Deposit slip templates are most commonly used by banks and financial institutions. A deposit slip is a piece of paper that is used by the bank’s customers to deposit funds or amounts into their bank accounts.

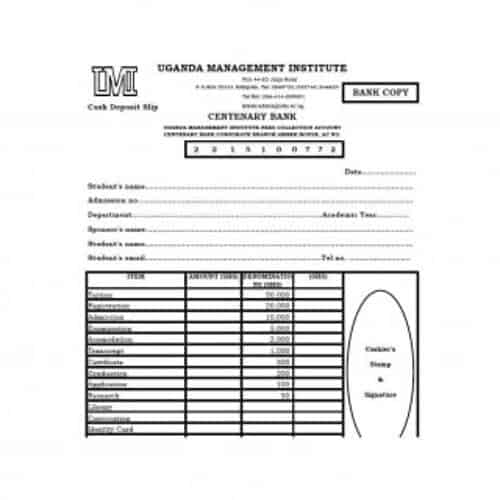

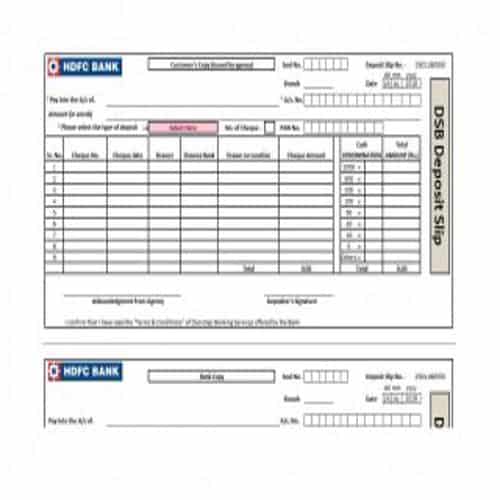

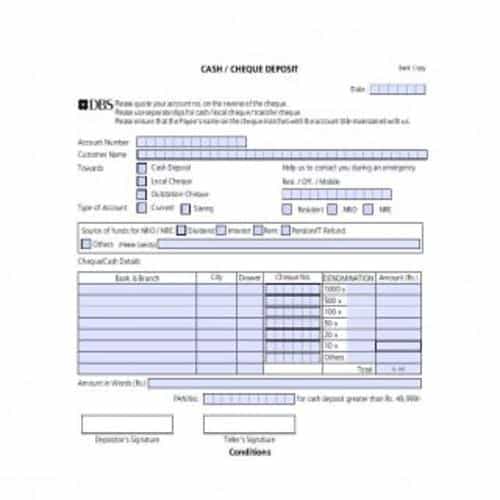

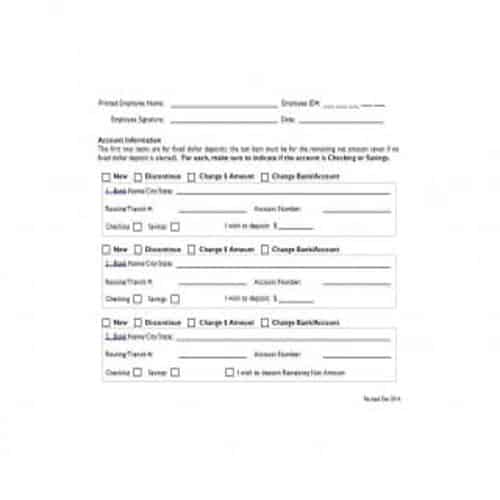

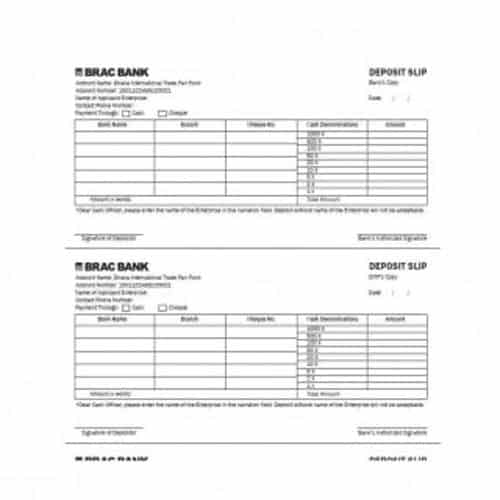

Every bank has its own custom deposit slip template so as to make it unique and identifiable. Similarly, the information contained in the deposit slips of the different banks may vary.

Whenever, a customer wants to deposit some funds into his account, he can not just present these funds to the banker and simply ask him to deposit them into his bank account. Every deposit must be made in a formal manner i.e, by filling and presenting a deposit slip.

In this article, some best quality deposit slip templates are provided for you below. So, make sure to check out these templates which are free to download and use.

