A debt validation letter is an official letter that a debt collector or a debt collection agency sends to a particular debtor of a creditor, while acting on behalf of that creditor. For this purpose, many debt collectors or debt collection agencies use pre-formatted debt validation letter templates.

It is the legal responsibility of the debt collectors to send you a proper debt validation letter that indicates the amount of debt, the details of the debt and any other relevant information. As a debtor, you have the right to ask for further information about that particular debt through a letter. This letter is called the debt verification letter, which is also explained below.

In this article, you are provided with some practical debt validation letter templates. So make sure to scroll down and check out these templates.

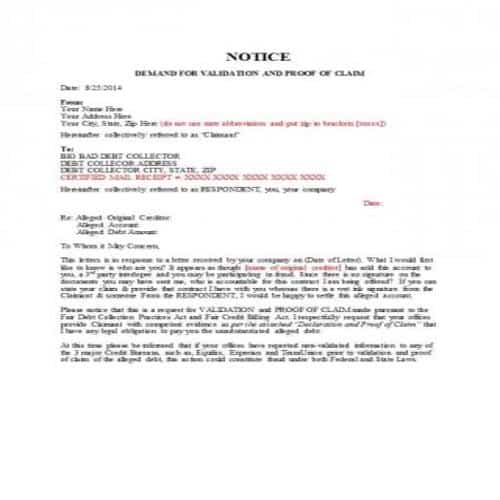

Simple Debt Validation Letter Templates

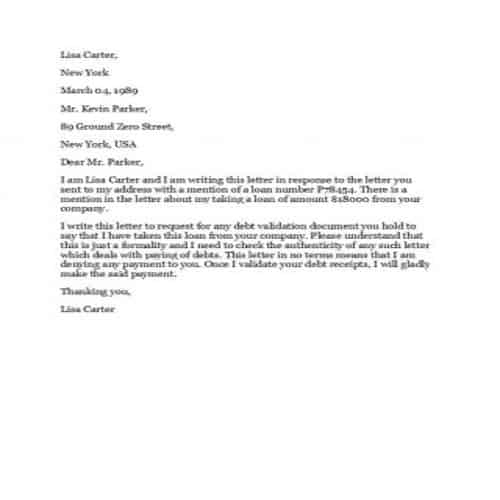

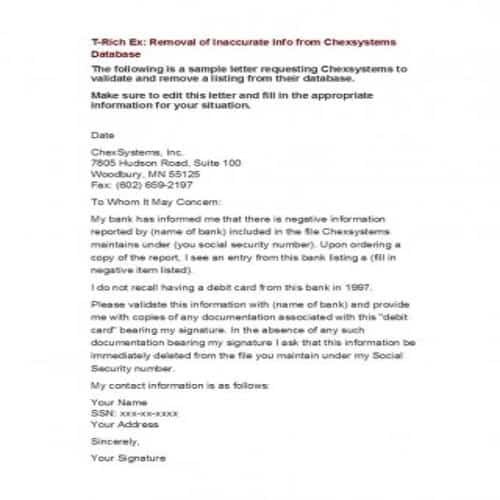

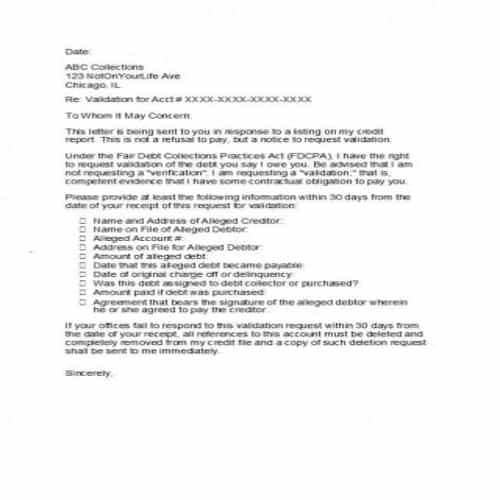

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Writing a Debt Validation Letter

A debt collector or a debt collection agency is required by law to write a proper debt validation letter to a debtor. Such a debt validation letter must only relate to the details and information about the debt. So, a debt validation letter must point out the following important information:

- The actual amount of the debt that the debtor owes.

- Name of the creditor, on whose behalf, the debt collector is writing such a letter.

- The debt validation letter must include a statement that the mentioned debt will be considered as valid, unless the debtor objects its validity, within a time period of 30 days of the first contact.

- Such a letter must also include a statement that if the mentioned debt is objected or if the debtor demands more information about the debt within the given time period, the debt collector will provide any such information by mail.

- It must also include a statement that if the debtor demands information about the original creditor within the given time period, the collector is bound to provide any such information.

