A balance sheet is also called a statement of financial position or a statement of financial condition. Basically it is the image of financial condition of an entity. In order to save time and effort, many entities may opt to use balance sheet templates for this purpose. A balance sheet is a summary of the financial balances of an entity,whether the entity is a sole proprietorship, a partnership business, any corporation or any other organisation such as a Government or a Not for Profit Organisation. Equity, Assets and liabilities of an entity are listed as on a specific date, such as the end of its financial year.

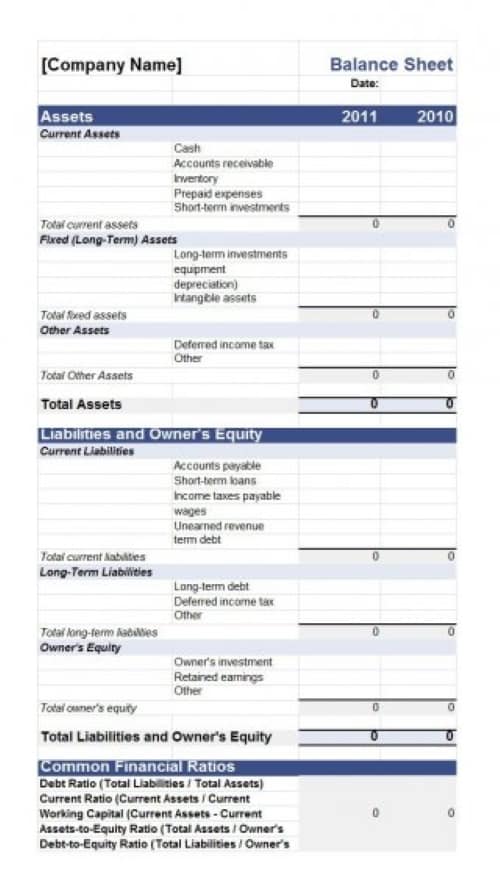

If you want to create a balance sheet for your business, you can easily do so by using the balance sheet templates provided below. These templates will enable you to further customize them for your desired purpose. Moreover, these templates are free to use. Just click the download button and use the balance sheet template of your own choice.

