In case of businesses, a collection letter is a formal letter that is written by an entity to its debtor for the collection of any outstanding debt. Typically such a letter is written by the accounts receivable department or a collections department of an entity. However, for this purpose, the services of a professional collection agency can also be hired. So, instead of wasting time and efforts in writing such a letter every time, the organizations can always look for and use collection letter templates too.

The basic purpose of such a letter is to formally inform the customers that they owe a debt to the entity. Sometimes, an entity would have to send more than one notices to its customers. Some best quality formal and official collection letter templates and examples are provided for you below. Feel free to download and use them according to your requirement. These collection letter samples are also editable.

Official Collection Letter Templates

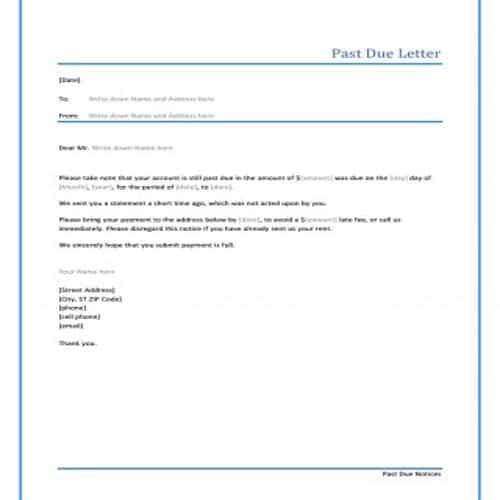

Official Past Due Rent Collection Letter

Simple Past Due Collection Letter Template

Final Collection Letter Template

Short Collection Letter Example

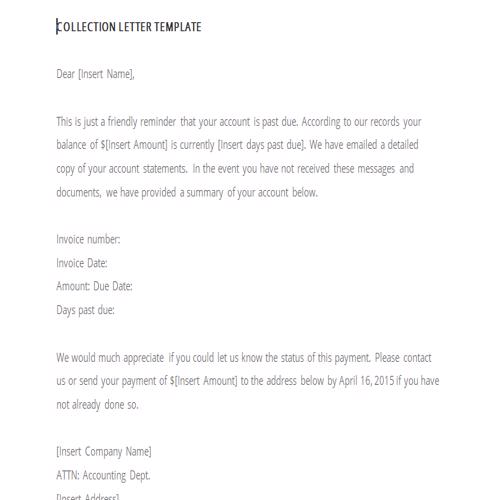

