A promissory note is a simple legal document in which a person undertakes to pay a particular debt. As it is a proper legal document and not just a piece of paper, so it is enforceable by law. In the business world, a verbal promise is absolutely legal but it is not that much reliable as compared to a proper documented written promise. A promissory note is actually an agreement between a debtor and a creditor in which a debtor actually promises to pay off his debts to the creditor. In this agreement, there are two parties involved. One party is the payer or debtor, which is also the maker of the promissory note and the other one is the payee or creditor, to whom the payment of debt is to be paid. The payer or debtor can also use promissory note templates for this purpose, especially if he does not know how to draft one.

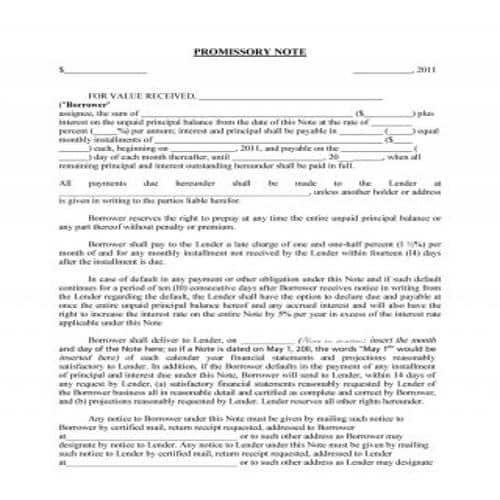

Along with many other things, a promissory note template also contains the rate of interest if agreed between the parties. If a debtor to a particular debt does not pay the amount of such a debt, a promissory note also serves as a key evidence in taking legal actions against such a debtor. If you are looking for a proper official promissory note, then make sure to scroll down and check these 50 amazing promissory note templates. These useful templates are available in MS Word as well as PDF files and are free to download for your use. We do hope that you will like our this effort.

