This article is particularly related to income statement templates but first of all, it is important to know about it. Among four key financial statements that the businesses use, income statement is of major importance. Whether a business is small or at a large scale,without preparing or using an income statement, an entity can never analyse its actual position. Income statement provides a very valuable information regarding a business of an entity. It provides the details of actual sales, relevant costs of these sales and all other expenses that incurred throughout the financial period. With this information, the accounting profit for the year is determined.

Income statement along with Balance Sheet, Cash flow statement and Statement of changes in Equity, gives a clear picture of the company’s business, to all the potential stakeholders. These stakeholders usually include investors, bankers, shareholders, credit rating agencies, government departments etc. If you want to prepare an income statement for your business, here you can get some of the quality income statement templates for free. You can edit these templates according to your business requirements in order to prepare a formal and an effective income statement. These templates are given below:

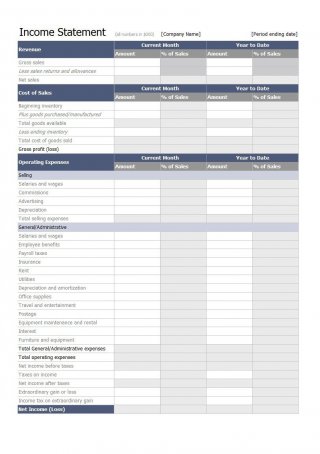

Income Statement Templates

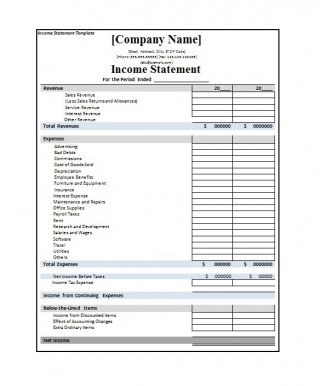

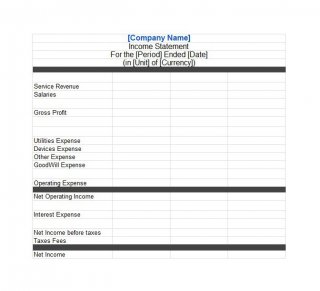

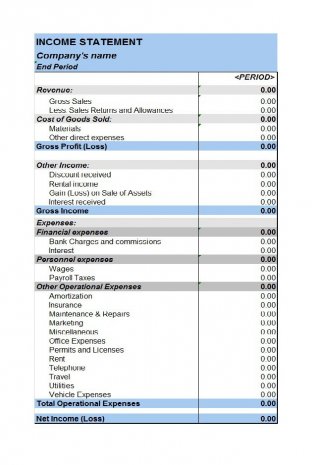

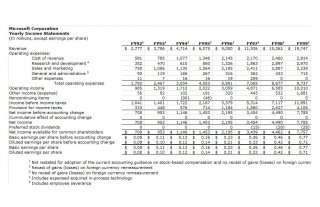

Simple Brief Income Statement Template

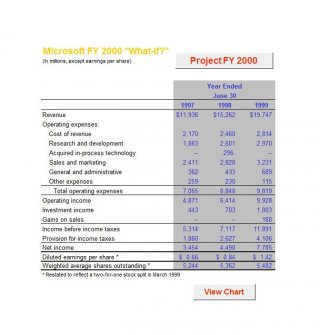

Exclusive Income Statement Template