Detailed Collection Letter Template

Brief Collection Letter Template

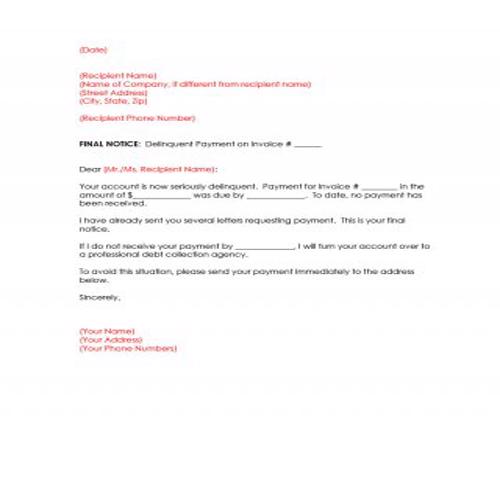

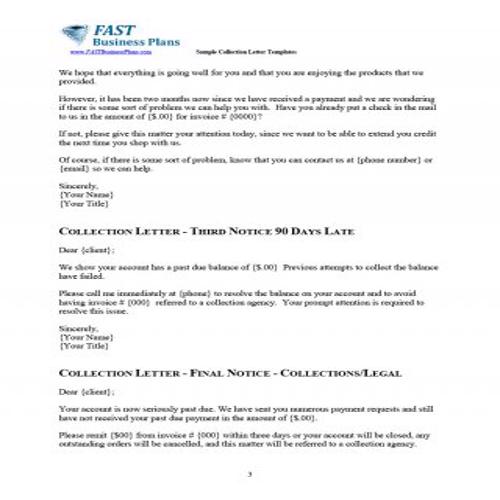

3rd Collection Letter Template

Final Collection Letter Template

Debt Collection Letter Sample

1st Collection Letter Template

Debt Collection Letter 3

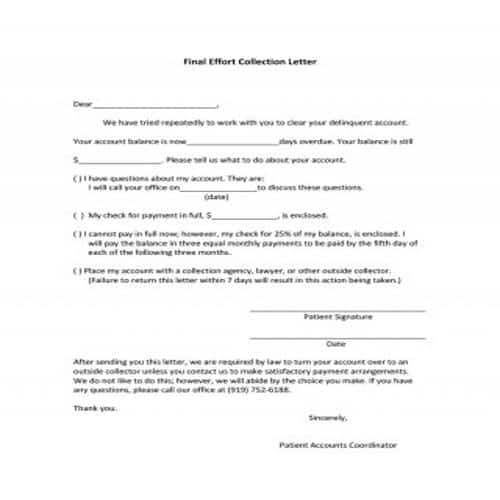

Final Effort Collection Letter

Detailed Collection Letter Template

Payment Collection Letter Template

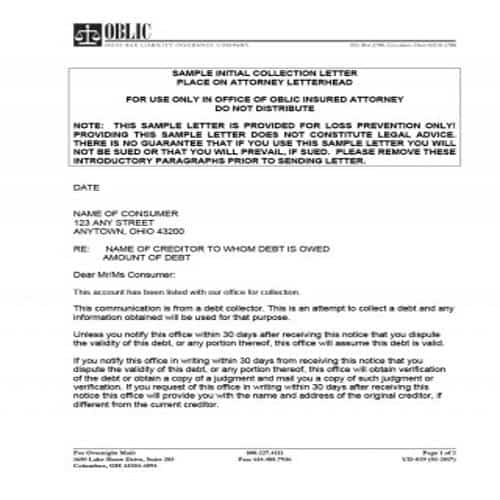

Initial Collection Letter Template

Multiple Collection Letters Template

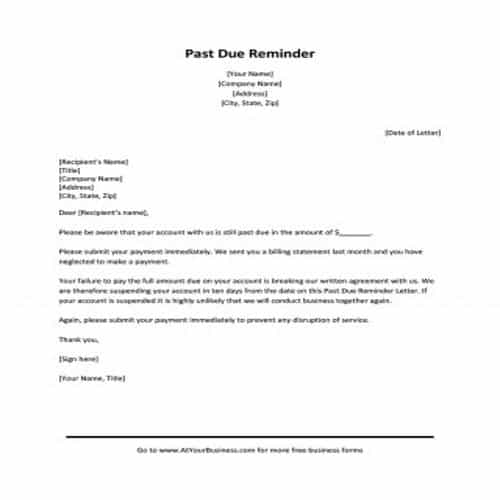

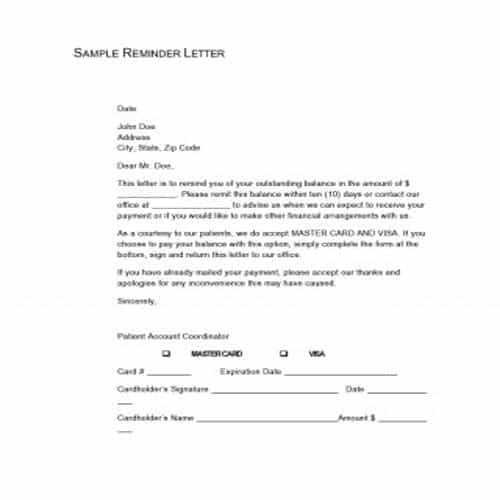

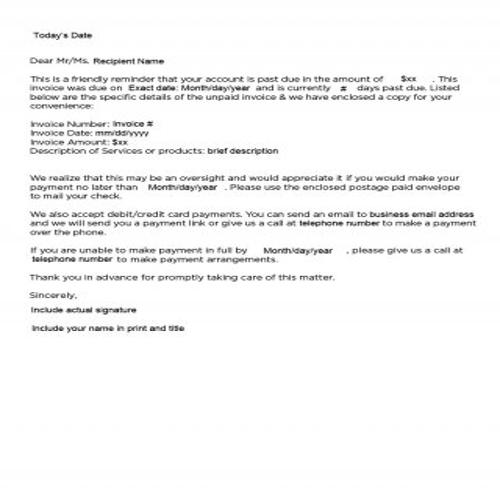

Past Due Reminder Letter Template

Friendly Due Reminder Template

Components of an Official Collection Letter

As mentioned earlier, a collection letter is written with a view to ask for the payments of the debt or debts owed to the customers. So, that is why it should be written professionally in order to make it more effective. Some of the major components of an official collection letter are as follows:

