For a business, the importance of a business budget can not be ignored. A business budget template is a document that includes the estimates and forecasts of the financial and operational goals of an entity. It is a formal document that contains the action plans related to allocation of resources, evaluation of performance and formulation of plans. A business budget template is a very important document and it must be prepared with due care and in a professional manner. You can download 30+ free business budget templates at this page.

A budget can be made on a weekly, monthly, quarterly, half yearly or yearly basis. It solely depends upon the choice of the entity that for what period they require the budget to be prepared. A business budget is also essential in order to be presented to the different stakeholders of the business e.g, bankers or other financiers etc. Make sure to check out the given below useful and editable business budget templates for better understanding.

Handy Business Budget Templates

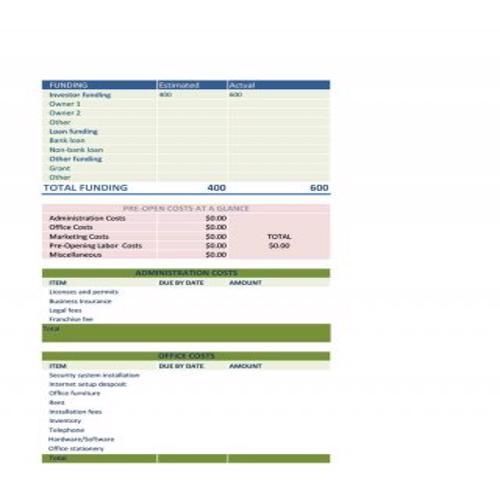

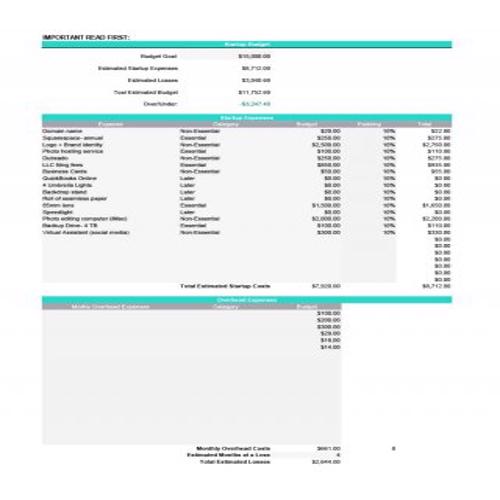

Basic Business Budget Template

Detailed Business Budget Template

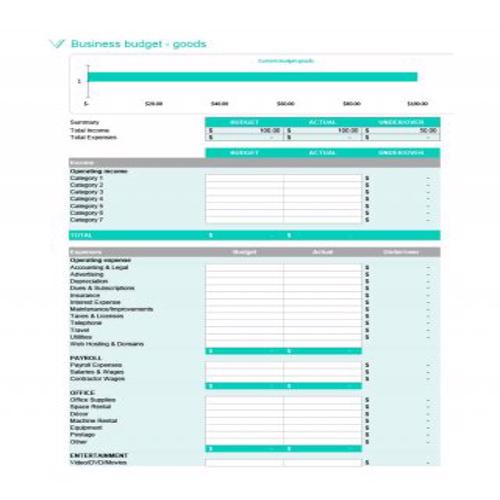

Comparative Business Budget

Mid Year Business Budget Template

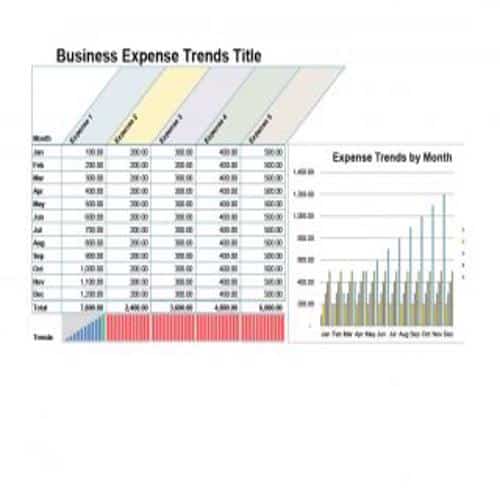

Trendy Business Budget Template

Special Business Budget Template

Formal Business Budget Template

Initial Business Budget Template

Handy Business Budget Template

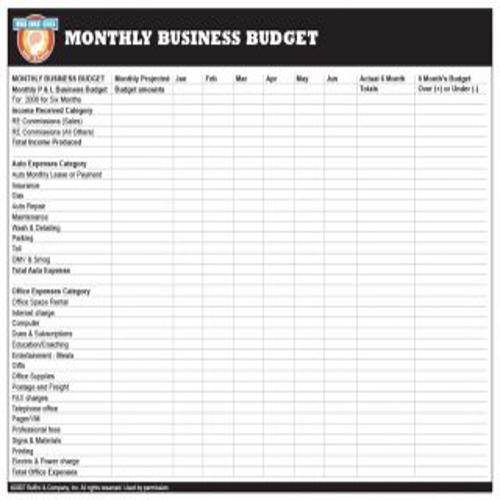