General Debt Validation Letter Templates

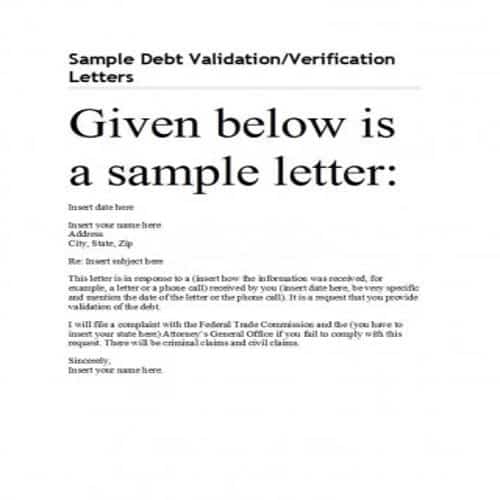

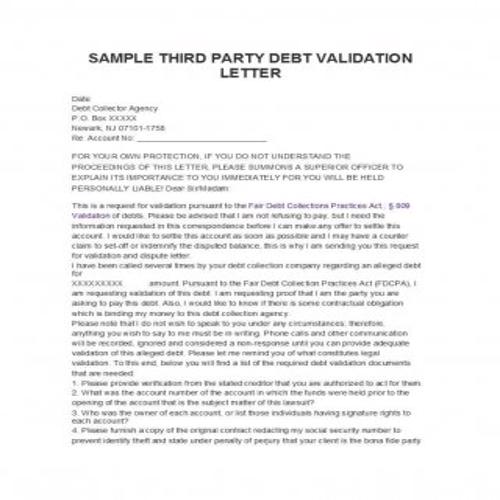

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

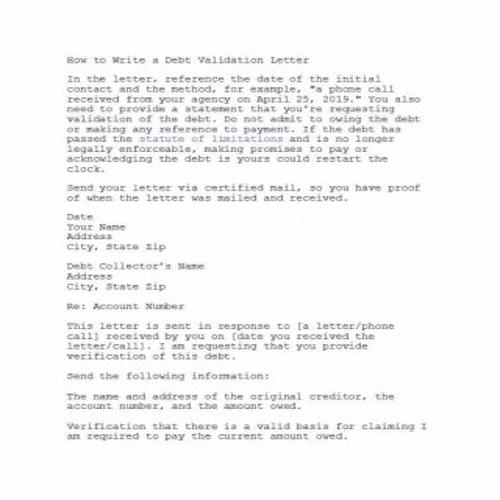

Writing a Debt Verification Letter

As mentioned earlier, after receiving a debt validation letter, it is the right of the debtor to ask for more details and information about the debt, for which he received a debt validation letter. The debtor can do so by writing a proper debt verification letter.

A debt verification letter is usually written in following two situations:

- If the intention of the debtor is to actually pay the debt, but he requires more information to verify whether he is paying the right debt to the authorized collector.

- If the debtor gets irritated by continuous contact of the debt collector, and he wants to prevent the collector from exercising further collection attempts.

As a debtor, you can ask for the following details and information from the debt collector:

- You can ask the debt collecting agency about its authority to collect the debt on behalf of the original creditor.

- You can demand the relevant documentation and other information which indicates that the debt is owed to you.

- You can also verify that whether or not the debt has exceeded the time period during which any legal action could have been taken.

The debt collector is bound by law to respond any such debt verification letter written by a debtor.