- Always mention the objective of writing such a type of letter i.e, inform and remind the customers that they owe a debt or debts and a payment is required to be made, in this regard.

- Include a reference to any previous letter that you have written to the customers for this purpose.

- If the customer has not replied or responded to any of your previous letters, then include a warning for legal action. This warning means informing the customer that if he still does not respond, you will have no choice but to take legal actions against him.

- Use a simple, straightforward, friendly, effective and professional language to communicate your message to the customer.

- In the letter which includes warning for legal action, as mentioned above, you can use a bit harsh tone, but still keeping the professional dignity.

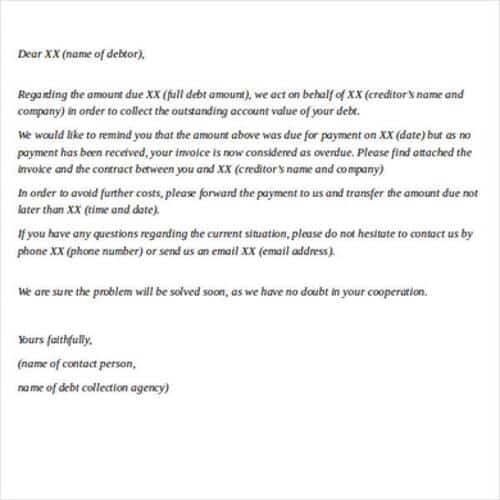

- The parties in the such a letter are usually the debtor and the creditor. The creditor writes such a letter to the debtor to inform him about the payment or debt that he owed to him. In some cases, where a professional collecting agency is hired for the purpose of debt collection, then there will be three parties i.e, the debtor, the creditor and the collecting agency.