Useful Deposit Slip Templates

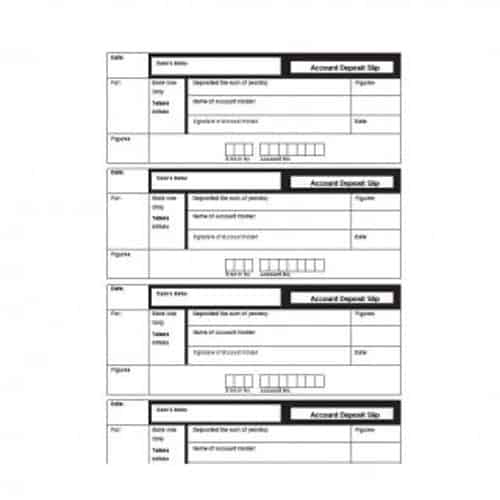

Simple Deposit Slip Template

Formal Deposit Slip Template

Special Deposit Slip Template

Usual Deposit Slip Template

Bank’s Deposit Slip Template

Proper Deposit Slip Template

Regular Deposit Slip Template

Complete Deposit Slip Template

Blank Deposit Slip Template

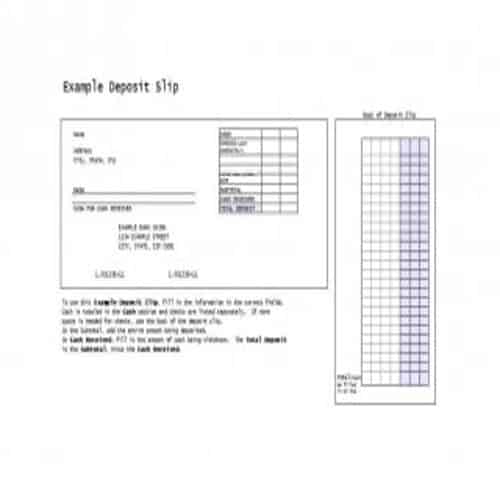

Example Deposit Slip Template

Online Deposit Slip Template

Specific Deposit Slip Template

Basic Elements of a Deposit Slip Template

Every bank uses its own specific deposit slip template. It solely depends upon the bank to include any information on its deposit slip that it thinks necessary to be provided by the customer.

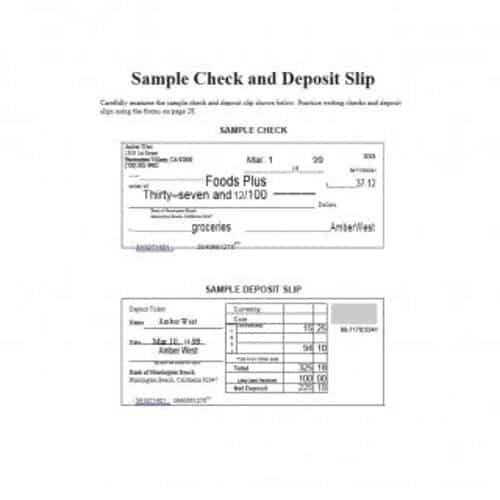

No matter how a deposit slip template is designed or drafted, the following basic elements are always present in it.

1. Account Number:

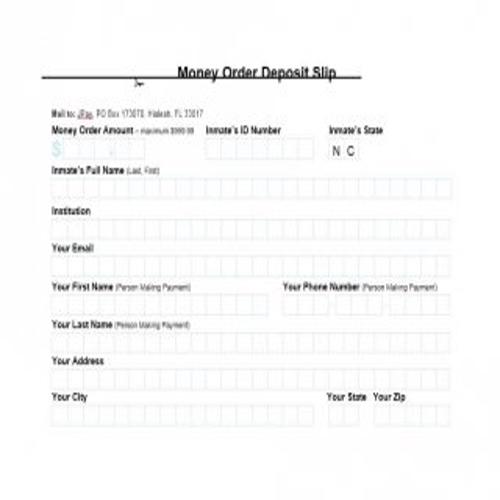

Every bank allots or assigns a unique bank account number whenever someone opens an account with that bank. The customer should mention his account number on the deposit slip while depositing the money.

2. Account Title:

It is the complete name of the individual, in case of a personal account, or the complete name of business, in case of a business account. Make sure to mention the complete and exact name and check for any spelling mistakes.

3. Date of Deposit:

It is the current date on which a deposit slip is presented by the customer to the banker, for deposit of money.

4. Bank Details:

Provide the required bank details mentioned on the deposit slip. Usually, this includes the specific name of the bank’s branch in which the amount is to be deposited and a code of that branch, if there is any.

5. Amount:

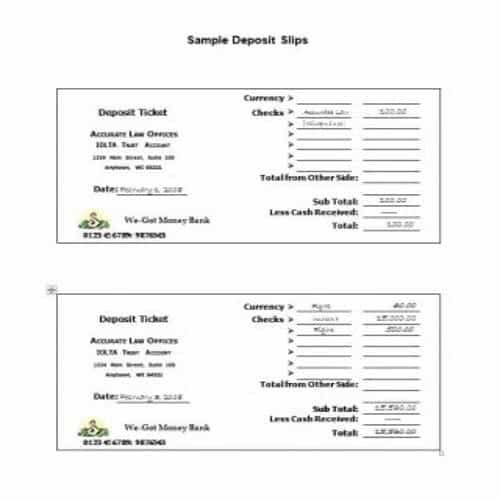

The amount of money that is to be deposited, must be mentioned correctly on the deposit slip. Usually the customers are required to mention both the amount in numbers and amount in words. So, make sure that both the amounts are same.