Sample Balance Sheet Templates

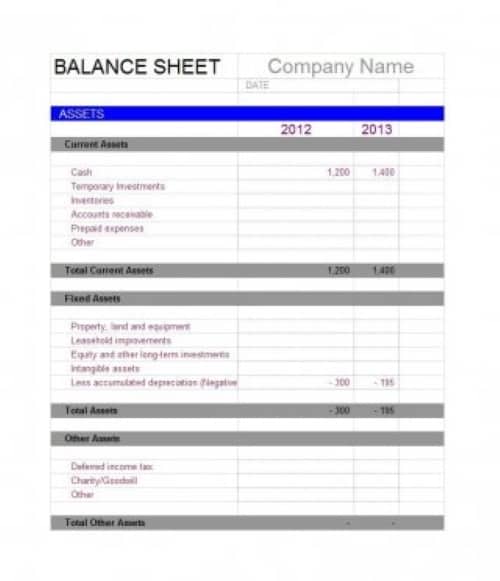

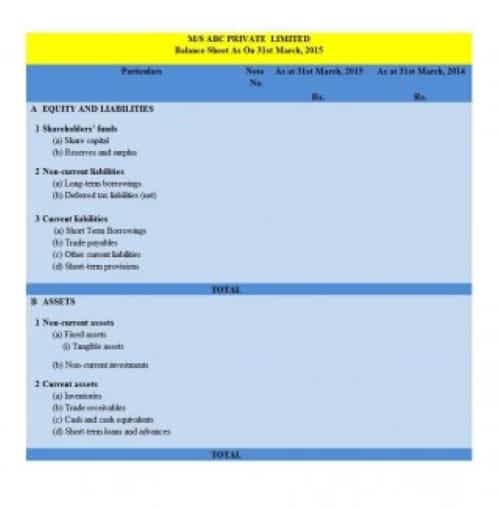

Comparative Balance Sheet Template

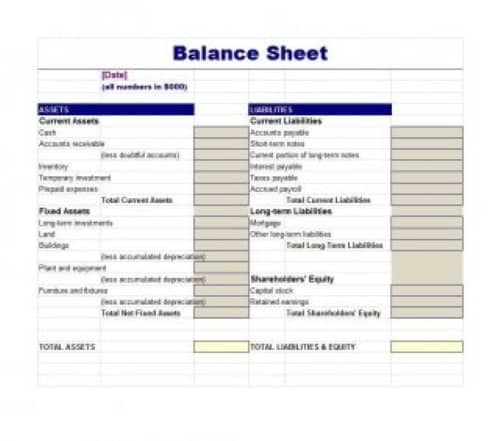

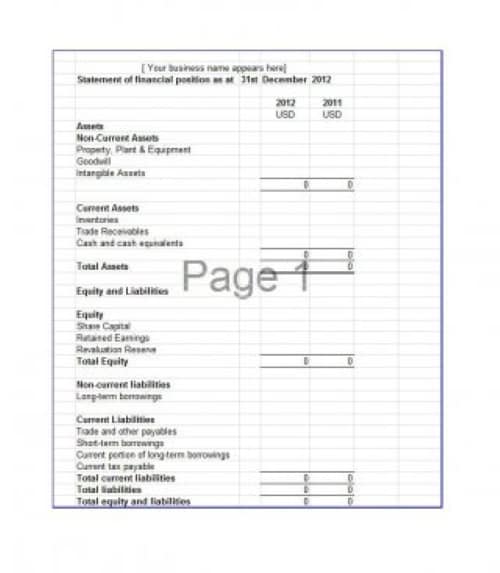

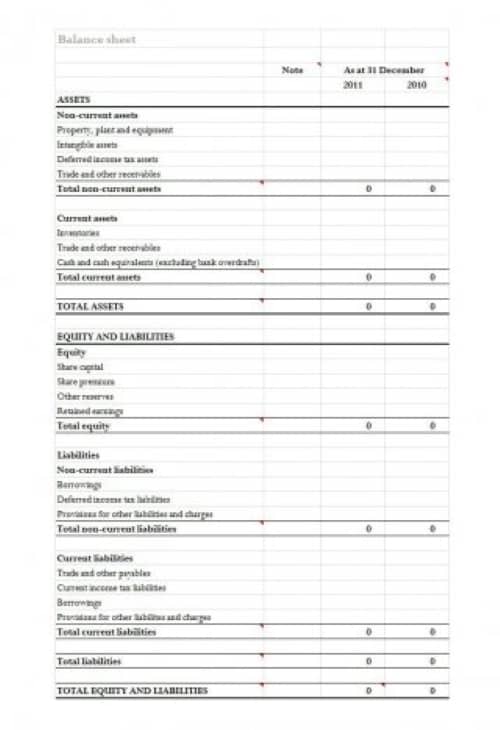

Simple Annual Balance Sheet Template