Formal Collection Letter Examples

Payment Collection Letter for Services Rendered

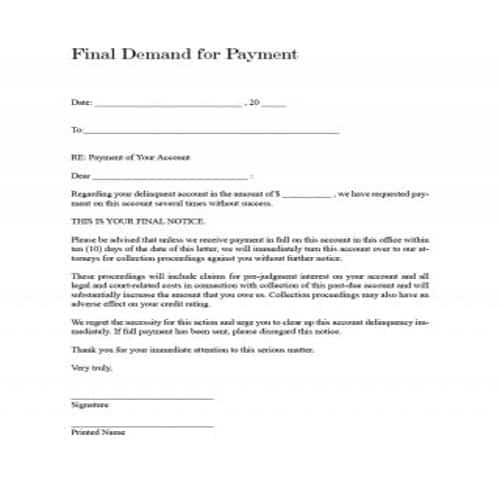

Final Demand for Payment Letter Example

Simple Detailed Collection Letter

Second Collection Letter Example

Brief Collection Letter Sample

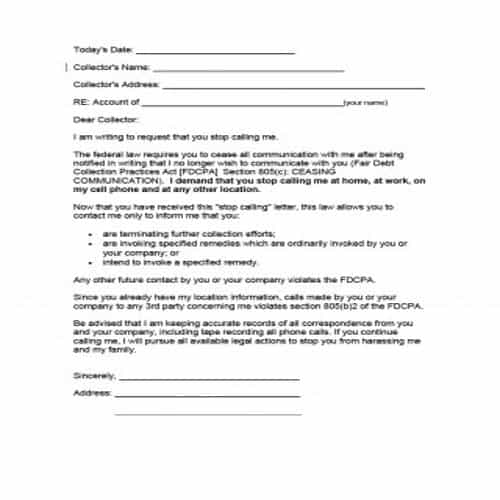

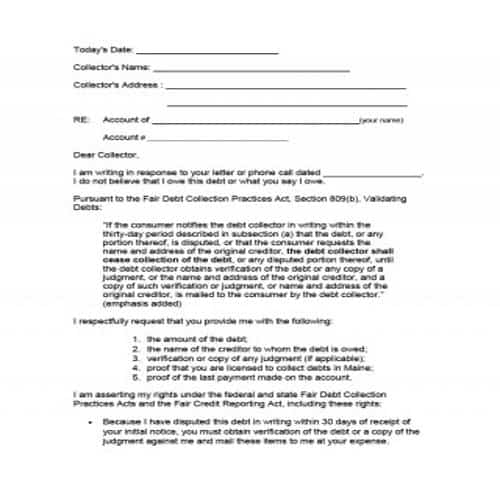

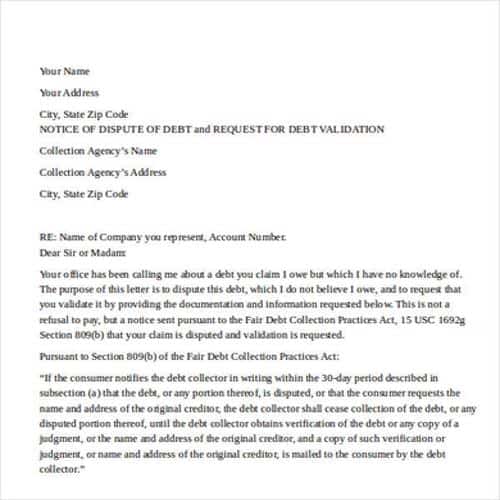

Sample Debt Collection Letter

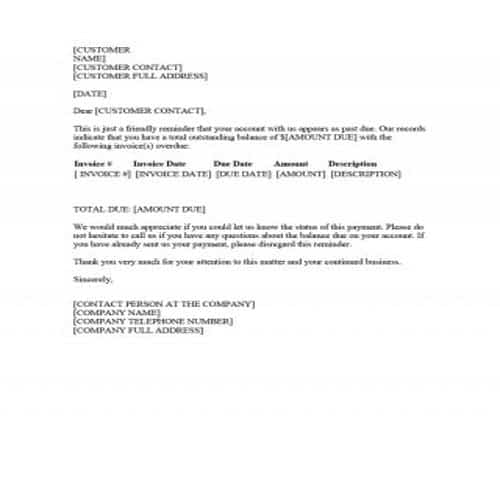

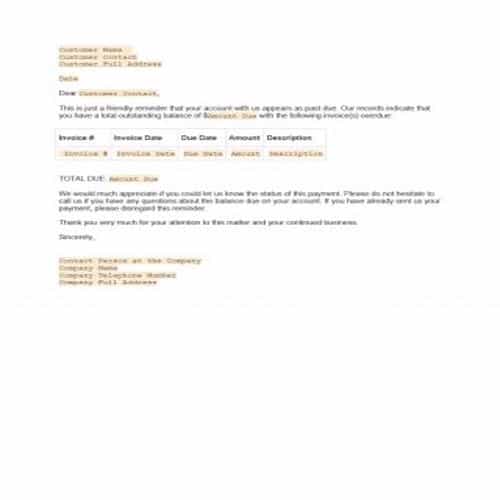

Collection Letter Example with Invoice details

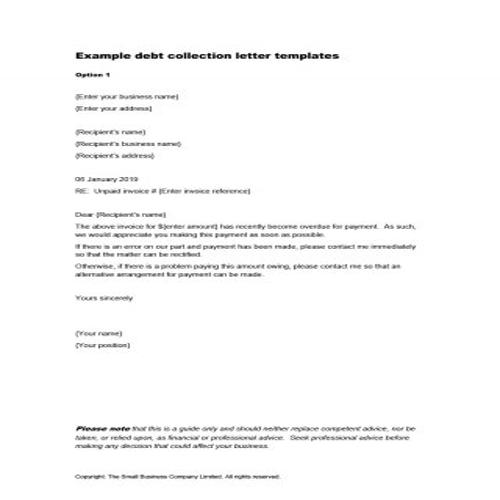

Example Debt Collection Letter Template

Simple Style Collection Letter

Sample Debt Reminder Letter

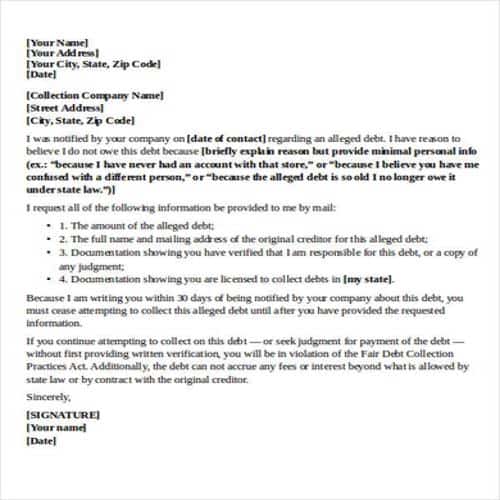

Brief Debt Collection Letter

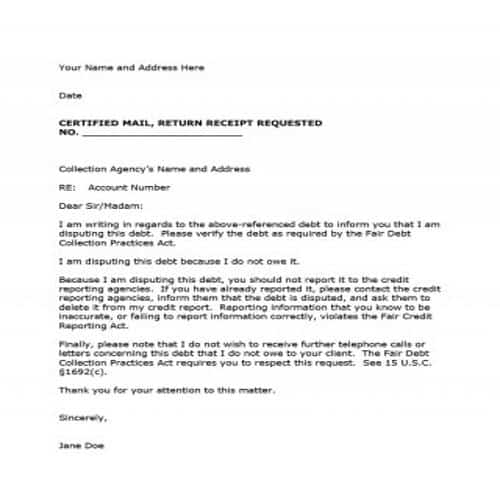

Collection Agency Certified Mail