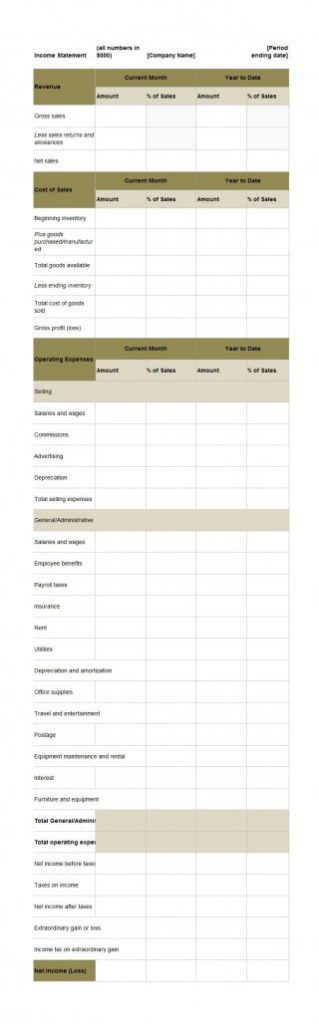

Company’s Income Statement Template

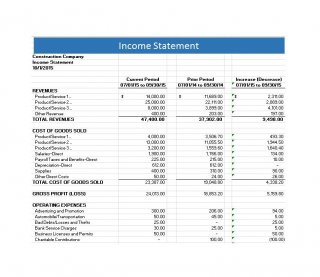

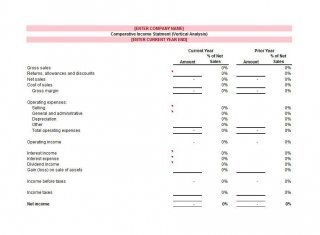

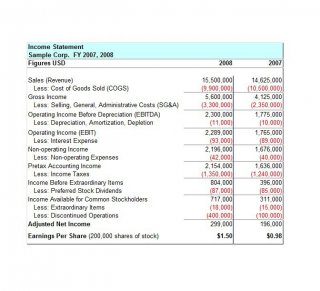

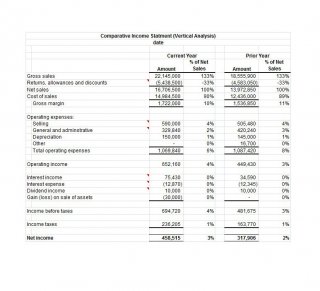

Comparative Income Statement Template

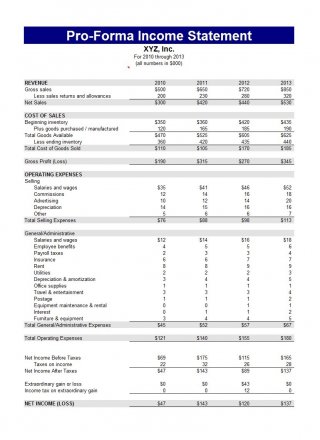

Pro-Forma Income Statement Template

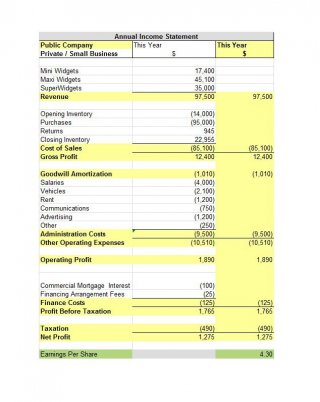

Current Year Annual Income Statement Template

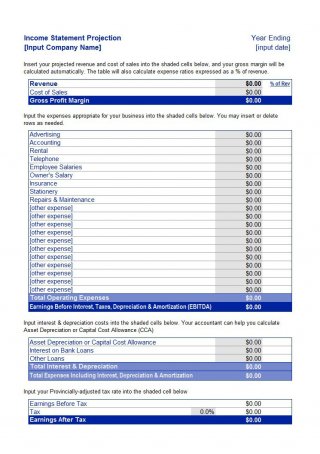

Projected Income Statement Template

Company’s Simple Income Statement Template

Sample Income Statement Template

Formal Income Statement Template

Easy Income Statement Template

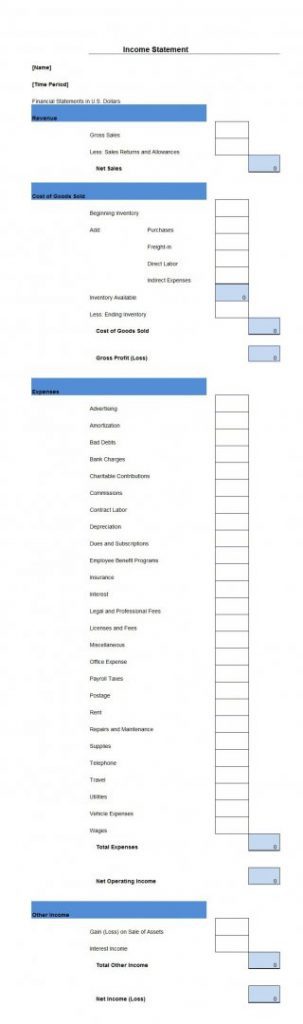

Income Statement Blank Format

Columnar Income Statement Template

Company’s Income Statement Template

Simple Income Statement Example

Detailed Income Statement Template

Company’s Income Statement Format

Elegant Income Statement Template

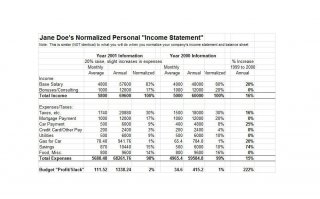

Personal Income Statement Template

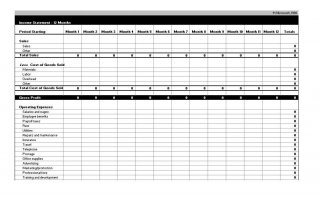

Month Wise Income Statement Template

Exclusive Income Statement Template

Quarter Wise Income Statement Template

Benefits of an Income Statement

As mentioned earlier, an income statement provides a valuable information which is important to the stakeholders as well as owners of the business. Some of the benefits of an income statement are mentioned below:

- It is a complete document in the sense that it takes people through all the events relevant to revenues and expenses during a financial period. No other document provides this much details regarding revenues and expenses.