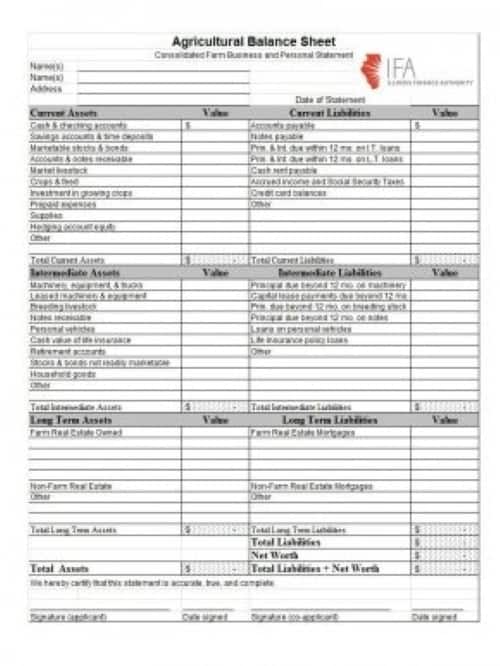

Agricultural Balance Sheet Template

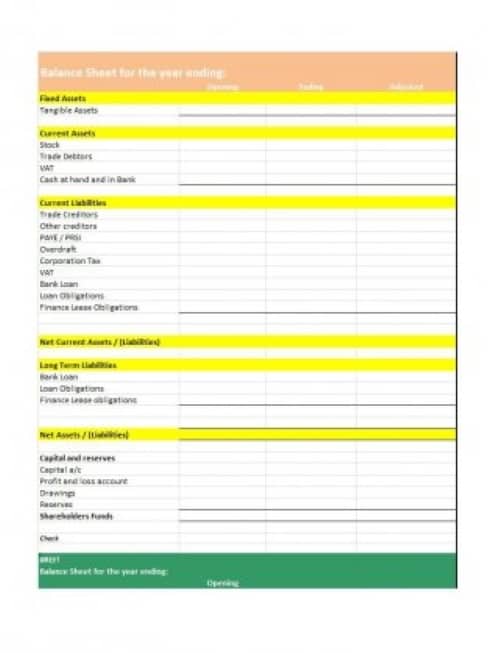

Year Ending Balance Sheet Template

Standard Balance Sheet Template

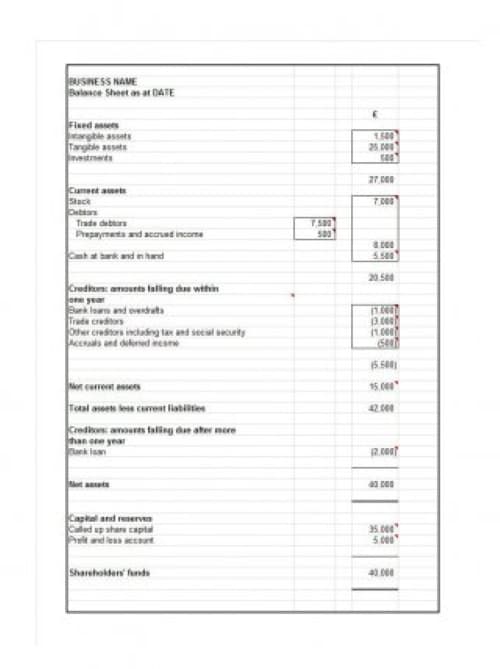

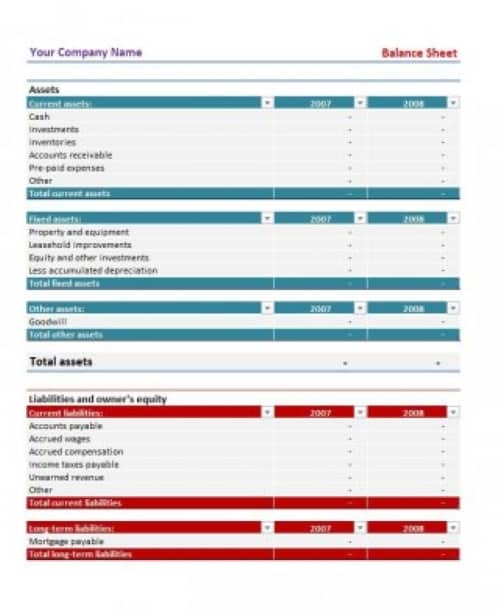

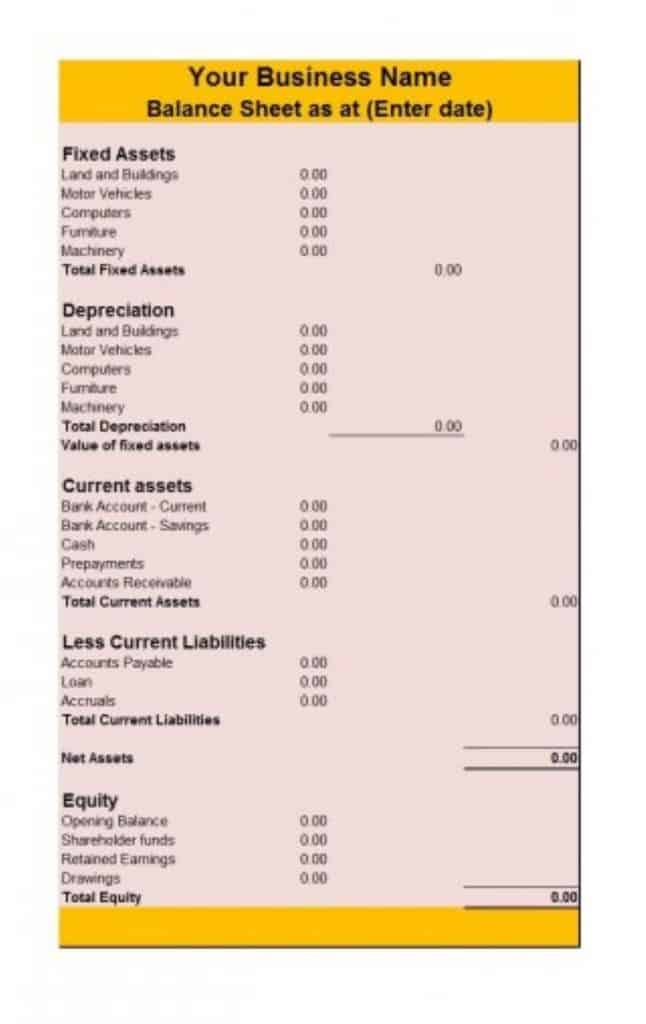

