every loan agreement template must include the following basic elements or details in it:

- The correct date on which the agreement is signed by the parties to the agreement.

- All the necessary details and information of the lender.

- All the necessary details and information of the borrower.

- The details of the amount of loan.

- Rate of interest that will be charged.

- Any conditions, if specified by the lender for the borrower, restricting the use of funds or amount of loan.

- The methods or options available to the borrower for repayment of loan.

- The time period or duration for which the loan is borrowed.

- A loan agreement template can also include the clauses or options for the termination or cancellation of loan.

- A loan agreement template can also include an early payment benefit and late payment penalty.

- What will happen or what action will be taken in case of default in repayment of loan, must be clearly specified in a loan agreement.