- It enables the investors to easily make analysis of the financial strength and position of the entity. The information like net profit and earnings per share for the year are of great important for the investors to make future decisions.

- Income statement serves as a parameter to track the overall performance of the business of an entity. Of course the most important thing in tracking the performance is the profit. Income statement clearly shows the actual ‘profit’ figure by showing ‘profit before interest’, ‘profit after deducting interest and before tax’ and ‘profit after deducting tax’.

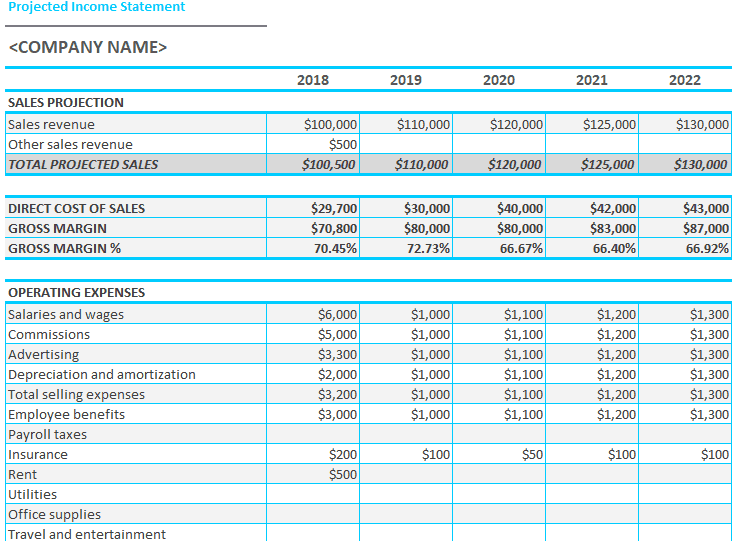

- Along with other financial statements, income statement is also used for forecasting and decision making. A projected income statement can be easily made for any future period, using and analyzing the data available from existing income statements.

- Income statement includes the complete details of tax expense for a particular period. Current tax and deferred tax are clearly explained with amounts mentioned on the face of income statement which helps making tax reporting responsibilities much easier for the entity.

- If a business wants to borrow money for its operations, the lenders usually demand to analyse the income statement of the entity. It provides them the information that whether or not the entity is in position of returning the borrowed amount.

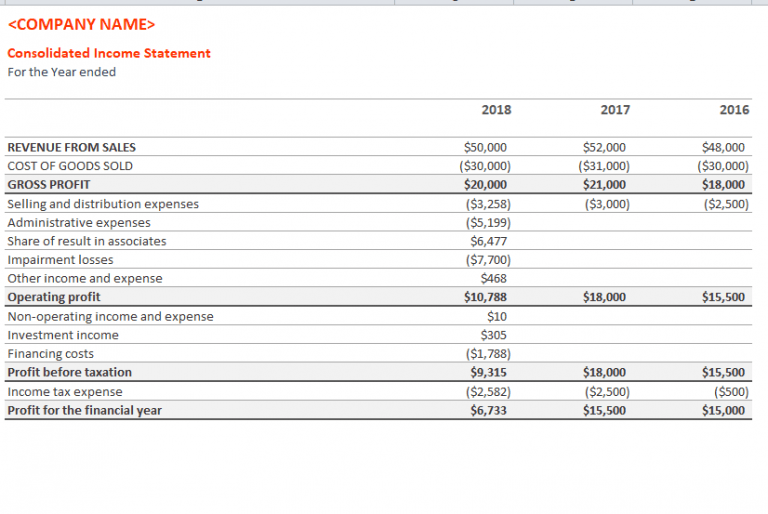

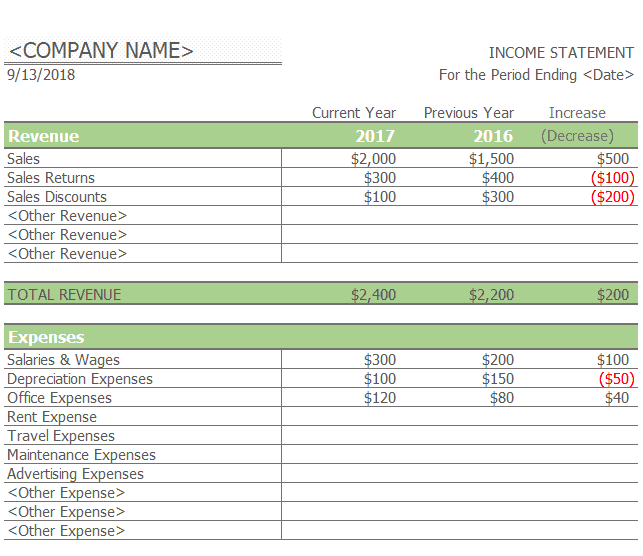

- A comparative income statement is helpful in determining the overall performance as it enables to easily make comparisons of revenues, expenses, taxes and profits of an entity from one period to another.