6. Type of Deposit:

In a deposit slip, it is always mentioned whether the amount to be deposited is cash, checks, drafts or any other instrument etc. So, make sure to check the box appearing before the different types of deposits.

Note: If you are depositing checks as well as cash, then write the amounts of each check and the amount of cash separately.

7. Total:

After writing all the amounts separately, write down the total amount of money that you want to deposit in your bank account.

8. Signature and Contact Number:

At the end, there is a signature line in which the depositor is required to put his signatures. The depositor is also required to mention his contact number on a bank deposit slip.

Practical Deposit Slip Templates

Handy Bank Deposit Slip Template

Official Bank Deposit Slip Template

Basic Bank Deposit Slip Template

Sample Bank Deposit Slip Template

Formal Deposit Slip Template

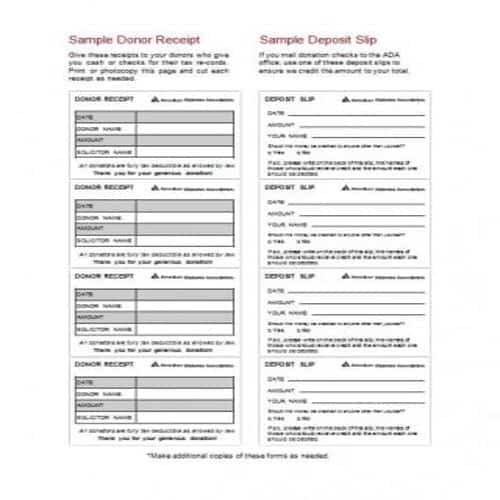

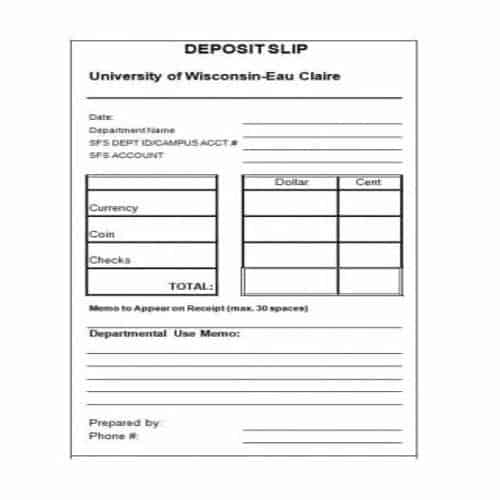

Departmental Deposit Slip Template

Deposit Slip Draft Template

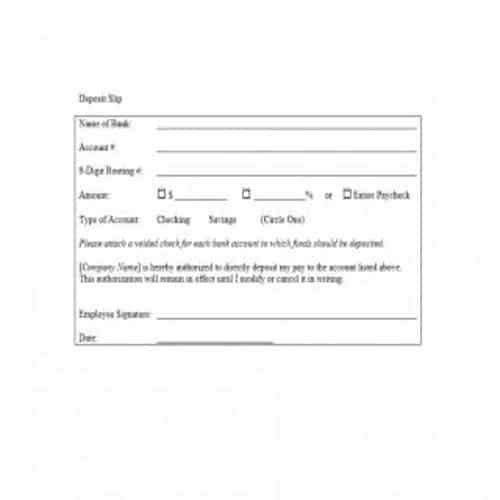

Deposit Slip Form Template

Standard Deposit Slip Template

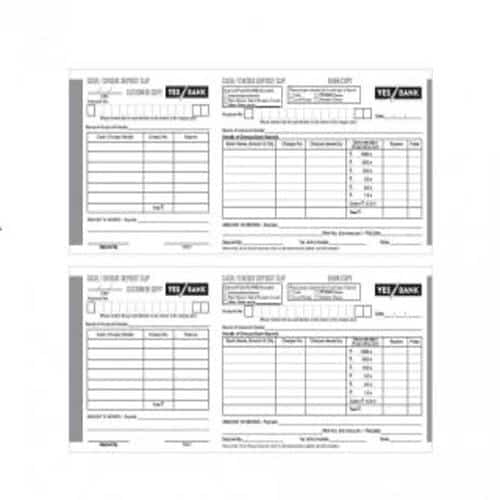

Check & Deposit Slip Template

Model Deposit Slip Template

Official Deposit Slip Template

Why a Bank Deposit Slip is used?

A bank deposit slip is very important to use for the following number of reasons:

- A bank deposit slip is a piece of paper depicting effective written communication between a customer and a banker.

- A deposit slip offers two way protection i.e, protection to both the banker and the customer.

- A proper record of bank’s deposit slips is very important to maintain, especially for the preparation of bank’s own financial statements.

- A deposit slip is enough to ensure a customer that the banker has deposited the correct amount of funds or money into his bank account.

- The record of deposit slips is also important to be maintained because in case of a dispute related to a deposit of funds or amounts, the court may order the bank to provide the deposit slips.

- The deposit slips are used to check and tally the total amounts deposited in a day, so as to make that all the deposits are properly accounted for.