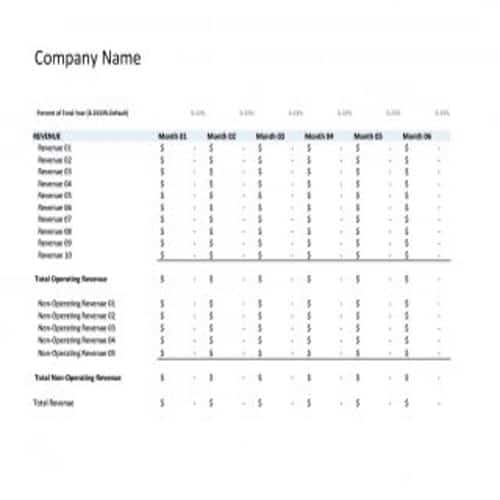

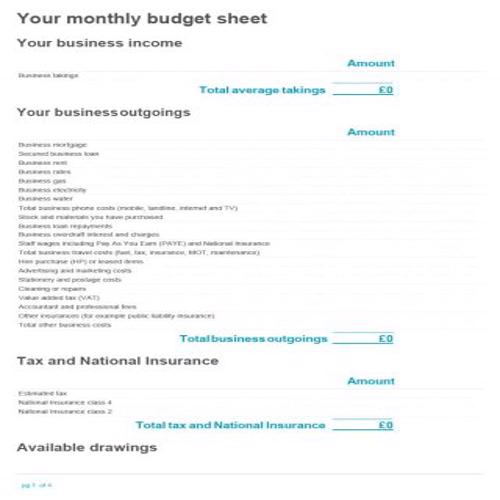

Monthly Business Budget Template

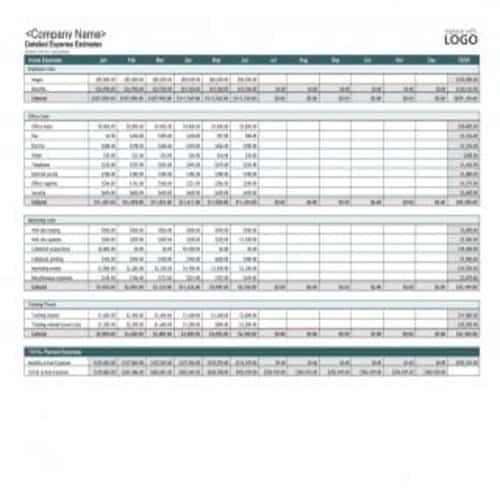

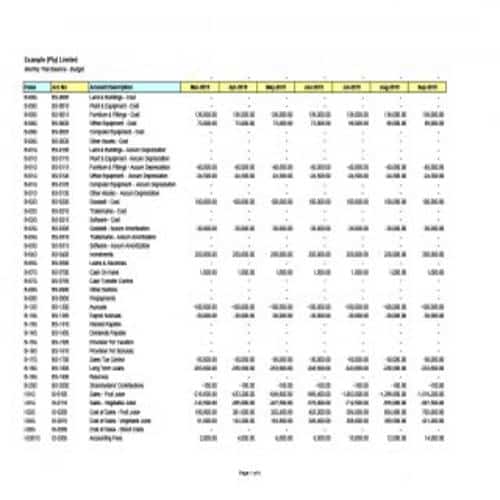

Extensive Business Budget Template

Unique Business Budget Template

Routine Business Budget

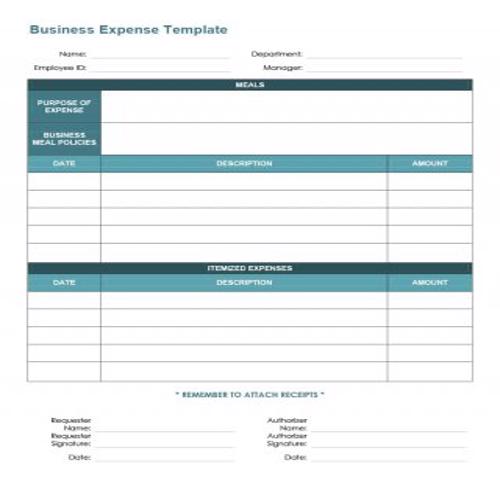

Blank Business Budget Template

Brief Business Budget Template

Simple Business Budget Template

Proper Business Budget Template

Entity’s Business Budget Template

Adjusted Business Budget Template

Tips for creating a Business Budget Template

As mentioned earlier, you can download the given business budget templates and customize them according to your requirements. However, if you opt to create a business budget template yourself, consider the following useful tips:

- If you are not preparing the budget for first time i.e, you already have an established business, make sure to gather all the relevant historical data of your business.

- If you are preparing the budget for the first time, search and use the financial information of some other similar businesses as your guideline.

- You should have the idea of your estimated sales and profits that you desire to make. Of course it will be based on the historical data and many other factors such as rate of inflation,rate of growth, market rate of interest etc.

- Perform a proper and detailed calculation of all the fixed and variable costs of the operations of the business.

- After that, calculate the profit and make sure that the profit margin is same as was projected or expected.