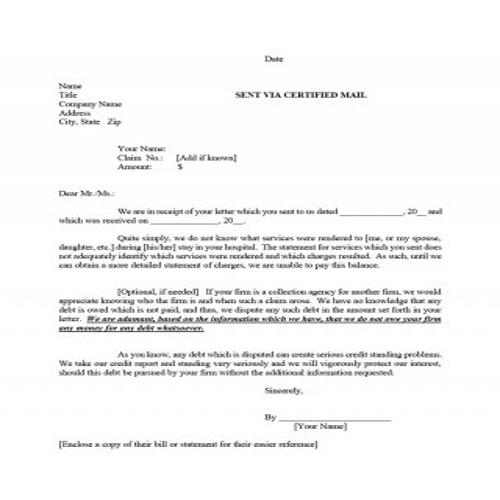

Collection Letter sent via Certified Mail

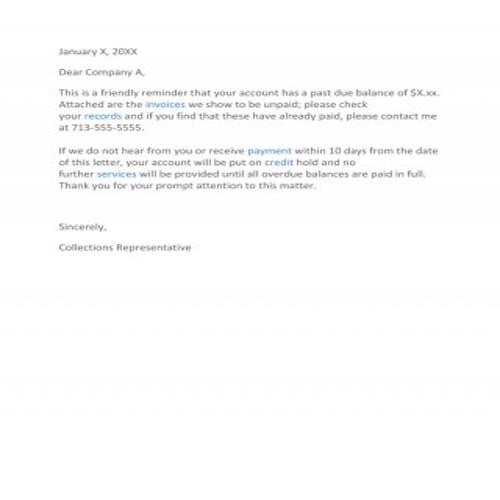

Friendly Debt Collection Letter Example

Model Debt Collection Letter

Final Debt Collection Letter

Simple Collection Letter Example

Types of Collection Letters

Generally, there are four types of collection letters, which are named as first, second, third and fourth collection letters. If you have contacted the customer just with a simple call or an email, then there is no need to sent any type of letter. Each of these letters are explained below:

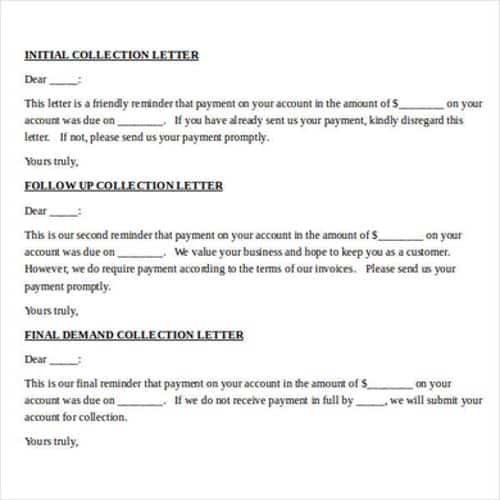

1. First Collection letter

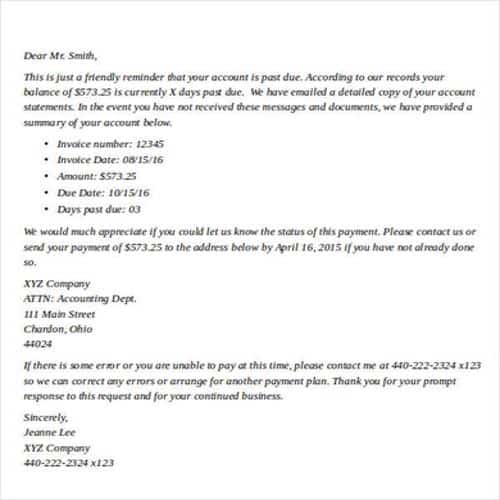

In this type of collection letter. normally a soft and polite tone is used. The first collection letter is sent when the customer is not responding to your