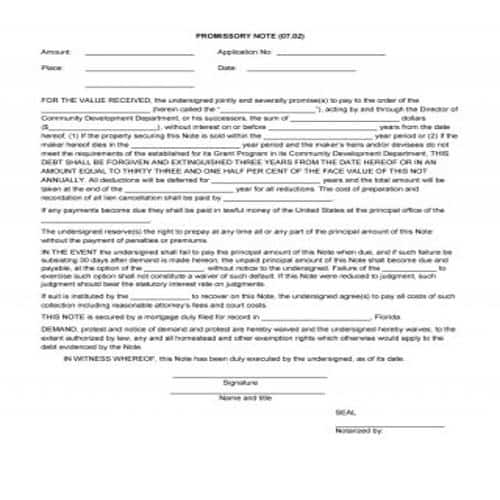

Promissory Note Templates in PDF

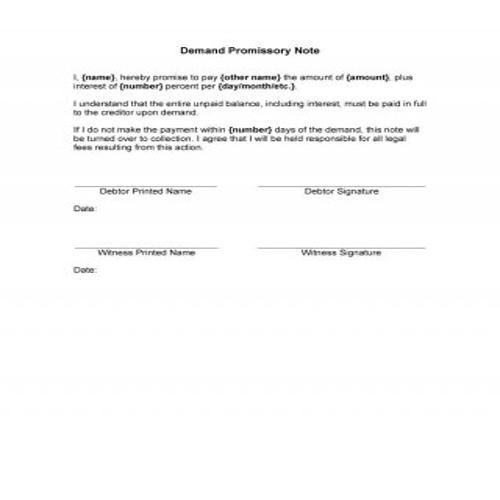

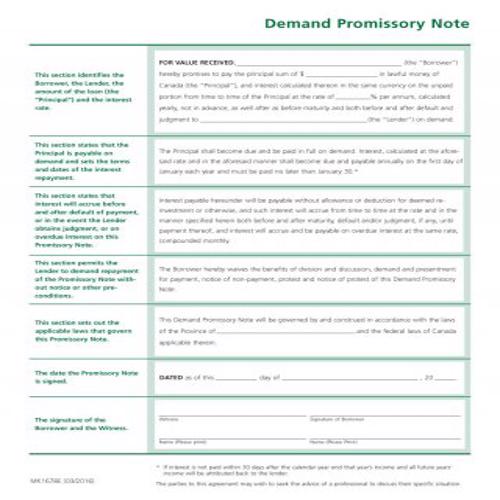

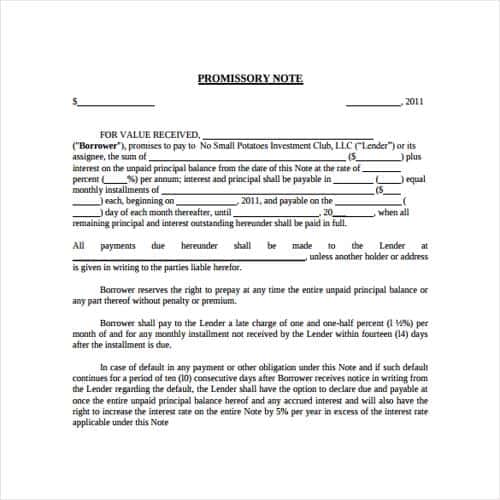

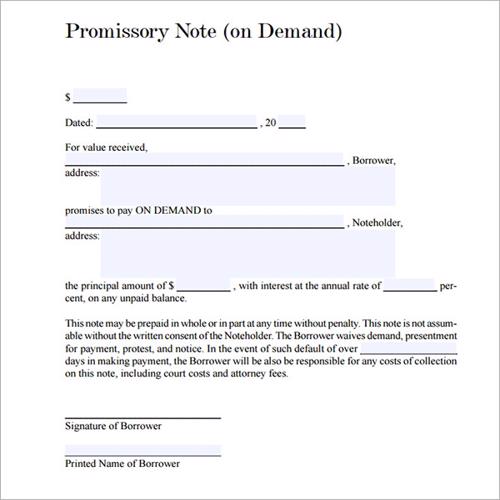

Demand Promissory Note Template

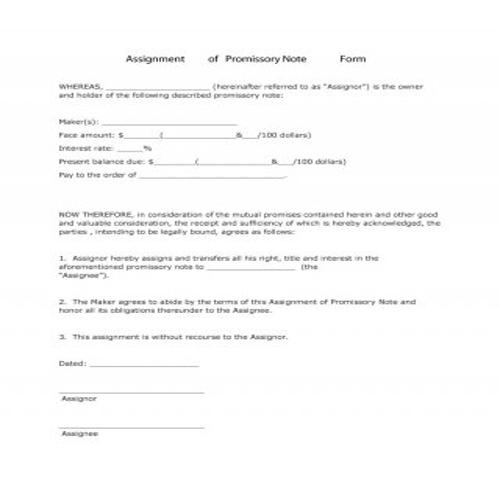

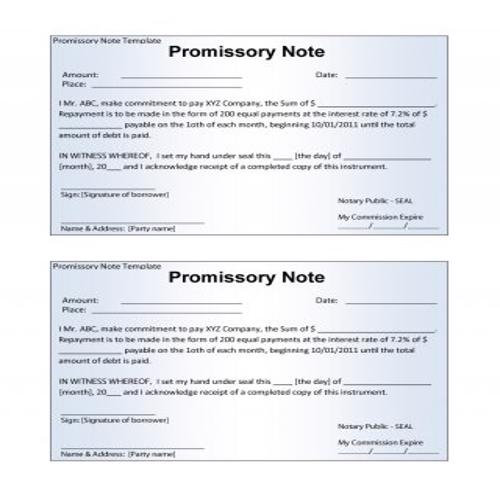

Promissory Note Form Template

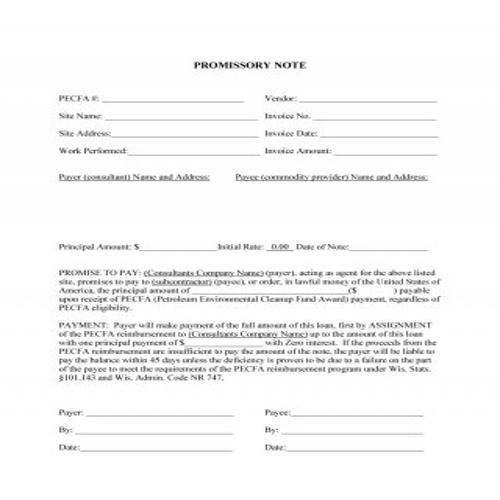

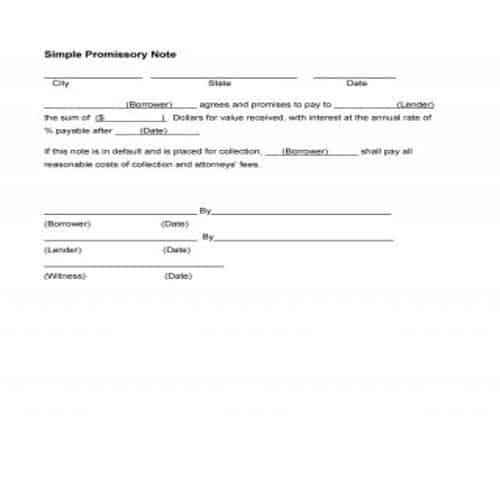

Simple Promissory Note Template

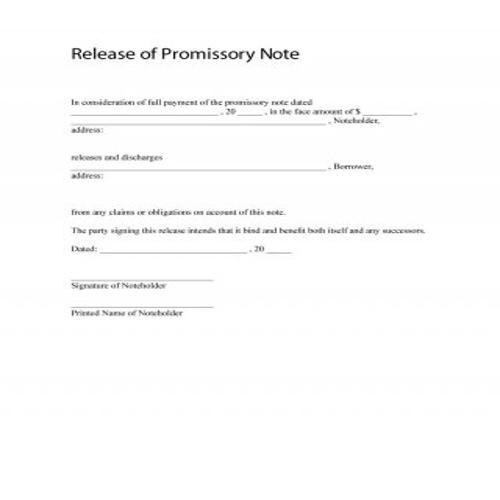

Promissory Note Release Template

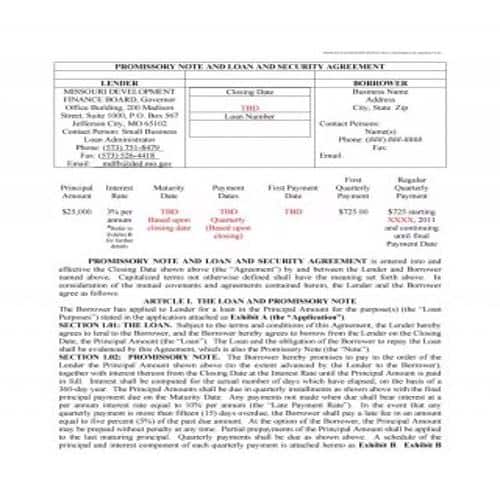

Corporate Reimbursement Promissory Note

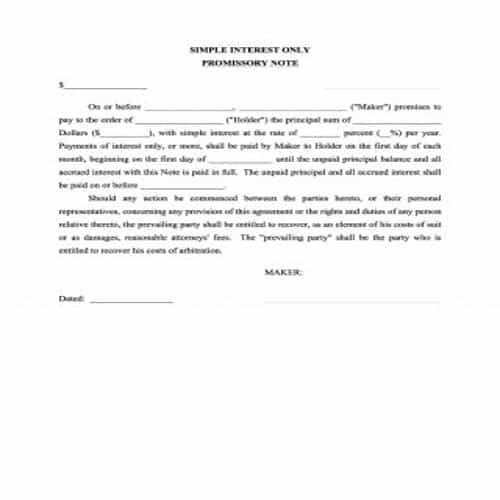

Simple Explanatory Promissory Note Template

