In this article, some practical audit report templates are given below, but first of all, let’s briefly know what an audit report is. An audit report is a report presented and written by an auditor which contains the auditor’s opinion on the entity’s financial statements. You can download multiple free audit report templates at this page.

Here, by opinion, it means that the auditor presents his view that whether or not the financial statements of the entity present a true and fair view of the entity’s position. Many entities have their own internal auditors but an audit report is particularly issued by external auditors. For more details, make sure to scroll down and check out the audit report templates that can be helpful to you.

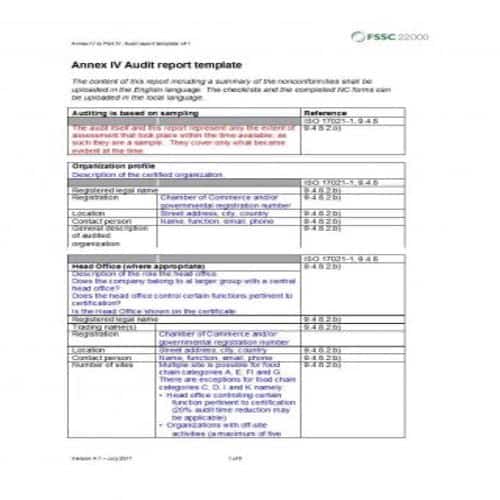

Standard Audit Report Templates

Ireland Audit Report Template

Auditor’s Report Template

IT Audit Report Template

IG Audit Report Template

Contracting Audit Report

City Berkeley Audit Report

Inspector General Audit Report

Annual Audit Report

London Audit Report Template

Legal Audit Report

Checklist Audit Report

Important Components of an Audit Report

An audit report must consist of the following important components:

1. Title:

This is the title of the audit report, which shall mention the addressee of the report. The title of the audit report must also include the date. Such a report is usually addressed to the BOD and shareholders of the entity.

2. Introduction:

The report must include a separate introductory paragraph, which states that the audit has been performed. It must also indicate the financial documents that were used while performing the audit. It shall also indicate the time period that is covered by the audit.

3. Scope:

The scope section of the audit report must mention that the audit is performed under the rules and regulations specified by the GAAS or Generally Accepted Auditing Standards. Here, the auditor must clearly state that the audit is carried out to provide reasonable assurance that whether or not the financial statements present a true and fair view.

4. Summary:

In this section, the auditor must include the elements of the audit which are of great importance to the executives or decision makers of the entity. The summary also includes the findings of the auditor while performing the audit.

5. Auditor’s Opinion:

This section includes the auditor’s opinion on the financial statements of the company. The opinion of the auditor must be very clear and precise. It means that the auditor must clearly state that whether the financial statements present a true and fair view of the entity or not. There must be no ambiguity in his opinion. Different types of auditor’s opinions are explained below.

6. Auditor’s Name:

The auditor must write down his name in the audit report, which indicates that he is the author of the audit report. If the auditor is a firm, then the firm name should be written on the audit report.

7. Auditor’s Signatures:

At the end, the auditor must put his signatures on the audit report. If the auditor is a firm, then the common seal of the firm must be affixed on the audit report, along with the signatures of the audit partner signing the report.

Sample Audit Report Templates

Procurement Audit Report

Audit Report

Clinical Audit Report Template

Prison Audit Report Template

Environmental Audit Report

European Audit Report

Air Quality Audit Report

Special Audit Report

eHealth Audit Report

Medical Research Audit Report

Food Act Audit Report

Types of Audit Opinions:

Following are some types of audit opinions:

1. Unqualified Opinion:

In an audit report, an unqualified opinion is given when the auditor determines that the financial statements of the entity are prepared in accordance with the relevant accounting standards, and present a true and fair view of all matters of the company. An unqualified opinion is also known as clear or positive opinion.

2. Qualified Opinion:

In an audit report, a qualified opinion is one in which the auditor determines that overall there is no error or misrepresentation in the financial statements, but the financial statements are not prepared in accordance with the relevant accounting standards.

When an auditor gives a qualified opinion, then he must include a separate section in the audit report, so as to mention the reasons for which he qualified his opinion.

3. Disclaimer of Opinion:

A disclaimer of opinion is given in rare cases like, in the absence of financial records or when the auditor is not allowed to access certain records or personnel, etc. In such situations, the auditor simply gives a disclaimer of opinion, which indicates that the auditor is unable to conduct the audit.

4. Adverse Opinion:

An auditor usually gives an adverse opinion in case if he is provided with misrepresented or incomplete financial records. This type of opinion has a very bad impact on the company. So, the company must try to rectify their financial statements and financial records and have them re-audited.