Types of Income Statements

An income statement has many different types and formats. Some of them are given below:

Consolidated Income Statement

This type of income statement is made where a company is a parent of one or more other companies, called subsidiaries. Consolidated income statement is actually the income statement of the group as a whole.

Projected Income Statement

A projected income statement is used for decision making and budgeting purposes.This type of income statement use estimated figures rather than historical figures for the estimation. Entities use such statements for comparing the actual performance with the projected performance.

Comparative Income Statement

A comparative income statement is made with information of current accounting year and its preceding year. One or more preceding years can also be used to make better comparisons of company’s current performance. A comparative income statement for different months of an accounting period can also be made.

Absorption Costing Income Statement

This one is the standard format of preparing an income statement. It is the required format of GAAP(Generally Accepted Accounting Principles) for external reporting. All of the manufacturing expenses, including fixed and variable, are considered as a part of a product’s cost.

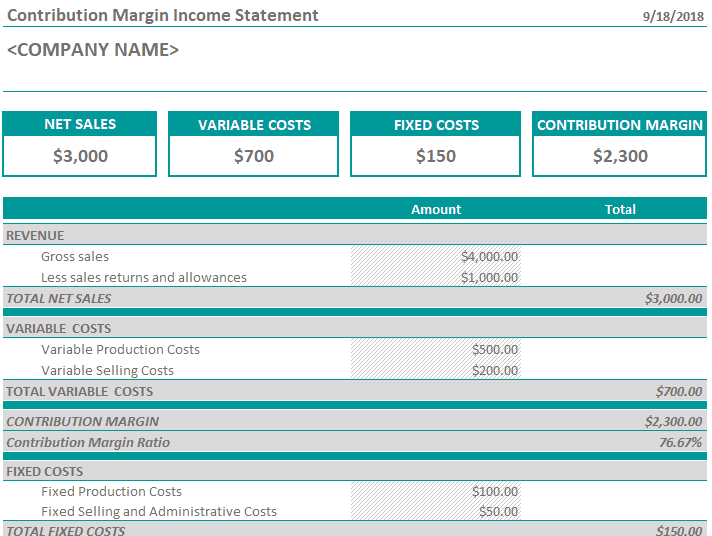

Marginal Costing Income Statement

This type of income statement is made by computing the contribution. Contribution is the profit after deducting all the variable expenses from the revenue. To calculate the net profit, all the fixed costs are then deducted from the contribution. It means that for profit, the contribution should be greater than the fixed costs. If the contribution is equal to fixed costs, then it is said to be an entity’s break-even point. It is the point where the business has no profit or loss.

Common Size Income Statement

This type of income statement shows how each separate item affects the profitability of the company. Along with actual amounts, each item is also shown as an overall percentage of the actual sales value.

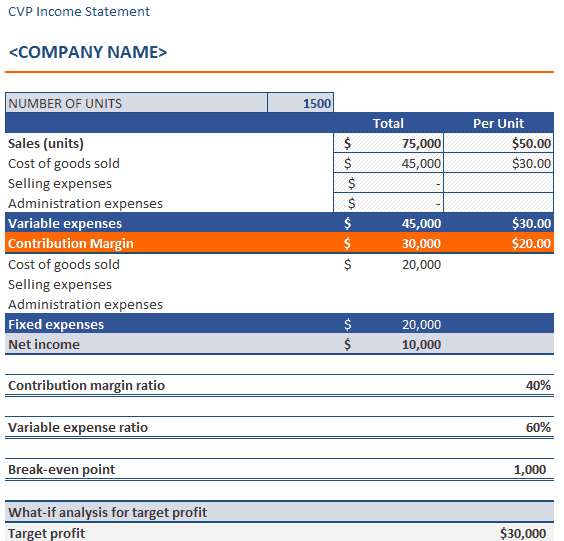

CVP Income Statement

CVP (Cost Volume Profit) income statements are those which are used to analyze the profitability of an entity in different scenarios. The format can vary depending upon the company but typically, this type of a statement includes revenue, fixed and variable expenses and contribution margins.

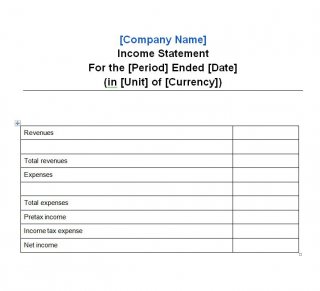

Single Step Income Statement

Single step income statement is the the most common type of income statement. All the revenues are listed together and then all the expenses of the business for the period are deducted from revenue, which results in a net profit or loss figure at the end. As the income statements of the companies are more complex and consist of more items, so the single step income statements are mostly used by the small businesses.