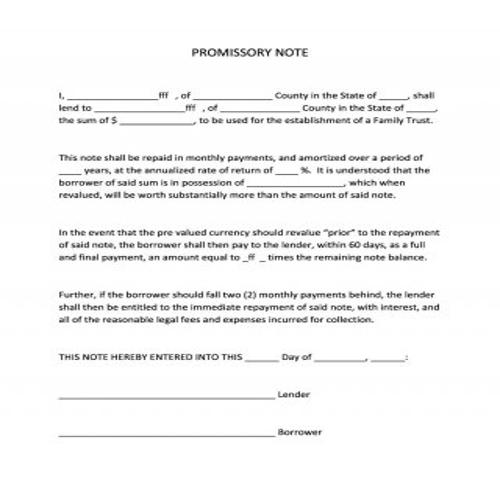

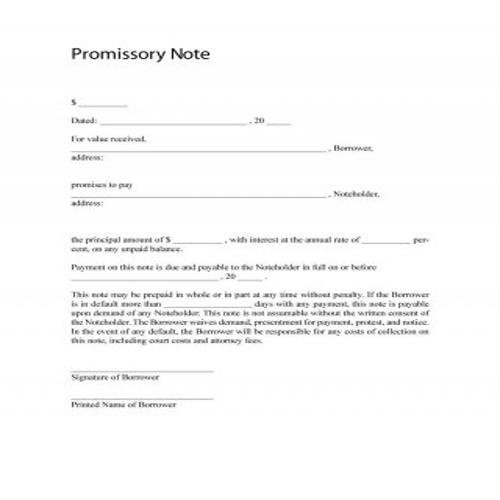

Basic Promissory Note Template

Proper Promissory Note Template

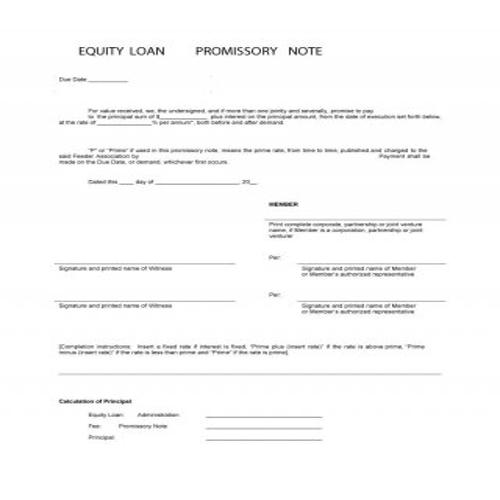

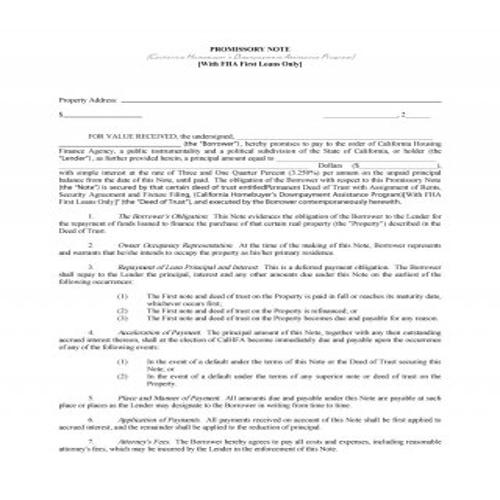

Equity Loan Promissory Note Template

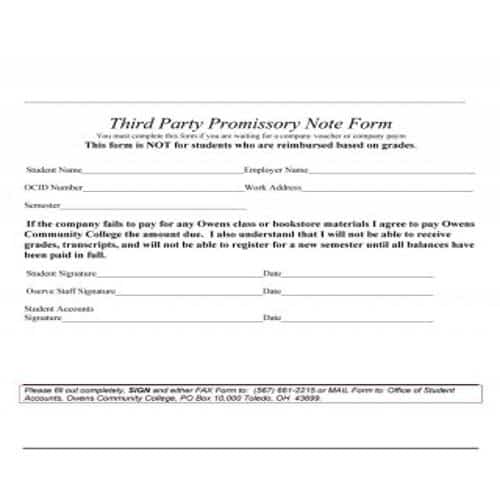

Third Party Promissory Note Template

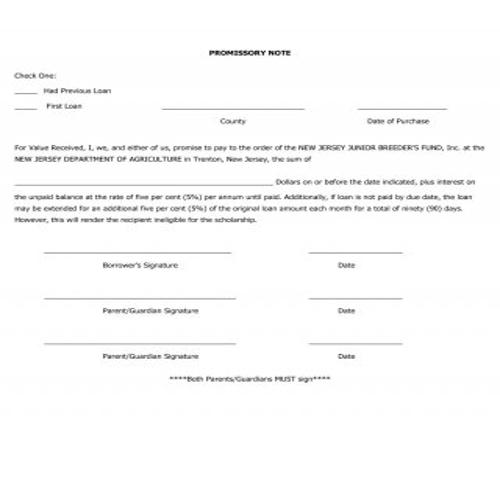

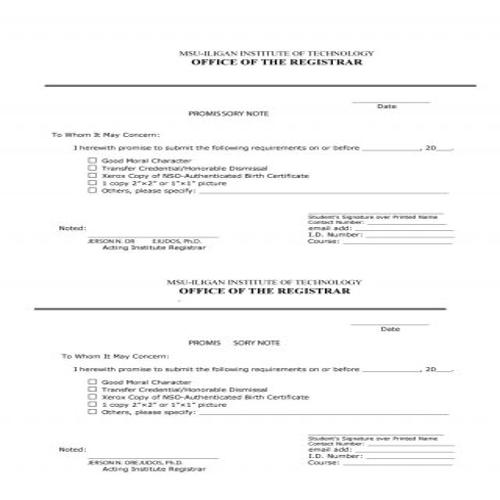

Student Loan Program Promissory Note

Detailed Promissory Note Form Template

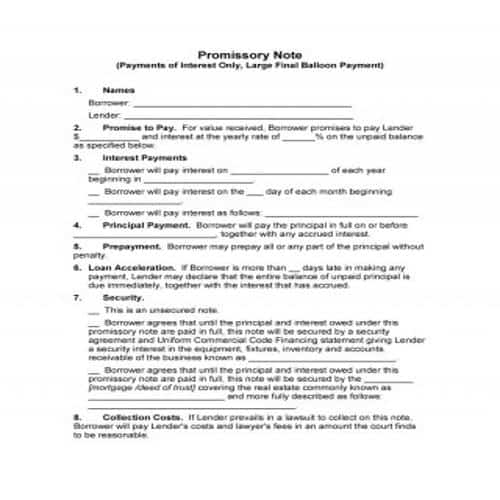

Interest Only Promissory Note Template

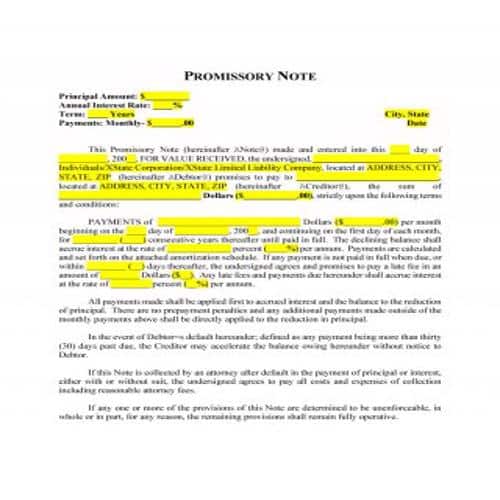

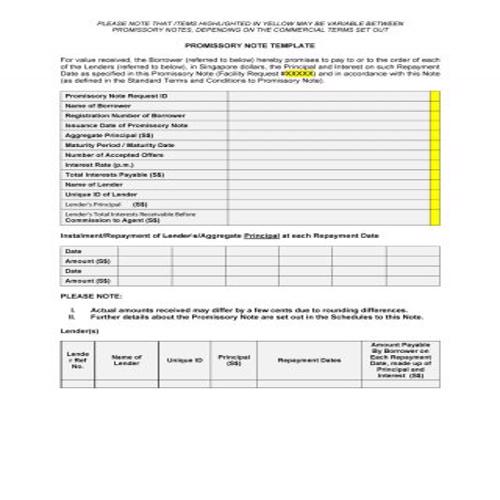

Highlighted Promissory Note Template

Routine Promissory Note Template

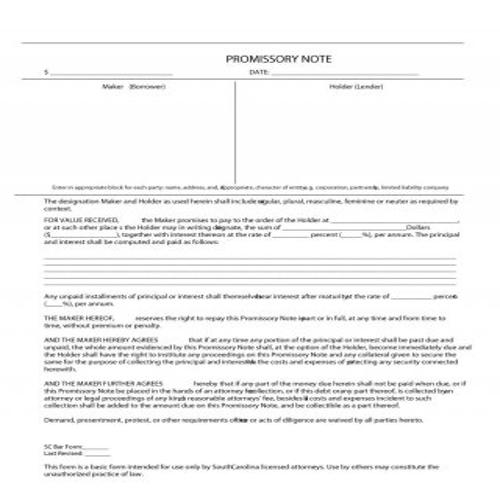