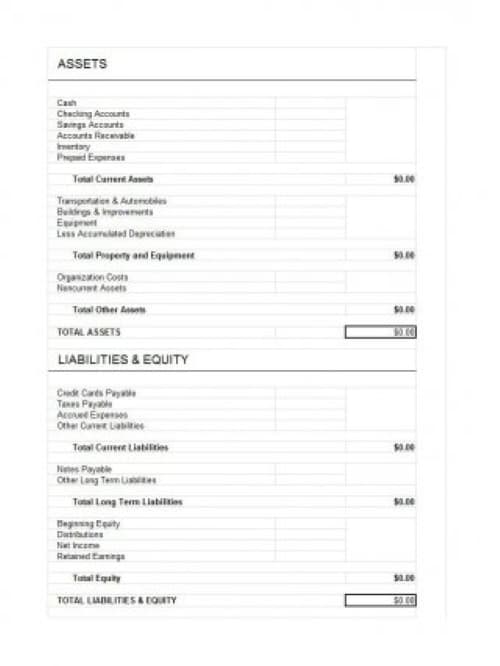

Business’s Balance Sheet Template

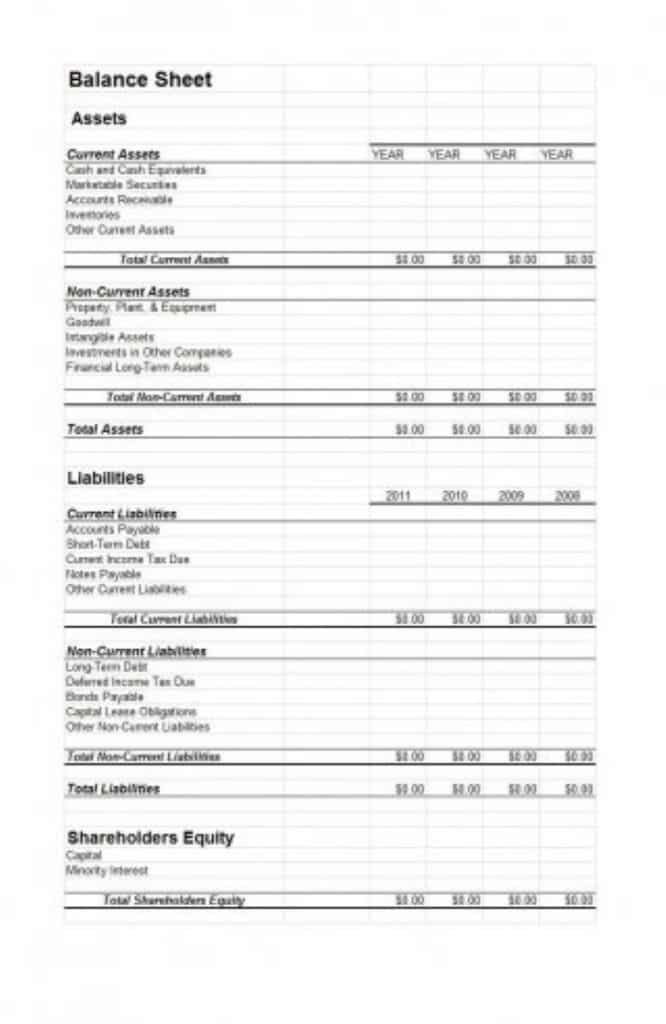

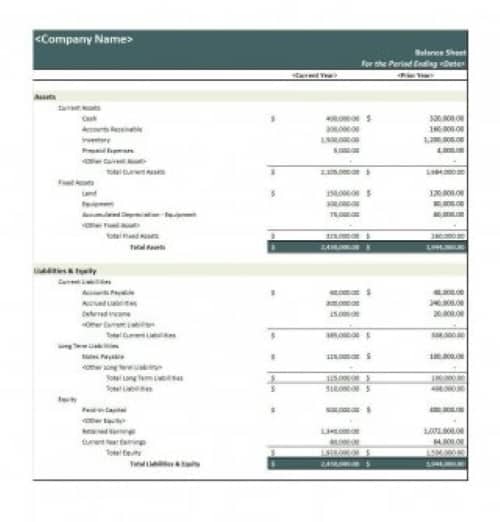

Multi Years Balance Sheet Template

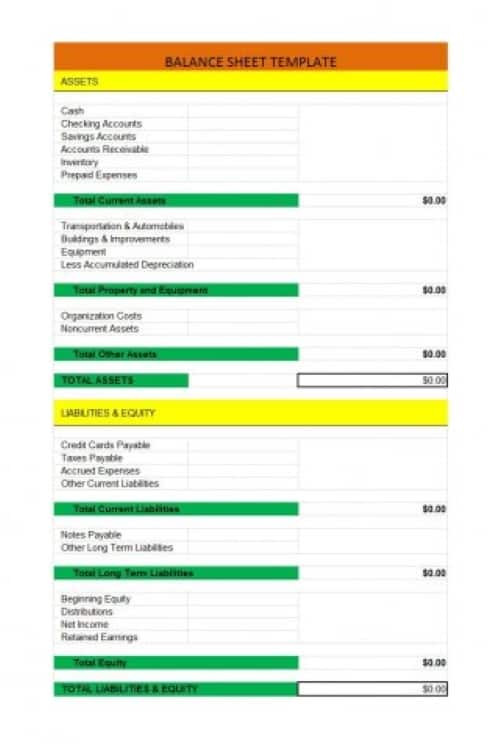

Highlighted Balance Sheet Template

Simple Balance Sheet Template

Two Sided Balance Sheet

Importance of Balance Sheet

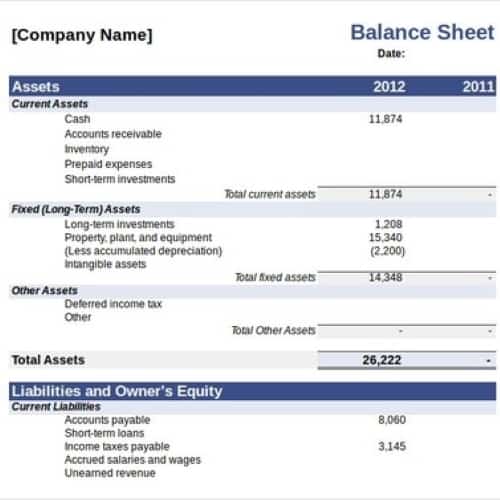

A balance sheet is very important as it gives a detailed picture of a business. Suppose you are the owner of a company and it is not possible to keep the track of income and expenditure on daily basis, this is why you need a balance sheet.