calls or emails. Such a letter is usually sent after 14 days of the due date of invoice. An accounting software can also be used to automatically send such a letter.

2. Second Collection Letter

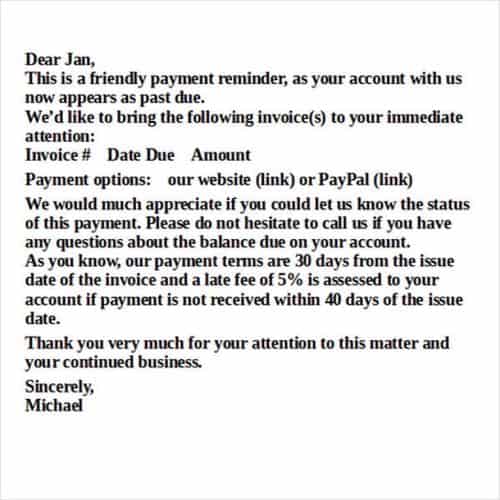

This type of letter is also soft and polite in nature just like the first collection letter. Before sending it, you should still try to contact the customer, at least once. Try to confirm that the customer has received the first letter. It might be possible that he is already willing to make the payment. Still, if you receive no response or reply from the customer, now it is the time to send the second collection letter. The difference in both the letters is that the second collection letter includes the information that you have tried to communicate with the customer by sending the first collection letter.