Promissory Note Blank Template

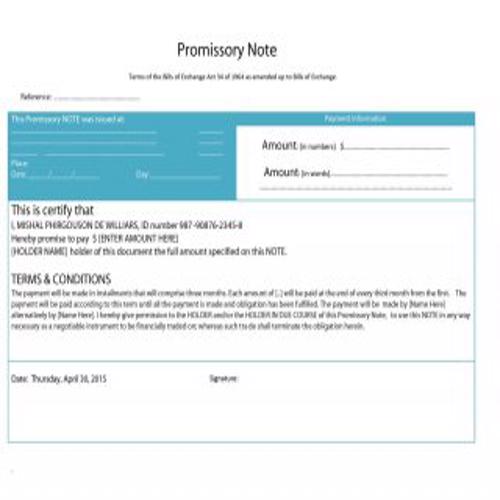

Promissory Note Template with Terms

Benefits of a Promissory Note

A properly documented and prepared promissory note has many benefits. These benefits are categorized as benefits to:

- Lender

- Borrower

- Third Parties

Benefits to Lender:

A promissory note provides many benefits to a lender or a creditor. If it is properly drafted, a lender can easily transfer it to a third party. Moreover, a lender takes benefit of the fact that a promissory note is a written document as it clearly mentions the rights and obligations of both the parties.

Benefits to Borrower:

For a borrower or a debtor, a promissory note has two main benefits. Firstly, as a promissory note is in writing, there will be no doubt about the obligations of the borrower, since all of the terms and conditions of a promissory note are properly written. Secondly, the promissory note must contain the signature of the debtor. Thus, the requirement of signature provides a protection to the borrower against any fictitious loans or any fraudulent changes or alterations in the terms and conditions of the promissory note.

Benefits to Third Parties:

A third party also gets some benefits of a promissory note, if he is a holder in due course. A holder in due course is such a third party who is in the possession of a promissory note in good faith and already gave something valuable for it. As a promissory note is in writing, it can be easily enforceable by the third party too.