- Even after finalizing the budget, it is always recommended to review and make changes and necessary adjustments in your budget. Especially in case where the actual expenses or revenues are not consistent with the estimated or budgeted expenses or revenues.

More Business Budget Templates

Useful Business Budget Template

Company’s Business Budget

Monthly Business Budget Template

Typical Business Budget Template

One Year’s Business Budget Template

Pro Forma Business Budget Template

Blank Monthly Business Budget Template

Simple Relative Business Budget Template

Colorful Monthly Business Budget Template

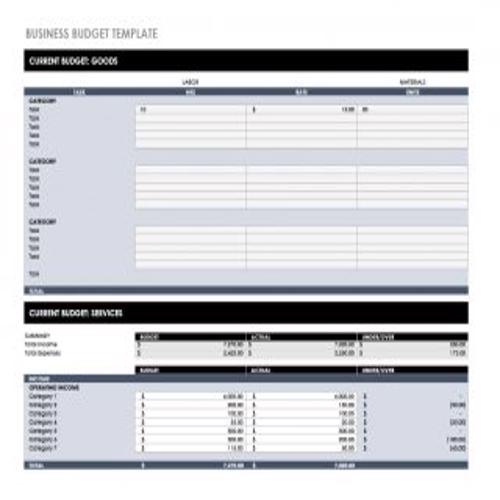

Professional Business Budget Template

Small Business Budget Template

New Business Budget Template

12 Month Business Budget Template

Month Wise Business Budget

Complete Business Budget Template

Special Business Budget Template

Comparative Business Budget Template

Simple Business Budget Sheet Template

Uses of Business Budget Templates

Some of the many uses of business budget templates are given below:

- Controlled income and expenditure.

- Motivation of workforce.

- Assignment of responsibilities.

- Allocation of resources.

- Numerical and practical setting of priorities and targets.

- Practical provision of direction and co-ordination in order to achieve business targets.

- Improvement in efficiency of operations.

- Proper monitoring of performance.

- Properly provides plan of action.

- Timely indication of irregularities, if any.