A balance sheet helps you to understand how good or bad your business or your company is doing. If the assets of the company has depreciated or if the liabilities of the company have increased or decreased, in a given time period. Generally, it reflects the overall health of the company.

Most importantly, the balance sheet helps to make decisions in the long run e.g, where the company needs to invest and in which areas, the company needs to improve etc. The information provided by a balance sheet helps the potential investors, lenders or any other key stakeholders to better understand how the business of the company functions.

It also helps them to learn about the principle resources of the company and any threats to its growth. With the combined information of balance sheet and income statement, the potential stakeholders can analyse the trends over time, check ratios and balances.

More Balance Sheet Examples

Company’s Decent Style Comparative Balance Sheet

Company’s Simple Style Balance Sheet Template

Comprehensive Balance Sheet Template

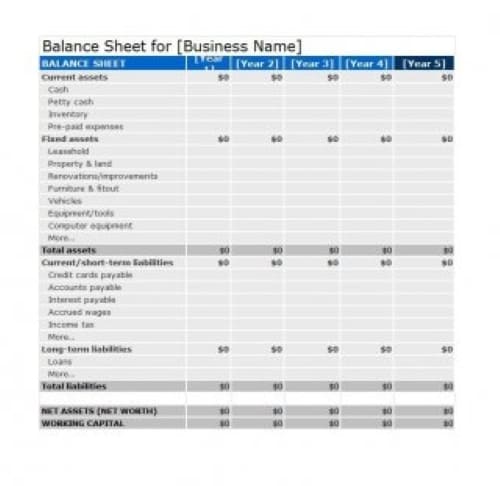

5 Years Comparative Balance Sheet Sample

Trader’s Balance Sheet Template

Elegant Style Balance Sheet Sample

Detailed Balance Sheet Template

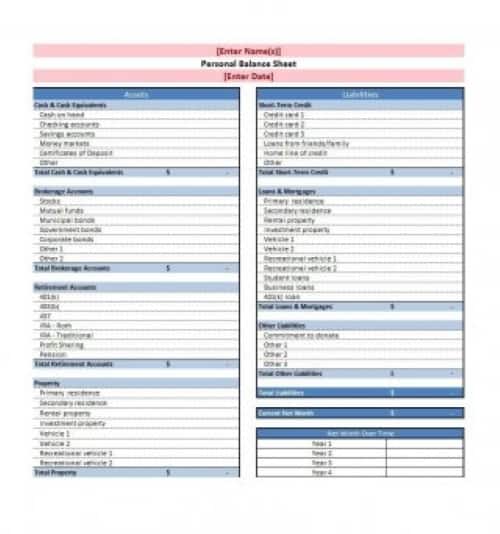

Personal Balance Sheet Template

Special Design Balance Sheet Template

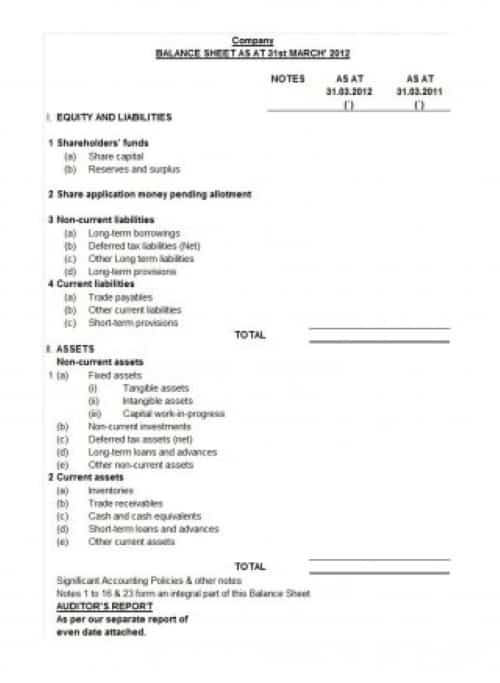