More Promissory Note Templates in PDF

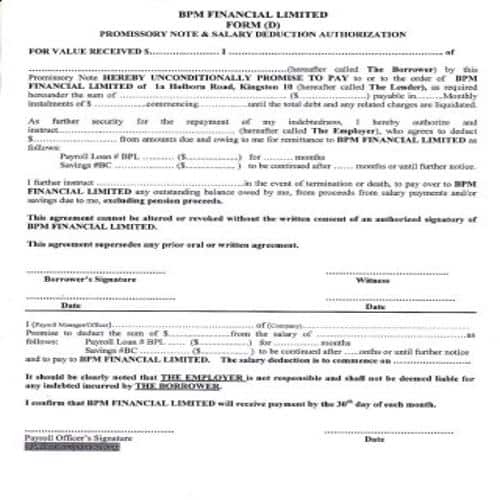

Company’s Promissory Note Template

Specific Promissory Note Template

Lengthy Promissory Note Template

Demand Promissory Note Template

Basic Promissory Note Sample Form

Official Promissory Note Template

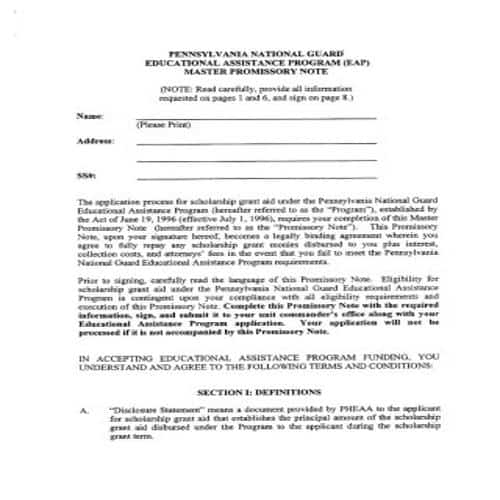

Master Promissory Note Template

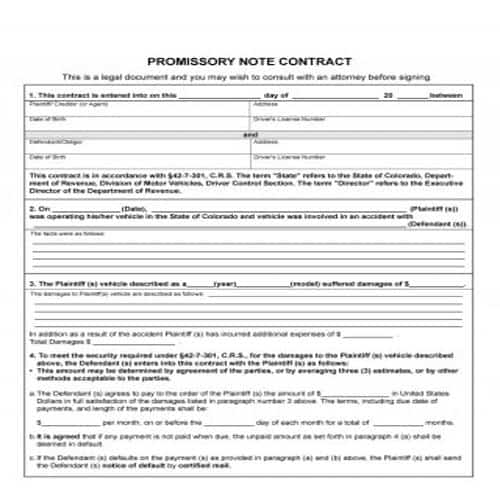

Promissory Note Contract Form Template

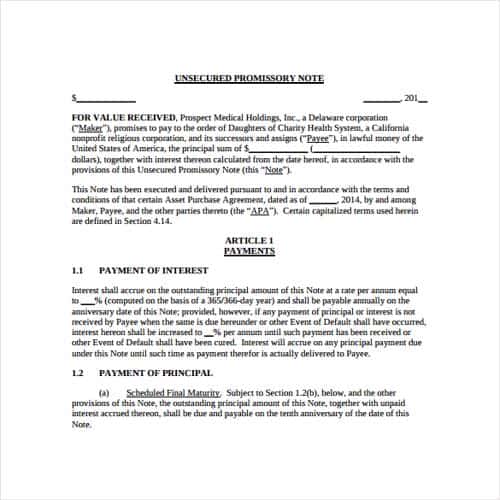

Unsecured Promissory Note Template

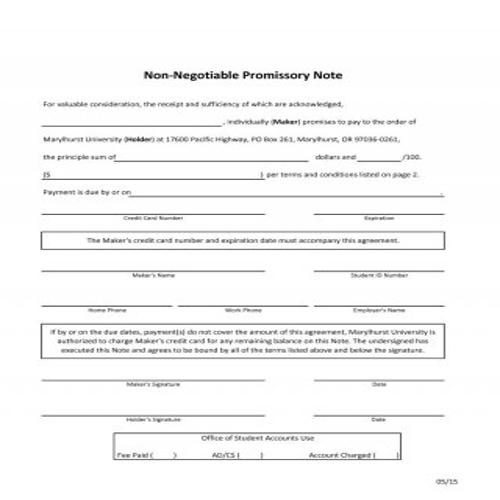

Non-Negotiable Promissory Note

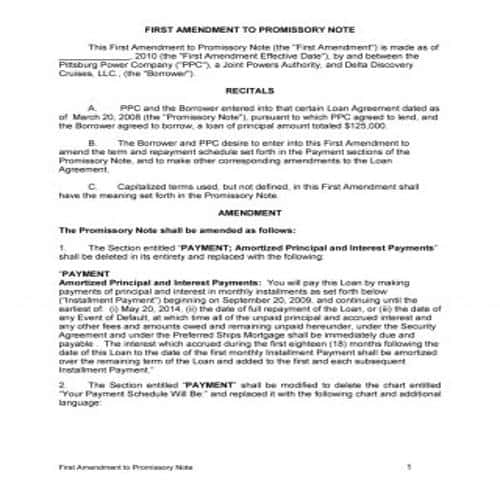

Amended Promissory Note Template

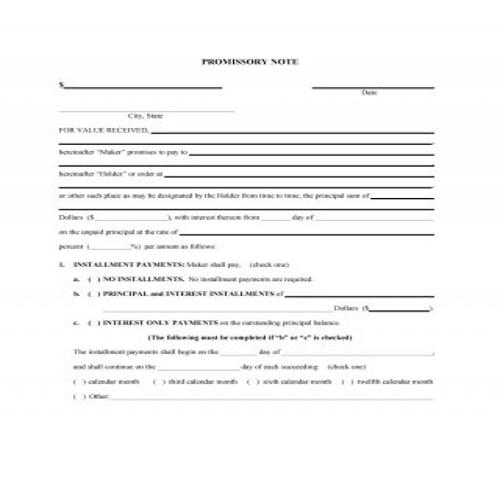