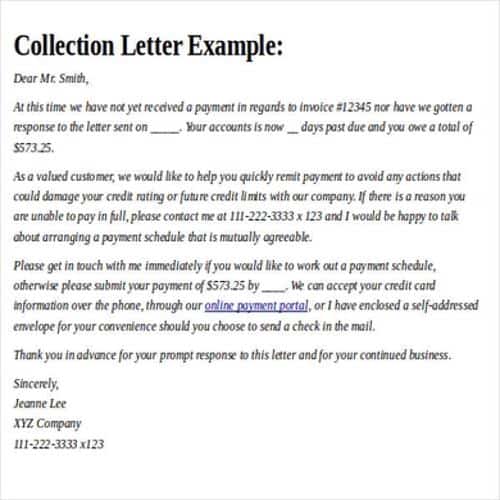

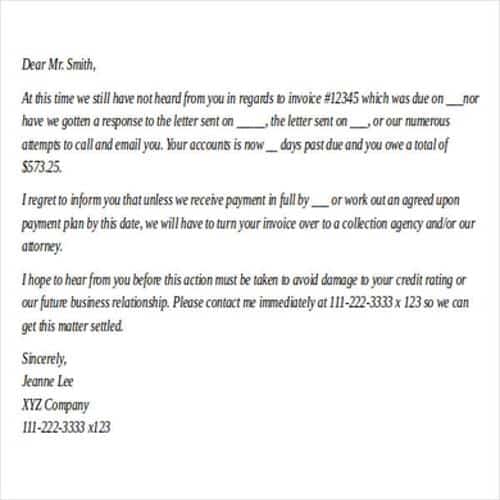

3. Third Collection Letter

The third collection letter is usually aggressive and assertive in nature as compared to the first and second collection letter. Before sending this letter, try to contact the customer once more. Still, if you receive no response from his side, then it is the time to send third collection letter to him. Just like the second letter. this letter also mentions that you have tried to contact the customer through the earlier letters, emails and phone calls. Just indicate the customer that his continuous irresponsibility will ultimately compel you to take legal actions against him. Make sure that you specifically send this letter through a certified mail. The benefit of doing so is that when customer receives the letter, he will have to sign for it. So, you will have a proof that he has actually received the letter. It will be an important document if you decide to take legal actions against the customer.

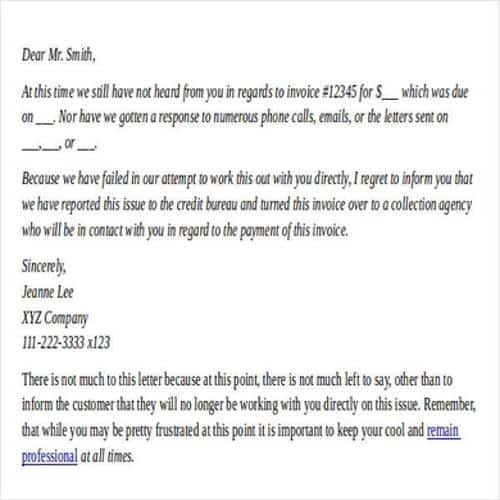

4. Fourth Collection Letter

Like third collection letter, this letter is also assertive and aggressive in nature. Sometimes it can be even more aggressive than the third collection letter, but still, the professionalism must be maintained. This letter is sent, after trying every other means of contacting the customer. At this point, it can be clearly established that either the customer is unable to make the payment or simply, he doesn’t want to make the payment. This letter should include a clear warning that your next step will be to take a proper legal action against the customer. Such a collection letter should also be sent through a certified mail.