Company’s Official Balance Sheet Template

Typical Balance Sheet Sample

Simple Balance Sheet Template

Company’s Proper Balance Sheet Template

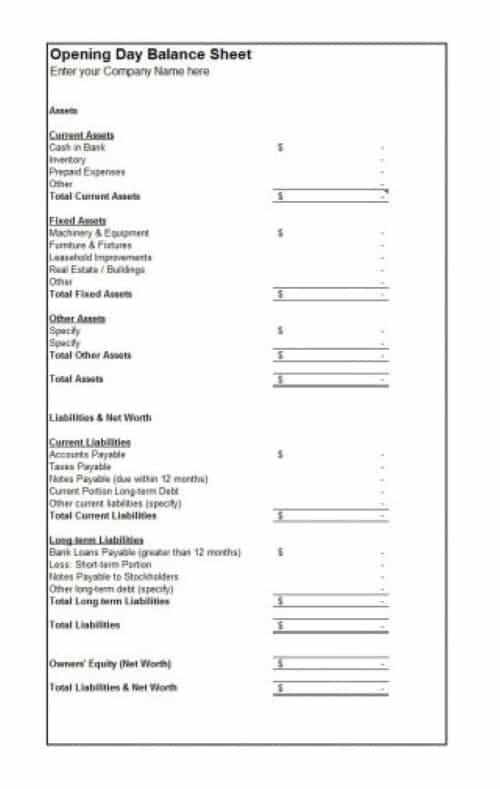

Small Business’s Balance Sheet Template

Company’s Basic Comparative Balance Sheet Template

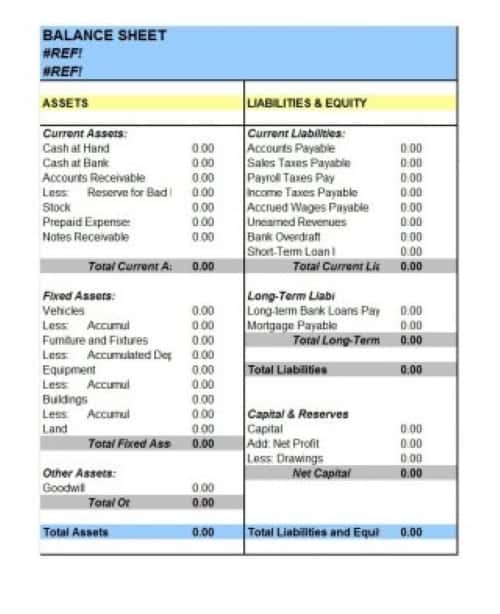

Components of a Balance Sheet

As stated earlier, a balance sheet of a business comprises of the equity, assets and its liabilities. Each of these three include different components, which are listed below:

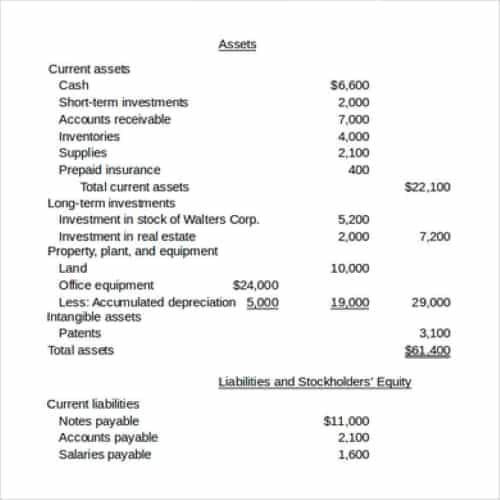

Assets

Non-Current Assets

- Property, Plant and Equipment

- Any investment property

- Intangible Assets e.g, patent, license and goodwill etc.

- Biological Assets

- Loan given to someone, whether an individual or an entity ( for more than one financial period)

Current Assets

- Accounts Receivable

- Cash and cash equivalents

- Inventories

- Cash at Bank

- Prepaid Expenses

- Accrued Revenue

- Loan given to someone, whether an individual or an entity ( for less than one financial period)

Liabilities

- Accounts Payable

- Provisions for warranties or court orders

- Financial liabilities such as corporate bonds and promissory notes.

- Deferred tax liabilities

- Interests on loans

Equity/Capital

- Issued capital and reserves attributable to equity holders of the parent company (controlling interest)

- Non-controlling interest in equity