Blank Promissory Note Form Template

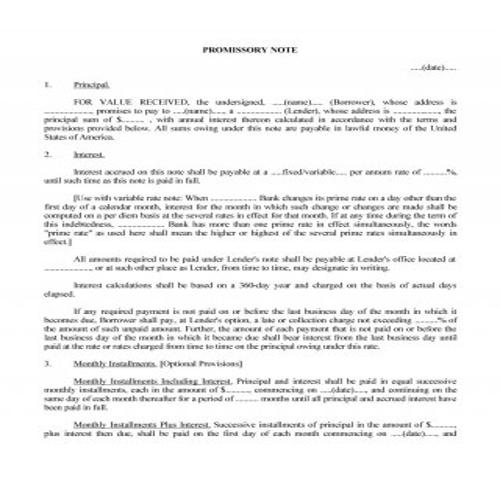

Sample Demand Promissory Note

Unsecured Promissory Note Template

Routine Promissory Note Template

On Demand Promissory Note Template

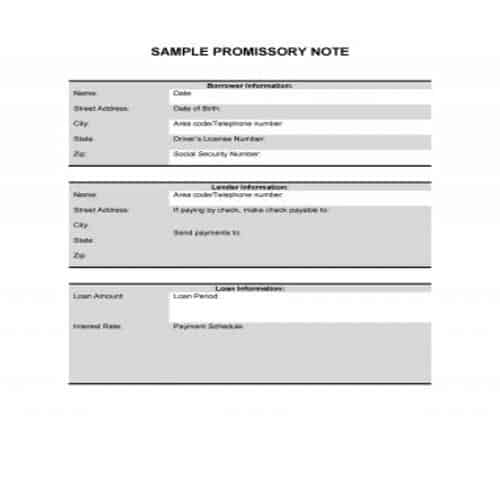

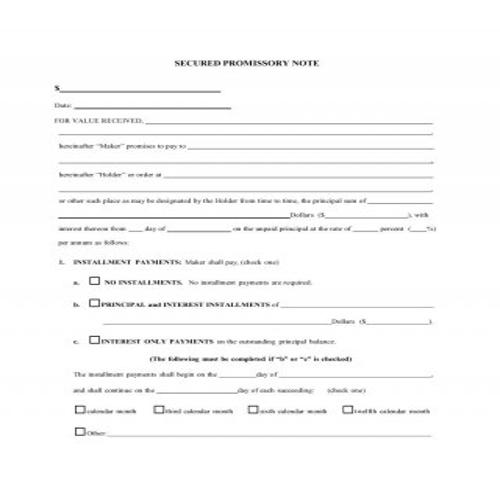

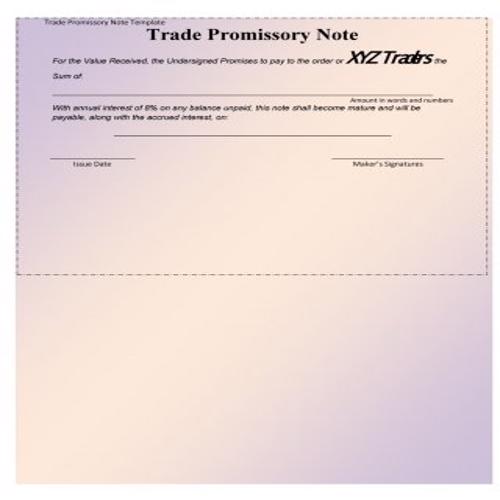

Elements of a proper Promissory Note Template

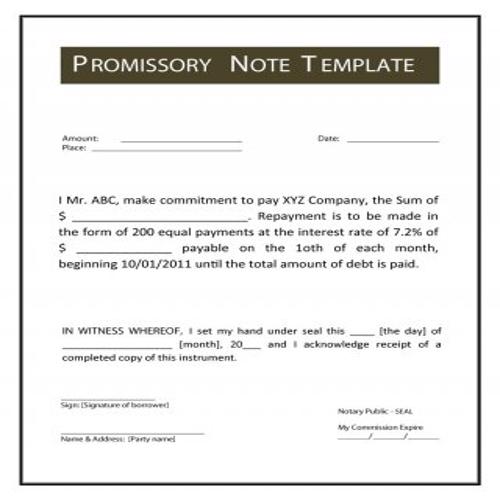

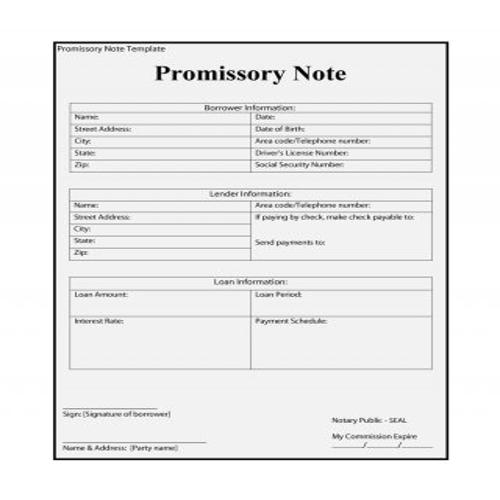

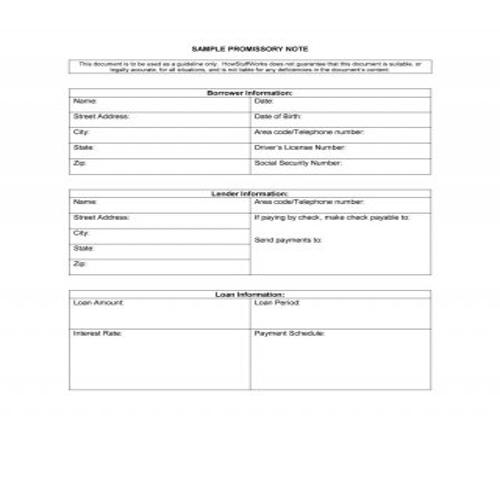

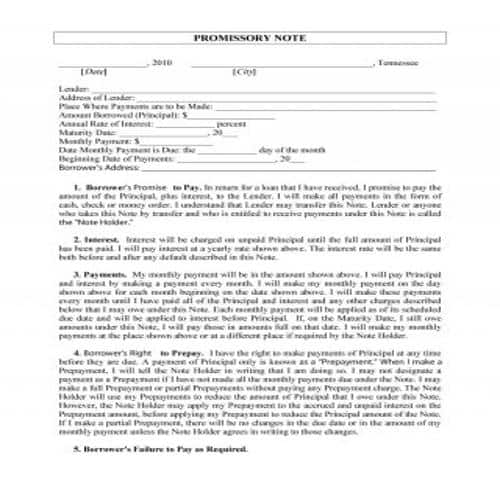

If you want to make your own promissory note template, then make sure to include the following general information in it:

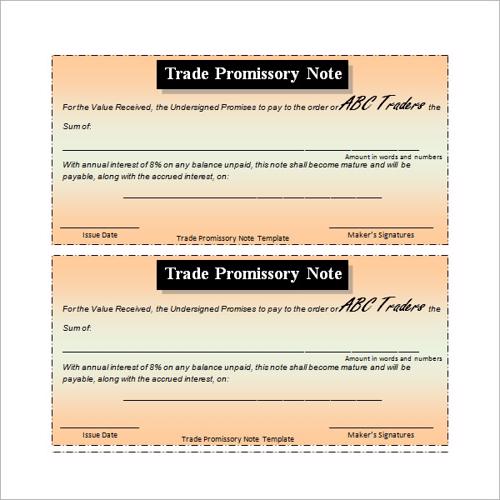