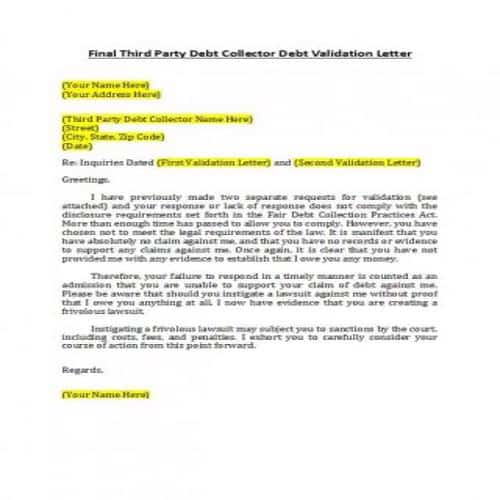

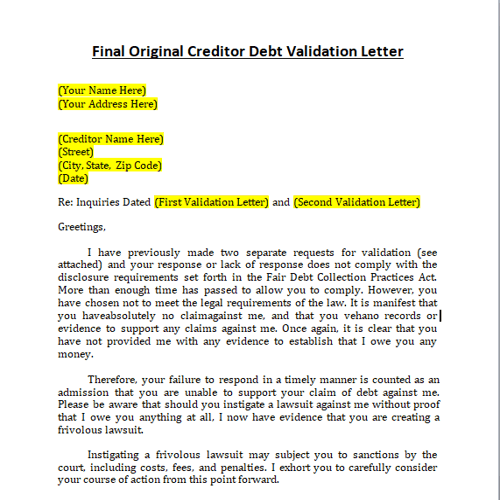

More Debt Validation Letter Templates

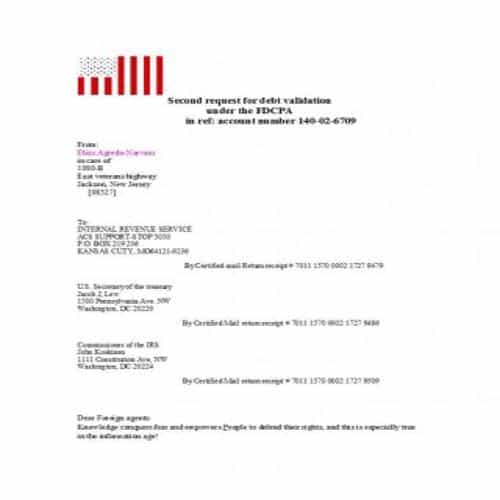

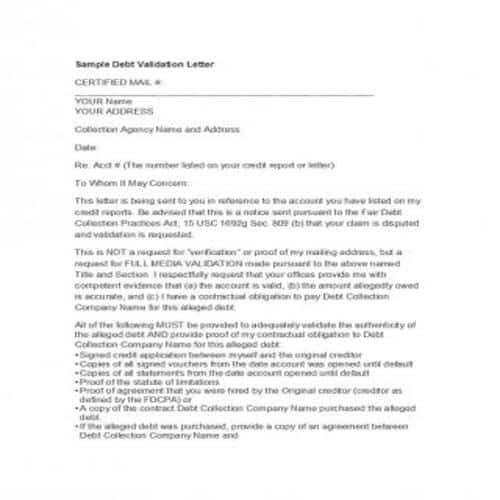

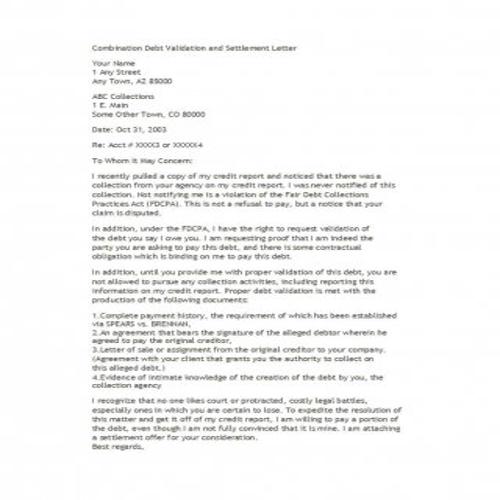

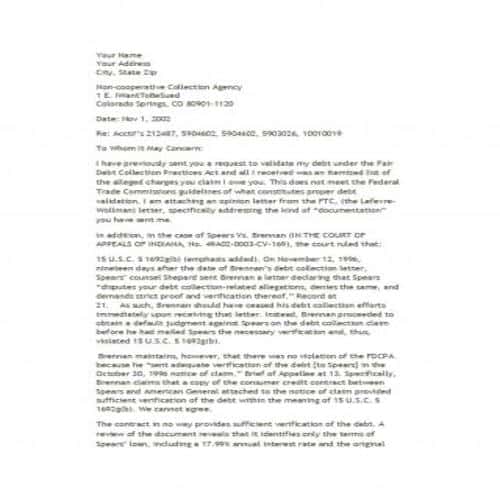

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

Debt Validation Letter Template

How a Debt Validation Letter can benefit a Debtor?

A debt validation letter can be of a great benefit to a debtor in the following four ways:

1. Ask for Evidence:

There can be errors and mistakes in anything. Just like that, it is also possible that a debt validation letter is sent to you for the debt that is not actually owed by you.

So make sure to ask for proper evidence and proofs about the debt and it is your legal right to do so. This way you can avoid paying a debt that is not yours.

2. Protection from Fraud:

It is the legal right of the debtor to ask the debt collectors about their authority to collect debt on behalf of the original creditor. The debt collector is bound by law to provide the debtor with necessary evidences and proofs of their authority to act as collection agents. This information is necessary in order to avoid fraud.

3. It gets you time to prepare:

According to the law, the debt collector must prevent from contacting you unless a request is made for the verification of the debt or for any other information. All the collection attempts and efforts must be stopped by the collector unless sufficient evidence is collected. So, this way, you can get enough time to prepare yourself for your defense.

4. Burden of proof:

In case a debt collector sends a debt validation letter to a debtor, it is the duty of the debt collector to prove that a particular debt is actually owed by the debtor. So, if you have enough evidence to show that a particular debt is not owed by you or you have already paid for that debt, your efforts will be minimized up to a great extent.