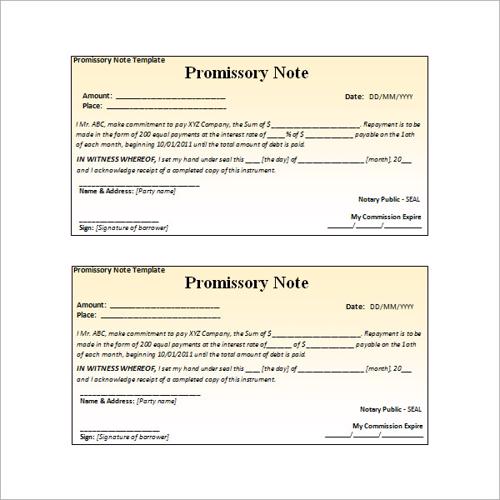

- Mention the payee or creditor of the promissory note, which is the person who lends the money to the borrower.

- Mention the payer or debtor, to whom the money is given. He is also the maker of the promissory note.

- Clearly mention the amount or face value of the promissory note which is borrowed by the payer, in numbers as well as words.

- Mention the date on which the payer promises to perform his obligations and repay the borrowed amount to the payee.

- Include the rate of interest that is to be charged on the amount of loan. This interest can be compounded or simple.

- Include all the relevant terms and conditions of the promissory note.